Cut your taxes Canadian Business

Post on: 21 Июнь, 2015 No Comment

(Photo: iStock)

Whatever you think of Mitt Romney, you’ve got to hand it to the Republican presidential candidate for taking advantage of his country’s tax system. In January, Romney revealed that he paid an effective tax rate of around 15% on his more than US$20 million income in 2010. Only about $375,000 of that—“not very much,” as Romney put it—was income he earned on the speaking circuit. The rest was investment income. While paying less tax on the dollar than the average American may not help his chances of becoming president, Romney did nothing wrong. He’s simply a savvy investor who understands the relationship between taxes and investing.

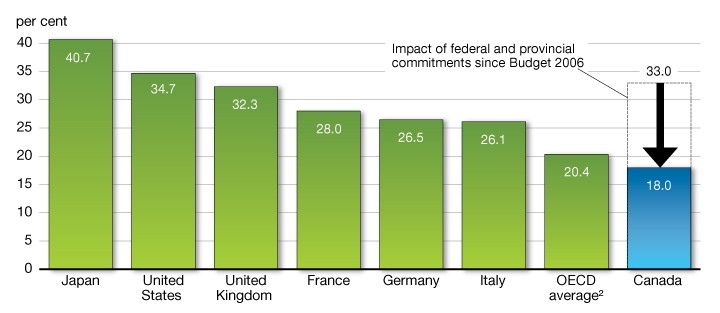

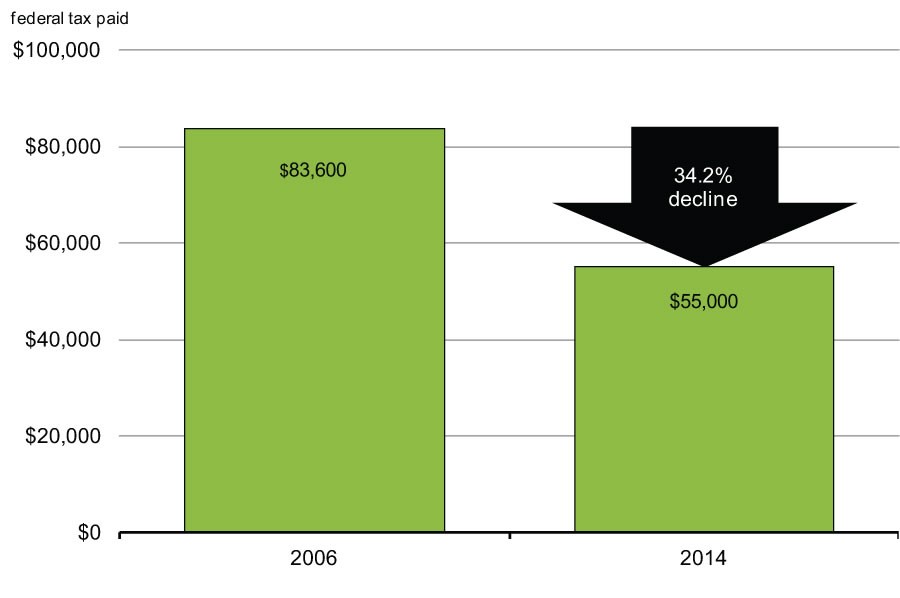

We could all stand to be a bit like Mitt, as you’ll likely discover while tabulating your 2011 tax return. As in the States, Canadian investment income is taxed at favourable rates compared to employment income. You won’t get your rate as low as the former governor and head of Bain Capital—the tax rates are unfortunately higher up here—but if you invest your money wisely, and with taxes in mind, you could pay as little as 20% on your investment returns.

Unfortunately, most of us don’t take taxes into consideration when we invest. But, says Craig Senyk, a portfolio manager with Calgary’s Mawer Investment Management, we should. “It’s one of the most underestimated things in an investment portfolio,” he says.

Minimizing taxes ultimately comes down to the types of securities you own and where you hold them. There’s not much tax planning to do if your only financial asset is a registered retirement savings plan. Anything held in an RRSP grows tax-free; you only pay up when the money is pulled out. It’s when one uses both registered and non-registered accounts that tax strategy comes into play. Jason Safar, a Toronto-based tax leader with PricewaterhouseCoopers, says the ideal investment in any taxable account is a high-growth, non-dividend paying stock. Why? Because a capital gain—the difference between the price at which you bought a stock and later sold it—gets a better tax treatment than regular income. Canadian dividend income is also taxed favourably, although not as well as capital gains for high-income earners. Plus, investors have to pay tax on their dividend income every year; you only fork over cash on gains when you sell a stock.

Investors with multiple accounts should hold growth stocks outside their RRSPs when they can, says Safar, because Canadians pay tax on only half the capital gain. Ontario investors who are taxed at the highest rate pay about 23.2% on their gain, while Alberta investors are on the hook for 19.5%. If the stock were held in an RRSP, investors would have to pay the same taxes on those gains as they would on ordinary income—so those in the highest bracket would have to pay 46% and 39%, respectively, when the money was eventually withdrawn. Canadian dividend stocks and the preferred shares of Canadian corporations should also be held outside an RRSP, explains Safar. The dividends from both are taxed at the lower dividend tax rate, which in Ontario is 29.54% and in Alberta is 19.29% for those in the top tax bracket.

The rule of thumb is that any investment that’s taxed at a rate lower than your regular income tax rate should be held outside your registered accounts. That means bonds, which don’t receive any special tax treatment, should always be held in an RRSP, registered retirement income fund (RRIF) or tax-free savings account (TFSA).

The situation gets more complicated with foreign dividends, which aren’t subject to the same favourable tax treatment as Canadian ones. Most national governments withhold about 15% of any dividends paid to foreign investors. However, this withholding tax doesn’t apply to U.S. dividend-paying stocks if they’re held inside an RRSP. That means any American dividend equity should be held inside a registered account, in order to get the full dividend amount, says Patti Shannon, vice-president and portfolio manager with Leith Wheeler Investment Counsel in Calgary. You’ll want to hold dividend stocks from other countries outside the RRSP, though, because investors get a tax credit for the amount that’s held back. “If I’m holding a Vodafone or Statoil, which pay hefty dividends, inside an RRSP, part of that dividend will be lost forever,” says Shannon. “Hold them outside, and while I’ll still be subject to withholding tax, I’ll at least get that credit.”

Tax-efficient investing can be even trickier for mutual fund holders. Funds often pay annual distributions made up of dividends, capital gains and interest, and investors often have no clue what that payout consists of. Russ MacKay, an associate portfolio manager with Calgary investment firm McLean & Partners, says that investors have to pay a different tax rate on each part of that distribution. The makeup often varies from year to year too, depending on what the fund holds and what it sells. Investors, he says, need to talk to their adviser or the fund company to figure out what the payout will look like. Also look at past history to see if there’s a pattern. “Understand if you’re buying something with a tax liability or a tax benefit built into it,” he says.

There’s more to tax-efficient investing than holding the right stock in the right place, though. To really save money, you also have to adopt a tax-efficient investment strategy. One way people get hit is when they sell too many stocks at once and are forced to pay a lot of gains, says Senyk. He thinks a portfolio should experience at most a 20% turnover in a year. People try to play the market too much, without realizing that they’ll have to pay tax on every gain, he says. Mutual fund managers themselves are often guilty of excessive turnover, says Senyk. What sometimes happens is that a fund ends up with a negative return, yet investors still have to pay capital gains tax on the stocks the manager sold. “How much of a slap in the face is that?” he asks. To avoid that situation, look for funds with low turnover, or try to find out a fund’s after-tax return.

Investors can also help minimize their capital gains bill by selling stocks that have lost value and realizing capital losses before Dec. 31 of each year. For every stock you sell, you get a capital-loss credit that you can apply against future gains. For example, if you lose $1,000 on a stock, you would get a credit on $500. If you’re in Ontario and in the highest tax bracket, you’d get a credit for 23.2% of the loss. The idea is to sell losing stocks to offset gains on other stocks. If you don’t have any gains, you can still offset capital gains paid over the last three years or carry that loss forward indefinitely to use against future gains.

While it’s not wise to sell a stock that could skyrocket, tax-loss selling isn’t always about dumping a dud. In fact, Shannon often sells perfectly good stocks to realize losses. She doesn’t buy the stock back immediately after selling it, though; Canada Revenue Agency’s Superficial Loss Rule prevents investors from realizing a loss if they repurchase that company within 30 days of the sale. To make sure she doesn’t miss out on any gains during that month, Shannon will instead purchase a similar stock in the same sector. If she sells RBC, for instance, she may pick up TD. After a month she can sell TD and buy back RBC.

In a similar manner, Senyk will buy a sector exchange-traded fund (ETF) for 30 days, which allows him to own some of the stock he just sold without running afoul of CRA. “I’ve sold Royal Bank and bought an iShares financial sector ETF,” he explains. “It’s got a 90% correlation to RBC, and the bank makes up 20% of the security.”

While there are plenty of strategies you can employ, if you stick to the basics—holding tax-efficient securities outside a registered account—you’ll end up pocketing more of your returns. Start planning now, though. If you do nothing, you’ll regret it the next time tax season rolls around.

What to hold in a registered account

Any investment that produces income that’s taxed at the same rate as regular earned income should be held in an RRSP if possible. That includes guaranteed investment certificates (GICs), bonds, bond funds and most real estate investment trusts, as their payouts are considered income and taxed at the regular rate.

You will be taxed on all the money you eventually withdraw from your RRSP at your regular rate, but you will have enjoyed years of tax-free growth, and most people have a lower income in retirement than they did when working, so their tax rate is lower too.

Be careful when it comes to REITs. Some do pay dividends, but REITs which pay a return on capital should be held outside an RRSP so the principal won’t get taxed when you withdraw. Among bonds, Mawer Investment’s Craig Senyk recommends Sun Life, which has a 4.75% coupon rate and good long-term prospects, and Quebec provincial bonds, which have a 3.5% coupon.

What to hold in a non-registered account

Investments that receive a favourable tax treatment should typically be held outside registered accounts such as RRSPs. That includes all Canadian dividend-paying, capital-gains-generating and preferred shares, all of which are taxed below the regular rate. Unless you retire in the lowest tax bracket, you’ll likely end up paying less money on these securities than you will when you have to withdraw income from an RRSP.

Senyk likes stocks that have high growth potential and high dividends. His picks include First Capital Realty (TSX: FCR), a Toronto-based developer and owner of shopping centres in big urban markets, and travel rewards company Aimia (TSX: AIM), formerly known as Groupe Aeroplan. Both are breaking into new markets and have dividends of 4.4% and 4.8% respectively.