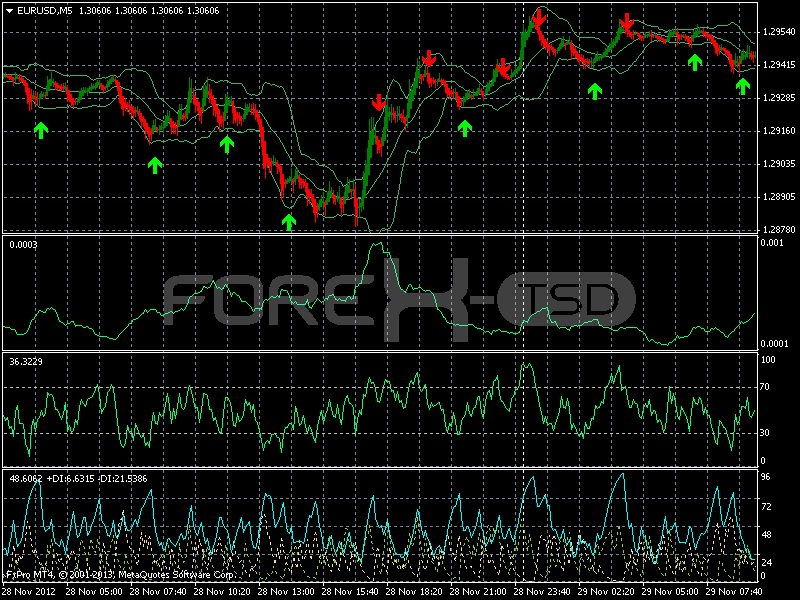

Daytrading Tool 5 minute buy

Post on: 29 Июнь, 2015 No Comment

This is a very straightforward tool, and you can pick it up pretty quickly, there is a tool for this trade. it is called you. This buy-sell signal is meant to provide improved entry/exit judgment, in other words it is like any other tool: not fail safe, needs to be used properly, and only improves your odds, which is the best you can do in the stock market. I got this idea from Andrew Keene at keene on the market.com. I am most interested in the buy-sell signals that come as buy signals off a swing low between cash market open at 9:30 and about 11:15, as manifested on the 5 minute ES (S&P Emini Futures) chart. This tool should translate well to most liquid indexes and some prominent stocks that trade gobs of money daily, like AAPL. The morning reversal off dips matches the trend since Dec ’11, so I will use it until the trend dies. Then I will reevaluate the tool, and perhaps employ it in a down trending market.

Usually the market puts in a day session high or low in the first hour. Ideally we get a buy or sell signal immediately following what turns out to be the high or low. What you want to see is a relatively wide range bar (not massive, just a bit wider than the preceding few bars) that exhausts a micro trend, and then a reversal bar that is your entry signal. This reversal bar should usually be a wider range (body of candle, i.e. open to close) than the preceding bar, and should with very very few exceptions close higher than the preceding bar’s open for a buy signal, or lower than preceding bar’s open for a sell signal. If this is hard to visualize, look at this annotated chart:

Note the buy signal just after the open. I did not take this, because I expected a morning dip, as has been the custom for the vast majority of trading sessions this year. This proved to be fortunate as the move was not worth it anyway. The sell signal (just after 1394.25 high) was a good one, tested prior candle’s high, closed below the open. So we are in this trade short from about 1392.75-1393. I use ES chart as a proxy for trading SPY options, because the real action is usually in the futures, but I like the SPY options liquidity and it fits my schedule better than futures trading. So I am long some SPY in the money puts from here. We get a few good red candles flushing us down a bit. Then energy begins to wane. Around 11:30, we get a buy signal, another good one. It moves straight up off the open, goes above prior bar’s high, and closes above prior bar’s open. We get immediate follow through on the next bar then waffle around for a bit. But it turns out to be a great exit, netting about 40 cents on SPY short on a range to that point of about 60-65 cents, not bad at all.

We need to talk safety, i.e. stops and risk-reward. You need to have a feel for the markets’ daily movements and general trend to optimize this tool. Stops should be outside the high/low for the day, if you are playing the early reversals. A move outside the day’s range usually invalidates your signal, and you should consider always having hard stops as far outside of the range as you are comfortable given your risk tolerance and your analysis of the risk-reward ratio on the trade. For instance, I felt we would see 1387 from 1393, so I could set my stop to 1395 for a 1:3 risk-reward ratio. My stop was safe and I ended up bailing just a few ticks early when downside momentum waned.

Now, before closing this post out. look at the not a buy signal we got around 1:50 PM. The bar was shaping up well. but remember what I said about the set up for the reversal bar? we don’t want it to be TOO wide, we don’t like that much volatility on our reversals, it makes it harder to see them for what they are, and harder to trust them, plus volatility increases your chances of being stopped out. The not a buy bar rallied hard, but couldn’t recoup that much ground in five minutes. Here is what happened since then.

Hmmm. looks like it might be a bear flag? Regardless, not the highest-odds entry, and that is what this tool is meant to bring us, so no trade there. I do think the low is in today but I don’t need to let my money do that talking.

www.hotstockmarket.com/t/203601/spy-daytrading-tool-blend-of-emas-macds-vwap-atr-trailing-stop-on-5-minute-chart