Definition and information on ZeroCoupon Bonds

Post on: 9 Апрель, 2015 No Comment

ZERO-COUPON BONDS

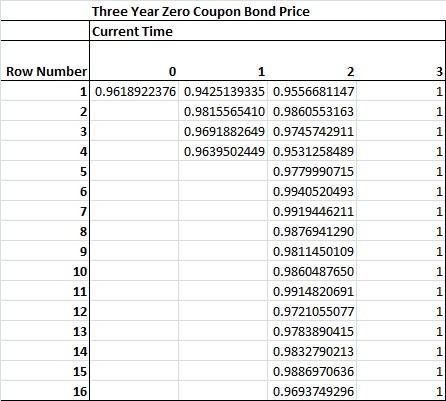

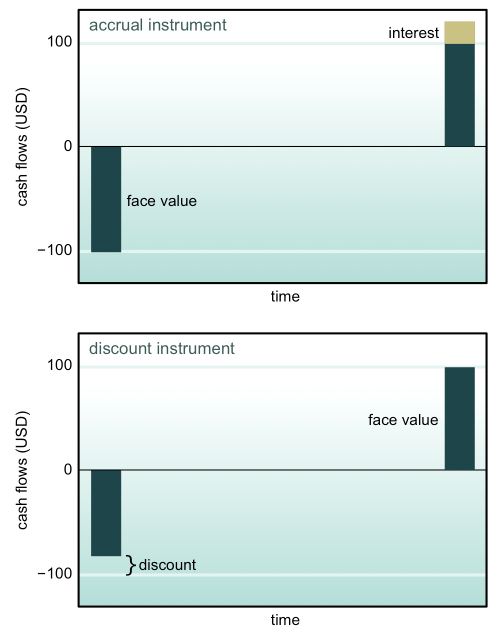

Corporate bonds that do not pay interest periodically (semi-annually) in the fashion of conventional types of bonds, but instead sell at discounts of par until their final maturity, when payment of principal at par plus all of the interest accumulated (compounded) at the rate specified at the time of original issuance of the bonds is paid in a lump sum.

This innovation in bond financing first appeared in 1981, at a time of high prevailing interest rates, and has proved to be popular under such conditions with both corporate issuers and investors. For issuing corporations, the advantages are that no cash is actually paid out until final maturity, but in the meantime the tax deductible amortization of the discount provides savings each year on income taxes. (As of 1982, the question was still unresolved as to whether the discount in full could be amortized on a straight-line basis per year or, as the Treasury maintained, the tax deduction should be based on the effective annual cost to the corporation times the discount dollar amount of principal as originally paid at issuance by the investor and accreting each year to maturity — a method which would result in lower annual amortization for the corporation than the straight-line method.)

For investors, the attraction of zero-coupon bonds is the locking in of the prevailing high interest rate at issuance of the bonds, to accumulate compounded and to be paid at final maturity along with the full principal at par. Thus a combination of high interest income (based on the specified interest rate at issuance) and the capital gain from discount price at issuance to full par at maturity would be indicated. Such has been the attraction of zero-coupon bonds that issuing corporations have been able to achieve a savings in the interest rate on such issues, fractional though it may be, as compared with prevailing market yields on conventional bonds of the same quality. For investors, zero-coupon bonds are especially suitable for tax-deferred plans, such as individual retirement accounts (IRAs), Keogh accounts, and other retirement plans. Non-IRA, etc. investors, however, would be paying taxes on the portion of the interest that accrues each year on such issues, although no cash would be received until final maturity. Also, it is pointed out that failure of the issuing corporation before the lump-sum payoff on zero-coupon bonds would imperil the success of such issues for investors.

The zero-interest idea has spread to a number of other types of issues including zero-interest insured certificates of deposit of banks; zero-coupon Eurobonds (especially active in the London market as of 1982); and non-interest-bearing receipts sold at discount evidencing claim for principal amount plus accumulated interest spaced at interim maturities for such receipts, besides the actual eventual maturity of the U.S. Treasury bonds or state or municipal obligations, notes, or unit trusts.

Non-callable Treasury issues backed by the full faith and credit of the U.S. government include:

CATS Certificates of Accrual on Treasury Securities

TIGRs Treasury Investment Growth Receipts

TRs Generic Treasury Receipts

STRIPS Separate Trading of Registered Interest and Principal of Securities

BIBLIOGRAPHY

DONOGHUE, W.E. High-Risk Investments. Executive Female, November/December 1988.

FOLDESSY, E.P. and BETTNER, J. Deduction in Danger: Tax Break Involving ‘Zero-Coupon’ Bonds Is Attacked by Treasury, Backed by Issuers. Wall Street Journal, May 19, 1982 .

NARAYANAN, M.P. LIM, S.P. On the Call Provision In Corporate Zero Bonds. Journal of Financial and Quantitative Analysis, March, 1989.

UPDEGRAVE, W.L. Capital Gains: The Twisting Path to Appreciation. Money, December, 1988.