Definition and information on Business Trade Cycle

Post on: 20 Июль, 2015 No Comment

Business Trade Cycle

Source: Encyclopedia of Banking & Finance (9h Edition) by Charles J Woelfel

(We recommend this as work of authority.)

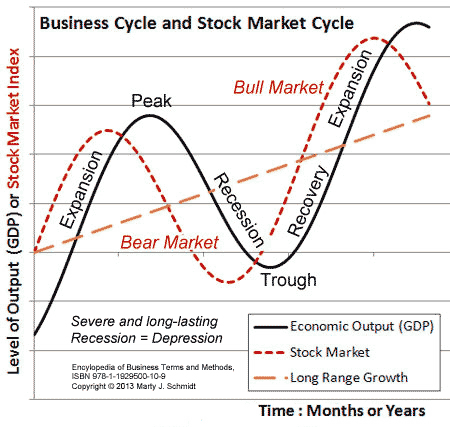

An interval that embraces alternating periods of business prosperity and depression. It is one of the most significant phenomena of the capitalistic system and appears to be an outgrowth of a system in which production requires considerable capital investment and some lead time before consumption. Business cycles are characterized by a series of phases that are more-or-less predictable in occurrence but not necessarily in timing or intensity. In the United States. since the 1930s, government intervention has been used to try to influence the timing and help dampen the intensity of business cycles. A description of the cyclical phases in the absence of such intervention follows:

1. Crisis. This is the turning point or decisive moment that marks the collapse of a period of prosperity, rising prices, increasing shortages, and considerable speculation in the expectation that prices will rise faster. Crisis is likely to be followed by panic, primarily a financial phenomenon characterized by a collapse of the credit structure; a universal demand for money payments; lack of confidence in the ability of debtors to pay debts; and usually a series of important business, brokerage, and banking failures, often brought about by the mounting accumulation of inventories acquired at high prices and financed on credit. Because of the sudden demand for cash, banks are the storm centers of the panic. If important bank failures occur, bank runs, even on sound banks, are likely to ensue, placing a great strain upon the banking system. Interest rates may rise to entice depositors to leave their funds with financial intermediaries.

2. Emergency liquidation. Following the crisis (and panic, if one occurs) comes a period emergency liquidation. During the previous period of prosperity and high demand, production boomed, eventually leading to an overall accumulation of high-priced inventories. When the crisis ends the period of high prices, businesses are eager to unload these inventories before prices decline, and they place goods on the market for whatever they will bring. This tendency is exacerbated by high rates of interest, which makes holding inventories expensive in a flat or falling market.

3. Depression. This is a period of low prices and drastic curtailment of production, resulting in widespread unemployment, reduction or elimination of profits, overcapacity in production facilities, many business failures, and a general reluctance or inability to use credit or to make new capital investment or spend on consumption. Interest rates drop in nominal terms but may remain high in real terms.

4. Readjustment. When the bottom of the price movement has been struck, the period of readjustment begins. It is characterized by an irregular and uneven process of price stabilization and readjustment of supply/demand relationships. Business becomes leaner and meaner — inefficient businesses have been eliminated, production costs are lower, and competition is sharper. Survivors tend to accumulate liquidity rather than other assets. Interest rates are low in real terms.

5. Recuperation or revival. The period of readjustment blends so imperceptibly into the recuperative phase that the latter is not easy to detect. By this time, the deflation process has been completed, bank reserves are high, and interest rates are low. The combination of easy credit and lower prices begins to stimulate demand, first through revival of consumer spending and eventually through business expansion. Unemployment begins to decline.

6. Prosperity. As the demand for goods increases, industrial activity picks up and more labor and capital are employed, resulting in increased purchasing power. This, in turn, stimulates demand. Because inventories are comparatively low, production and deliveries lag orders, and idle labor and productive capacity are pressed into service. This condition leads to increased production costs and rising wages, prices, and profits. With the revival of credit demand, interest rates begin an upward trend.

7. Overextension and speculation. Eventually, businesses find existing plant and equipment inadequate to supply the demand. This leads to an expansion of capital spending but at higher cost and at higher interest rates on borrowed money. Although product prices and profits are rising, production costs tend to rise faster as less productive inputs are brought into use. To maintain profit levels, producers raise product prices until they meet buyer resistance, which sets the state for another crisis.

Many hypotheses have been advanced as to the cause of the business cycle. Haberler (Prosperity and Depression, 3 rd ed. 1952) has identified the following classification of theories: (1) purely monetary; (2) overinvestment; (3) changes in costs, horizontal maladjustments, and over indebtedness; (4) underconsumption; (5) psychological factors, and (6) the harvest theories (relating agriculture and the business cycle, including the sun spot theories).

The analytical tools found in Keynes General Theory of Employment, Interest and Money (1936) — liquidity preference, marginal efficiency of capital, and the consumption function — are compatible with any of the above theories, but Keynes himself seemed to stress the psychological factors, emphasizing the role of expectations in the behaviour of both consumers and investors. Followers of Keynes, however, cite underconsumption or oversaving — both consequences of changed expectations — as casual factors.

A monetarist school, led by Milton Friedman and often called the Chicago school because of his position on the faculty of the University of Chicago has emphasized the importance of changes in the money supply as being more important than interest rates in determining the national economic health. In its simplest form, the approach argues that the central government should ensure modest but regular increase in the real money stock to allow for orderly long-run growth. This approach found much favor in the early 1980s but proved more difficult to implement than expected.

In recent times, the great debate regarding business cycles is whether government countercyclical measures now preclude the possibility of a serious depression. Since the Great Depression of the 1930s many measures have evolved that are intended to take the edge off of the traditional business cycle. FISCAL POLICY and MONETARY POLICY, acting within a more effective institutional environment, can derail economic developments that once led inexorably to crisis. AUTOMATIC STABILIZERS help prop up or slow down consumer spending that might otherwise exacerbate cyclical lows and highs. Greater regulation of financial institutions and practices helps prevent panic and abuse. Better economic information helps prevent the unanticipated accumulation of inventories.

A counterargument is that private investment is the keystone of cyclical phenomena. Investment responds to changes in sales expectations — that is, it anticipates demand but not in time to stimulate investment based on expectations of demand. Automatic stabilizers might slow down but could not prevent a prolonged downtrend in business activity.

Fiscal policy mechanisms are slow and cumbersome and monetary policy alone cannot actively stimulate business investment if the business community does not anticipate sustained or increased demand for products and services. (It can, however, discourage business investment by raising the cost of credit.) Therefore, competitive markets, rather than government directives, are as a rule the most efficient instruments for organizing production and consumption. The government creates an atmosphere favorable to economic activity when it encourages private initiative, curbs monopolistic tendencies, avoids encroachment on the private sector, and privatizes as much as of its own work as is practicable.

In the mid-1970s, partly as a result of the large increases in the price of oil, the economy was confronted with stagflation, characterized by the coexistence of inflation and stagnant or falling demand. This combination tested many economic theories and in 1974-75 produced the most severe recession since the 1930s. In late 1979, the Federal Reserve Board tightened credit severely to bring inflation under control. This policy dampened the economy during the early 1980s but also set the stage for the long period of prosperity that was still in progress in 1988.

The National Bureau of Economic Research has measured the duration of U.S. business cycles, from turning point to turning point, from 1854 to the current date. These data are shown in the following table. Note that the November 1982 trough is the latest date shown in the table because no peak had yet been reached as of mid-1988.

Major business cycles expansions and contractions from 1919 to 1987 are presented in the appended table.

BIBLIOGRAPHY

AUERBACH, A.J. The Index of Leading Indicators: ‘Measurement Without Theory, ‘Thirty-Five Years Later. The Review of Economics and Statistics, November, 1982. Andrews Trading cycles. Andrews Publishing Co. Morgan Hill. CA. 18 times per year. BUREAU OF ECONOMIC ANALYSIS, WASHINGTON. DC. Statistical Indicator Computer Tapes available from the Bureau:

Business Conditions Digest Data File.

Long-Term Economic Growth, 1860-1970.

Seasonal Adjustment, Composite Diffusion Indexes, and Time Series Processor Programs.

X-11 Seasonal Adjustment Program.

X-11Q Seasonal Adjustment Program.

Composite-Diffusion Indexes Program.

Time Series Processor Program.

Cycles. Foundation for the Study of Cycles. Monthly.

GORDON, R.J. The American Business Cycle: Continuity & Change.

University of Chicago Press, Chicago. IL. 1984.

MITCHELL, W.C. Business Cycles: The Problem and Its Setting. University of California Press, Berkely. CA. 1927.

What Happens During Business Cycles: A Progress Report. University of California Press, Berkeley. CA. 1951.

Business Cycles and Their Causes. University of California Press, Berkeley. CA. 1941.

NELSON, C.R. Investor’s Guide to Economic Indicators. John Wiley and Sons, New York. NY. 1987.

SCHUMPETER, J.A. Business Cycles: A Theoretical, Historical, and Statistical Analysis of the Capitalist Process. Porcupine Press, Inc. Philadelphia. PA. 1981.