Definitive Guide To Emerging Market Bond ETF Investing

Post on: 13 Июнь, 2015 No Comment

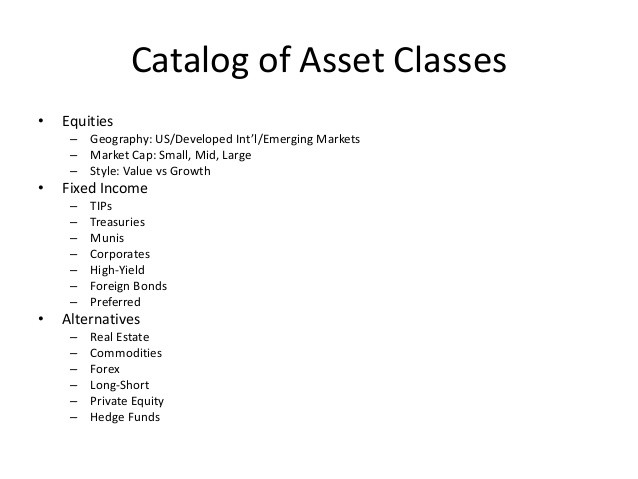

Much has been made of the stellar performance of emerging market ETFs during 2009 and the importance of maintaining an allocation to these funds in investor portfolios. But these discussions have primarily focused on emerging market equity ETFs. overlooking a rapidly-expanding corner of the bond ETF market. Emerging market bond ETFs saw cash inflows of more than $1 billion in 2009 as investors looked to add some geographic diversification to their fixed income holdings. There are multiple ETFs offering U.S. investors exposure to this increasingly-popular market.

Although emerging markets bond investing is becoming more popular, the options for U.S. investors remain fairly limited. Emerging market bond investing consists of debt issued by governments of emerging economies. At present, there are no ETFs offering U.S. investors exposure to corporate debt or mortgage-related debt from countries headquartered in emerging markets.

While debt issued by the U.S. government is generally thought of as risk-free, bonds from foreign governments carry significant risks. Even when they have the ability to do so, some countries have historically been unwilling to repay certain debts, leaving out-of-luck bondholders with no recourse to recoup their losses. To compensate for this considerable risk, debt issued by governments of emerging economies generally includes much higher interest rates than Treasuries or investment-grade corporate debt (and occasionally higher than coupons paid on junk bonds ). One bond issued by the government of Venezuela, for example, maintains a credit rating of BB- and pays a coupon of 13.6%.

After relatively strong performances in 2008, many domestic fixed income funds suffered in 2009 as investors regained their appetite for risk and bought up equities. Emerging markets bonds benefited from this trend. as a decreased likelihood of default in many countries translated into a drop in yields and a jump in prices (to stay up to date on all of the best-performing ETFs, sign up for our free ETF newsletter ).

Price Drivers

The value of debt issued by emerging market economies can by impacted by a number of factors, including both country-specific and region-specific issues and more global developments. The major drivers of emerging market bond ETFs include:

- U.S. Interest Rates: Interest rates in the U.S. impact the value of sovereign and corporate bonds issued by emerging markets. As U.S. interest rates rise, the coupon payments from Emerging Markets Bonds ETFs become relatively less attractive, since investors can receive higher risk-adjusted rates from domestic fixed income investments.

- Government Intervention. Many emerging market countries have a history of heavy government intervention into economic markets. In many countries the government controls vital industries, which can range from telephone networks to financial institutions to energy. Even industries that are not directly controlled by the government they often have to deal with intense government scrutiny and (in some situations) widespread corruption.

- Monetary Policy: A great deal of emerging market issues have been linked to poor monetary policies implemented in the past, including the Asian financial crisis and the Russian debt default. These crises have generally resulted from high debt levels and uncontrollable inflation, leading to significant declines in the value of the currency.

- Government Stability: In addition to an ability to repay its debts, the willingness of emerging markets governments to do so has a significant impact on the value of emerging markets bonds. While the concept is foreign to many U.S. investors, many countries are ruled by unpredictable leaders who may decide for various reasons that they are no longer bound by debt covenants.

ETFdb Pro members can read more about the factors impacting emerging market bond prices in our ETFdb Category Report (if youre not a Pro member yet, sign up for a free trial or read more here ).

Emerging Markets Bond ETFs

Investors looking to invest in debt originated in emerging markets have two main options from which to choose: the iShares JP Morgan USD Emerging Markets Bond Fund (EMB) and PowerShares Emerging Markets Sovereign Debt Portfolio (PCY). While these funds are similar in some ways, their underlying holdings are significantly different in others, leading to a unique set of risk and return profiles.