DCF Analysis

Post on: 28 Июль, 2015 No Comment

Based on your internet connection speed, please adjust the video settings for improved resolution. We recommend that you set the quality at 480 pixels or higher for better viewing.

Discounted Cash flow Analysis (DCF Analysis ) is a widely used method of stock valuation. The goal of DCF Analysis is to estimate the amounts and dates of expected cash receipts which the company is likely to generate in future and then arriving at the present value of (the sum of) all future cash flows using an appropriate discount rate.

Just to understand the concept and without going into great detail, take the example of SMA Limited, a research & education firm, which is planning to buy a new computer for its office. The new computer will cost Rs. 12,000. The CEO at SMA Limited hopes that the computer will generate the following expected Future Cash Flows (FCF) in the next 5 years:

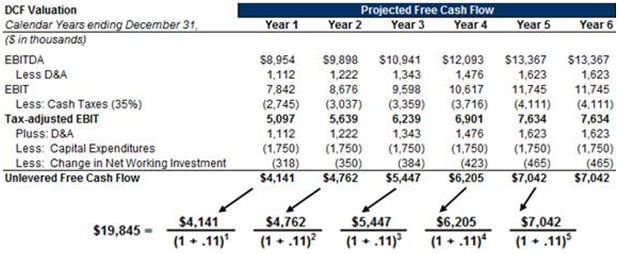

The second step is to calculate the present value of this expected FCF of Rs. 19,000. An easy way to do this is to calculate the present value for each years expected FCF and add them up. Use the formula below to do this.

Present Value = FCF / (1+R) n

Where:

R= discount rate (we have assumed 9.5% in our example) (Read more about discount rate below)

N = number of years

What does it mean? Simply put, the CEO is getting something which is worth Rs. 14,574.5, for a price of Rs. 12,000. Another way of looking at this would be that the CEO is getting Rs. 14,574.5 for Rs. 12,000. Thats almost a Rs. 2,500 or a 17% bargain.

While DCF analysis may work well in arriving at the present value of a cash generating asset, it does have its drawbacks, particularly when applied to value the fairness of stock prices. The big challenge is that DCF works on too many projections and assumptions.

The most important, yet difficult aspect of DCF analysis is the projection of future cash flows and future capital expenditure. To do a meaningful analysis, you need at least the previous 5 10 years of data and projections for a similar period in future. Even if you follow a company closely, it is only easy to predict the cash flows for the next 2-3 years, but beyond that the assumptions are more like imagination. Most analysts use previous years growth rates (both in revenue and capital expenditure) to arrive at future cash flows. This is likely to bring somewhat correct results in case of large caps companies with predictable cash flows but not mid-cap companies which are in a growing phase. Companies which are planning huge acquisitions or capital expenditure in future or ones which have done something similar in the recent past will have volatile cash flow patterns and it is futile to average them out.

An area which is even greyer is the discount rate. It is the minimum rate of return which the investor expects from the investment. An easy approach is to assume a risk free rate such as the Weighted Average Cost of Capital (WACC) or the fixed deposit rate being offered on investments by commercial banks (i.e. 7-10%). However, the right way to look at this rate is to think of it as the minimum expected rate for investment in an asset class as risky as the one being compared with. For example, if an investor is planning to invest in a highly risky project, it is pointless to compare the expected return with the FD interest rate; he should compare it with the average return expected of other projects which are just as risky.

The true art of DCF analysis would be in predicting the future cash flows based on corporate research, management interaction, industry analysis etc. For example, if a company is setting up a new plant which is likely to start generating revenue in 3-4 years, the free cash flows for the first 3-4 years may be lower and may grow exponentially post that. Here however the problem will be deciphering between managements realistic and over-ambitious goals.

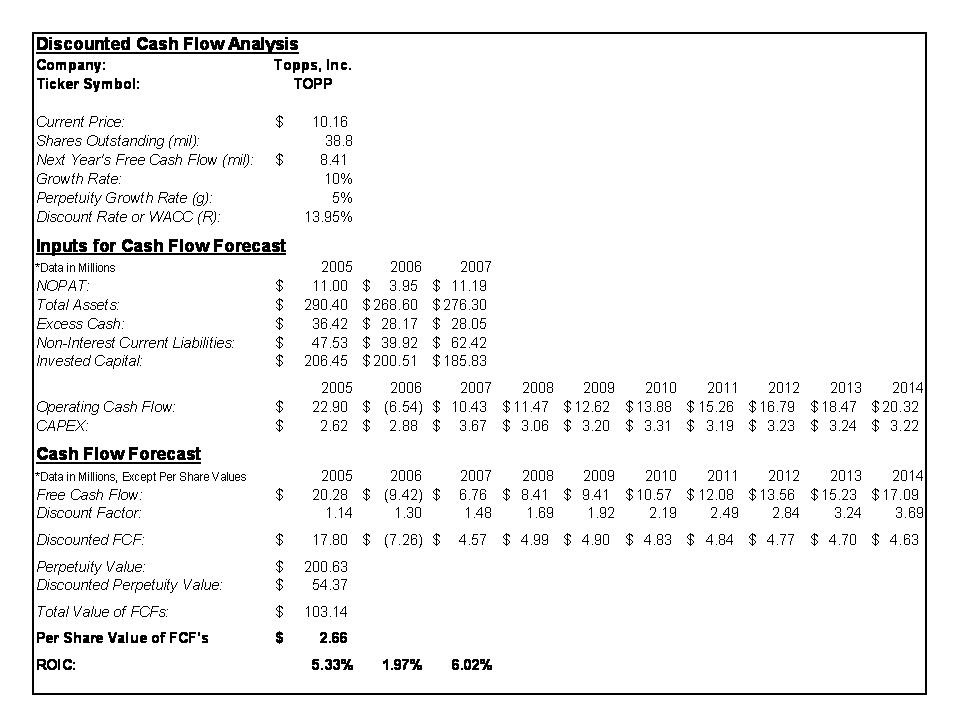

DCF Analysis as a Method of Stock Valuation

CASE STUDY — ITC Limited

Just to explain how assumptions and future predictions can completely change the dynamics, let us calculate the present value (you may call it the intrinsic value ) of ITC Limited using the DCF Analysis model.