Defensive Stocks DividendPaying MoneyMakers

Post on: 28 Март, 2015 No Comment

Exchange-traded funds offer a convenient way to invest in sectors or niches that interest you. If you’d like to add some defensive stocks to your portfolio but don’t have the time or expertise to hand-pick a few, the Guggenheim Defensive Equity ETF ( NYSEMKT: DEF ) could save you a lot of trouble. Instead of trying to figure out which defensive stocks will perform best. you can use this ETF to invest in lots of them simultaneously.

ETFs often sport lower expense ratios than their mutual fund cousins. This ETF, focused on defensive stocks, sports a relatively low expense ratio — an annual fee — of 0.65%. The fund is fairly small, too, so if you’re thinking of buying, beware of possibly large spreads between its bid and ask prices. Consider using a limit order if you want to buy in.

This defensive stocks ETF has outperformed the S&P 500 over the past five years and lagged it over the past three. As with most investments, of course, we can’t expect outstanding performances in every quarter or year. Investors with conviction need to wait for their holdings to deliver .

Defensive stocks are tied to companies offering products and services that we tend to buy no matter how the economy is doing. For example, think of shampoo, medications, electricity, and so on. Such companies add a defensive element to a portfolio, bolstering it in downturns.

More than a handful of defensive stocks had strong performances over the past year. Seagate Technology ( NASDAQ: STX ) soared 83% and is near a 52-week high while also offering a 3.5% dividend yield. (It has been upping its payout by an annual average of 29% over the past five years, most recently by 13%.) You might think that after all that growth, the stock is now overvalued, but its P/E ratio is still just about 11, in part because investors worry about the effect of the weak PC market on this hard-drive giant. Seagate Technology faces significant competition. and posted disappointing earnings in its last quarter.

Tobacco giant Lorillard ( NYSE: LO ). known for brands such as Newport, Kent, True, Maverick, and Old Gold, advanced 41% and yields 4.3%. It has become a leader in electronic cigarettes with a 49% market share for its blue eCigs, but the FDA may soon regulate those and they may face taxation like conventional cigarettes, so that’s weighing on some investors’ minds. Lorillard is also a major player in menthol cigarettes, which have been banned in Europe (beginning in 2022) and may be more regulated or banned here, too. Lorillard’s last quarter featured revenue up 10% over year-ago levels and earnings topping estimates.

Marsh & McLennan ( NYSE: MMC ) popped 37% and yields 2.2%. The insurance broker has been making money from Obamacare, serving as a consultant to corporations. Marsh & McLennan is offering its Mercer Marketplace to companies, to as a private health-insurance and benefit exchange. The company is also putting a lawsuit from then-New York Attorney General Eliot Spitzer behind it, having paid some $850 million to settle the matter. Marsh & McLennan is being added to the S&P Global 100 index, with the departure of Dell. which is being taken private by its founder.

ConocoPhillips ( NYSE: COP ) gained 32%, trades near a 52-week high, and yields 3.8%. The company recently posted third-quarter results that topped expectations, partly on strong production numbers from its domestic Eagle Ford shale operations. (We’re talking about a 66% bump here.) Asset sales also played a key part. Not all of its numbers are beautiful, though, as its revenue and earnings have been shrinking, and free cash flow has been lumpy, with a loss in 2012. ConocoPhillips has been focused on production more than exploration, with promising results.

The big picture

Consider adding defensive stocks to your portfolio. A well-chosen ETF can grant you instant diversification across any industry or group of companies — and make investing in and profiting from it that much easier.

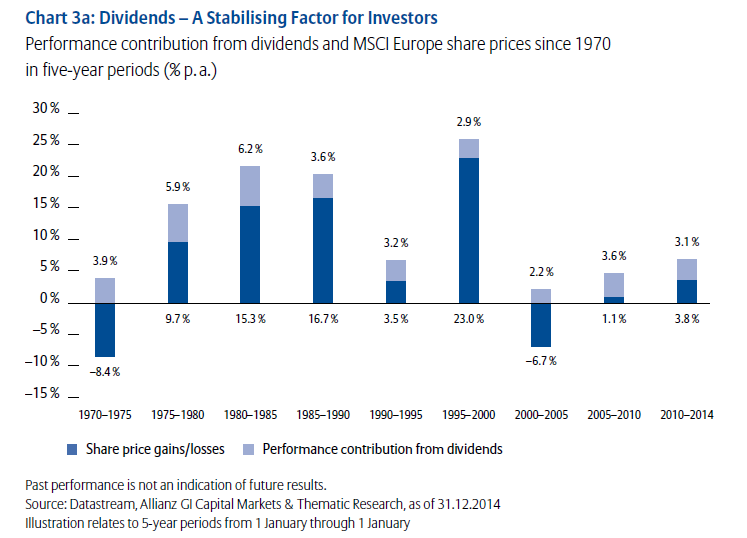

Add power to your portfolio with strong dividend payers

It’s hard to go wrong with healthy and growing dividend-paying stocks. Over the long term, the compounding effect of their quarterly payouts, as well as their growth, adds up. Thus, our analysts have identified nine compelling rock-solid dividend stocks in a free report. To discover the identities of these companies before the rest of the market catches on, download this valuable free report by simply clicking here now .