Cyclical versus Secular Bulls versus Bears

Post on: 28 Апрель, 2015 No Comment

Is this a Cyclical Bull within a Secular Bear? Who Cares?

Stick with the Evidence

The Strongest Stock in the Market

—

While every investor knows the terms bull market and bear market, every investor seems to have a different definition of each. Some people consider any period of rising prices a bull market. Others require that prices generally rise for a certain time—maybe six months—to be called a bull market. And of course there’s the popular (though highly flawed) view that any 20% move up in an index represents a new bull market, while a 20% decline constitutes a bear market.

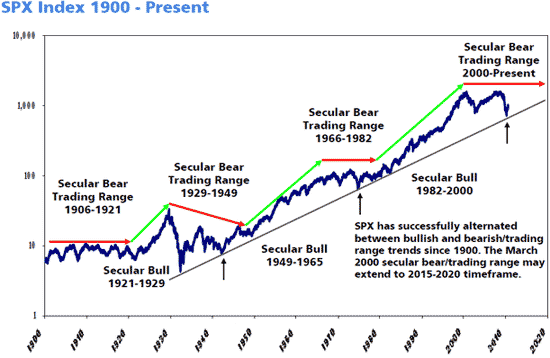

Adding complexity to these simple phrases is the cyclical versus secular debate. Simply put, a secular bull market is one that supposedly lasts many years or even decades. The years 1982-2000 are often called a secular bull market—on a very long-term chart, prices headed higher during that time. But you also had individual bear markets within that time, lasting maybe six to 12 months each, before the bulls retook control.

On the flip side, the 1966-1982 period is often referred to as a secular bear market; the Dow didn’t make any progress during that time! But within that period you had numerous cyclical bull markets, again, each one lasting six to 12 months, before the bears retook control.

That brings me to today, as some people are referring to the current three-month upmove as just a bear market rally. Some are referring to it as a cyclical bull market within a secular bear market that began back in 2007. Still others think we’ve been in a secular bear market since 2000, while others believe we’re in a new bull market.

Confused yet? You should be! I like a good debate as much as the other guy, but in this case, I find the whole secular-cyclical-bull-bear debate to be a waste of energy. I specifically remember when I was at Prudential Securities back in the late 1990s, and the market was beginning to fall apart thanks to the Russian ruble and Long Term Capital Management implosion. At the time, Ralph Acampora, who was head of Prudential’s technical analysis team, was on the squawk box, telling all the brokers and money managers he was turning bearish for such-and-such reasons; the specifics aren’t important. (For the record, turning negative was a good call.)

What I do remember is that one of the brokers asked a question: Ralph, do you think this is a correction? Is it a cyclical bear market within a secular bull market? Or is it the start of a secular bear market? I will never forget Acampora’s answer: Call it a banana for all I care. Prices are heading down.

At the time I liked to debate and was a bit disappointed in his answer. But as the years have passed, I have learned the value of what he said. Really, the whole debate is just semantics and takes away from the major goal—making money.

—

For instance, you can say all you want that we’ve been in a secular bear market since 2000. and you may be right. But secular bear or not, that didn’t stop many big winners from lifting off from 2003-2007, including Apple, Google, First Solar, Crocs, Research in Motion, Coach, XM Satellite Radio, Intuitive Surgical, Potash, Mosaic, Intercontinental Exchange, Nasdaq Stock Market, Southwestern Energy, Ultra Petroleum. need I go on?

7E/media/Images/Graphics/Ads/bgvsquare.ashx /% The reverse is also true. We might have been in a secular bull market during the 1980s and 1990s, but many investors lost most of their capital during the ’87 crash, the 1990 bear move or the ’97 and ’98 emerging market debacles.

Listen, I’m a long-term investor, and I plan on being involved in the stock market for decades to come. But allowing the secular-cyclical, bull-bear debate to affect your investments can be a mistake. It’s better to just go with the evidence the market has presented. Right now, the market timing indicators I follow are still bullish, although the recent correction brought a couple of them close to the brink.

In the longer term, I’ve written before in a few different spaces that I do believe the bear market is over and we’re in a new bull market. The main reasons I believe this are (a) the huge decline that has already taken place since 2007, which brought about 50-year lows in consumer and investor sentiment, (b) the bottoming process from October through March of this year, which repaired the damage from the crash (c) the minuscule number of stocks hitting new 52-week lows even during the market’s latest pullback (still in the single digits!), and (d) a couple of the blast-off signals the market flashed in March and April (such as 90% of all NYSE stocks getting above their respective 10-week moving averages).

Maybe a better way to say it is that, given the above, I think the odds are heavily in favor of this being a new bull market, not just a brief rally. However, there are no 100% bets in the stock market—as we’ve seen during the past year, anything is possible in the stock market. If my indicators turn decisively negative, am I going to say, Well, this is just a pause before a renewed upmove. Buy with both hands!? Of course not. I’m going to go with the evidence, i.e. raise some cash, try to hold on to my strongest performers, and then re-evaluate the situation every day. Let someone else make the bold call—remember the saying that there are old traders, and there are bold traders, but there are no old, bold traders.

So far, the indicators are positive, and while the past couple of weeks have been damaging to a wide array of stocks—from leaders to off-the-bottom stocks like financials and commodities—I’m still betting that this is a bull market. Cyclical or secular? I’ll let you debate that one.

— Advertisement —

It’s Time to Buy

So says Cabot Market Letter, the investment advisory that has called every new bull market advance since the 1970s. And it’s declaring once again. It’s time to buy!

From the market’s bottom in March 2003 to the recent low in March 2009, the S&P 500 lost 18% in total and the Nasdaq lost 3.5%. Cabot Market Letter, however, left them in the dust: Advancing a total of 94% during the past six years (nearly 12% per year).

Don’t miss out on the first innings of the new bull market. Get started today!

—

With most stocks getting hit in the past week, it’s hard to find a stock that’s at a pristine buy point. And, frankly, even if I saw one, I’m not sure it would work out—when the market is under pressure, good stocks can go bad in a hurry. So I want to highlight a company with a new product, with outstanding sales and earnings growth, and whose stock is probably the strongest in the entire market—in other words, it’s a potential winner once the bulls re-take control.

The company is STEC Inc. (STEC), which I’ve written about a few times in both Cabot Market Letter and Cabot Top Ten Report. On the surface, the firm appears to be just another semiconductor firm, producing solid-state (read: flash) drives. And there’s nothing special about that; SanDisk and others produce flash memory for many consumer devices, and at this point, flash is just a commodity product.

However, STEC Inc. does not produce flash memory for consumer products—it’s targeting large-scale commercial uses like servers and huge storage devices. And it turns out these drives are NOT run-of-the-mill; STEC Inc. has basically no competition, and that’s a big deal because the drives save tons of component and power costs (up to 50%!) and boost performance markedly when compared to hard disk drives.

IBM is using STEC’s drives in two of its most popular storage and server systems, Fujitsu is using STEC’s drives in one of its storage systems, and Hewlett-Packard is also a big-time customer. Right now, demand is so strong that STEC just upped its second quarter earnings guidance. causing a massive 30% jump in the shares.

Honestly, I do think you could nibble here, maybe buying a token position. but I’m content to simply watch it closely and wait for a better-looking entry point. If the market has indeed shrugged off its case of the jitters, I expect STEC to enjoy further upside. Keep it high on your own Watch List.

All the best,

Mike Cintolo

Editor’s Note: Cabot Top Ten Report is the #1 source of new stock ideas, like those mentioned above by Mike. Crocs, First Solar and STEC Inc. As the editor, Mike always has his eye on the market, looking to discover which stocks are going to be the leaders of the new bull market. Every Monday, he provides subscribers the market’s 10 hottest stocks, including a detailed fundamental and technical analysis. If you’re ready to discover the strongest stocks in the market today, Cabot Top Ten Report is right for you. Click here to get started today!

—

Michael Cintolo can be found on Google Plus.