Day Trading With Only The 20Period Moving Average Trading Setups Review

Post on: 16 Март, 2015 No Comment

Day trading is a fast game with many factors. It is best to keep your trading method simple for effective trading.

For traders looking for simplicity, using only a 20-period moving average to day trade is a great option.

20 is not a magical number or the best kept secret in day trading. Basically, any intermediate period is useful for day trading. A long 200-period moving average lags too much and does not help day traders. A short 3-period moving average is almost like price itself and is mostly redundant.

As for the choice of moving average type, we are using exponential. But a simple moving average will work fine too. The key is consistency and do not keep changing the period or type of your moving average.

1. Using Moving Average For Market Context Analysis

Determining the price action context, whether the market is trending or in a range, requires discretion and experience. A moving average can help to clarify the price action.

These are some questions to help you clarify the context using a moving average.

- Are prices above or below the moving average now?

- How did prices get there?

- Have prices been overlapping with the moving average?

- What is the slope of the moving average?

- Has the slope been changing often?

The answers to these questions cannot be interpreted in isolation. We need to integrate them to form an analysis.

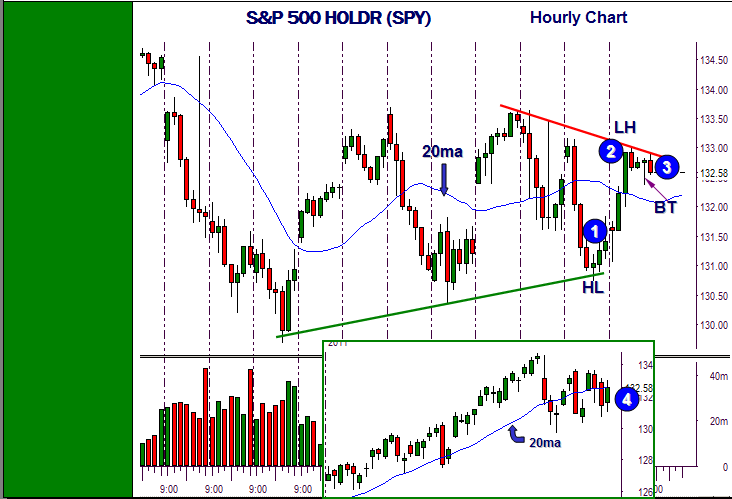

Example of Using Moving Average for Price Action Context

Lets try to answer the guiding questions above.

- Price is now above the moving average.

- It got there after a bounce off the moving average. However, it has not exceeded the last swing high.

- 7 out of the past 20 bars overlapped with the moving average. The bars that overlapped mainly had long bottom tails. The bars that did not overlap the moving average were all above it.

- The slope of the moving average is positive but not overly steep.

- The slope of the moving average turned down momentarily at two instances.

Integration and analysis of trading context

Prices were mostly above the moving average and bounced from the moving average. These signs show that the day has been bullish .

However, the slope of the moving average is not steep and had turned negative at two instances. So, despite the bullishness, the market is not in a strong trend .

What are the implications of our analysis on our day trading?

We should only take long trades until there are bearish signs. But due to the lack of a strong trend, we should aim for nearer targets.

2. Moving Average Day Trading Setups

After analyzing the market context, we have to look for trade setups and the moving average is again a useful tool.

In a bull trend, buy when prices retrace to the 20-period moving average. In a bear trend, sell when prices pullback up to the 20-period moving average.

This chart shows the price action after our price context analysis.

The two-bar reversal at the moving average was a buy signal. As the context was bullish, we took the trade. However, as implied by our context analysis, we should not press for large gains.

3. Trade Management

Although not applicable in the same example, the moving average is also a natural tool for placing trailing stops. The moving average follows the price trend but lags behind it.

Hence, a trailing stop based on a moving average locks in profit and at the same time gives enough room for whipsaw action.

Conclusion: Day Trading with Moving Average

Day trading with a moving average is a simple approach to capturing intra-day trends.

It is a valuable tool for traders learning price action. This because a moving average plots on the price chart itself and interacts with price itself. When we look at a moving average, we have to look at price as well.

Open a chart now and put on a 20-period moving average. If you practice enough, a 20-period moving average is possibly the only indicator you need.