DCF Analysis

Post on: 28 Апрель, 2015 No Comment

DCF Analysis

More than one year ago I was spending some time in a library and I was fortunate to bump into an interesting book about valuations: Investment Banking by Rosenbaum and Pearl. I read the intro and liked the practical focus and made a photo of the cover to add the book to my wish list. The past month I decided to spend some time to learn more about corporate finance, so I decided to buy the book via Amazon. After reading the chapters related to discount cash flow (DCF) analysis I can affirm that the book is great, and provides a concise and practical framework to know how the professional’s bankers value companies.

In the following post I’ll resume some of the main points from the Discounted Cash Flow (DCF) analysis chapters. The valuation process described by the author relies on 5 key steps:

- Study the target and determine the key performance drivers: the key drivers for the valuation can be internal (e.g. new product, new customers, more efficiency) or external (e.g. macroeconomics factors, acquisitions). This information can be found in recent SEC filings (e.g. 10K, 10Q, 8K) or for private companies in company website, SEC filings of competitors, customers, or suppliers

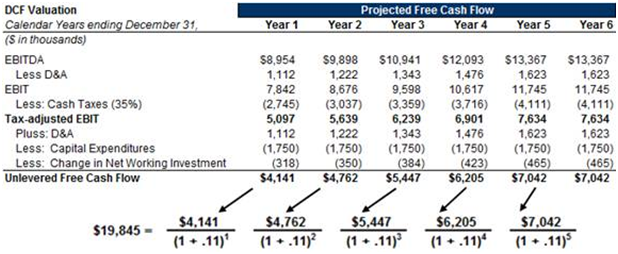

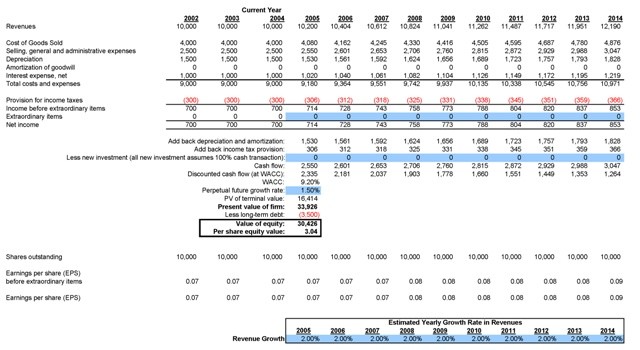

- Project the free cash flow: typically projected over 5 years, spanning at least one business cycle. In the case of private companies where the financial projections are not provided by the management the analyst will analyse historical data, sector trends and consensus estimates for public comparable companies. The values to estimate are related to the variables in the FCF formula: FCF=EBIT(1-T)+DA- ∆NWC- ∆NFA. EBIT and NWC will be driven by sales, DA and NFA are related to the capital expenditure, and T will be the marginal tax rate generally in the range of 30-40%

- Calculate weighted average cost of capital: the WACC is dependent on the target capital structure and to the risk profile of the estimated FCFs. For this reason in companies with different business units (BUs), WACC can be calculated as an average of the WACCs of the different BUs. The formula of the WACC is: WAAC=Re*(E/Ev)+Rd^*(1-T)*(D/Ev). The target capital structure can be derived from comparable companies, or if not defined, is often set to maximize the enterprise value (Ev). This target value is considered to be constant through the projection period. In calculating Kd the best approach is the one that is forward looking. In the sense that considering the target capital structure we can derive a future rating for the company debt, and a consequent cost of the debt. The Ke is calculated using the CAPM formula: Re=Rf+ βL* (Rm-Rf). The risk free rate (Rf) is provided by different sources like Ibbotston Associates (IA uses an interpolated yield for a 20 year bond). The market risk premium (Rm-Rf) ranges from 4% to 8%, being the market reference the S&P500 (for USA companies). The β is a measure of the covariance between the rate of the return on a company’s stock and the overall market return (systematic risk). For USA companies the S&P500 is used as a proxy for the return on the market. Public companies historical betas can be sourced from Bloomberg, Facset, Tomson Reuters. But this values cannot be a reliable indicator of the future returns. For this reason is better to use a predicted beta (e.g. MSCI Barra) because it is forward looking. In the case of a private company the beta can be calculated analysing traded peer companies. To neutralize the difference in the capital structure the banker will calculate the asset beta (unlevered beta) for each company, and then calculate an average weighted on the market cap. The average unlevered beta is then relevered to the target capital structure. Following the main formulas: 1) βu= βL/(1+D/E*(1-T)) where E is the market-cap, 2) βL= βu*(1+D/E*(1-T)) where D/E is the target debt to equity ratio. For small companies a size premium can be introduced, Ibbotson provides size premium based on market-cap. The Re formula is: Re=Rf+ βL*(Rm-Rf)+SP

- Determine terminal value: there are 2 methods used to calculate the terminal value (TV): 1) exit multiple method. In this case TV= EBIDTAn * Exit Multiple (n=terminal year of the projection period), 2) perpetuity growth method. In this case TV=FCFn*(1+g)(WACC-g) (g is the perpetuity growth rate). The 2 methods are often used in conjunction to provide a sanity check. For example if I use the EMM method then I can derive an implicit growth rate. If this value is to high is could be that the exit multiple assumption is unrealistic

- Calculate present value and determine valuation: the present value of the FCF an TV, discounted using the WACC is the enterprise value. In this process is often used the mid-year convention assuming that the FCF are generated not at the end of the year. In this case the discount factor will be 1/(1+WACC)^(n-0.5). Note that the TV will be discounted using the year-end discounting because the multiple used in the EMM is often related to the end of the year EBIDTA. Once we have calculate the Ev we can calculate the Equity value using the following formula: E=Ev Net Debt Preferred stock Non controlling interest + Cash and Cash Equivalents

The precedent DCF analysis gives to managers a great framework to analyse the key drivers of the value generation for their company. The final value of the company is not the key result of the analysis, the main achievement is going through the process, understanding which levers need to be used to maximize the company success.

Do you know other frameworks to value companies?