Credit Default Swaps Controlling Exposure to Risk

Post on: 26 Апрель, 2015 No Comment

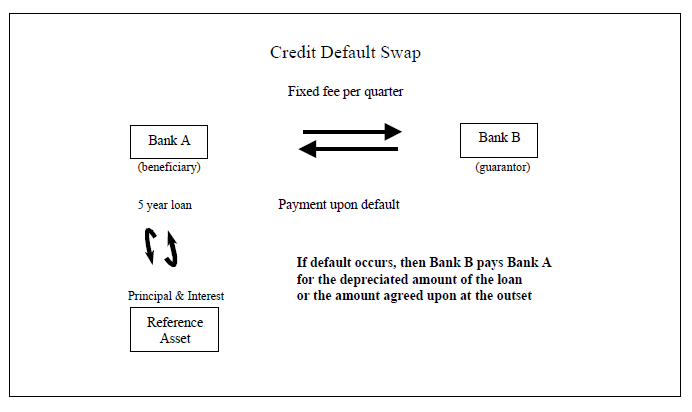

Credit default swaps are the utilized to control one’s exposure to credit risk. A credit default swap is similar to an insurance contract because it provides protection against specific credit events. In a typical credit default swap, one party sells credit risk, usually associated with a corporate bond or underlying credit asset, to the counterparty. The buyer pays a periodic fee or premium, normally expressed in basis points on the notional amount, to the seller. In return, the seller pays default payment upon a default i.e. defined credit-related event of the underlying corporate entities, thus protecting the buyer from a financial loss.

Credit default swaps are often founded on the ISDA Master Agreement which defines the protection and obligation of the parties. However, if any default does not occur during the term of the swap, then the buyer continues to pay the premium till maturity. Traditionally, there is no exchange of money when the two parties enter into the contracts. The payments are done only during the term of the contract.

The premium paid by the buyer to the seller is most often called a “spread”. It is expressed in basis points per annum of the notional value of the contract and, typically, paid quarterly for corporate credit default swaps or even semiannually. The notional value of a contract implies the total face value of the underlying asset. It is important to note that these spreads are not the same as the yield spreads of a corporate bond or government bond. The maturity period of a typical credit default swap varies from one year to ten years, with five years being the most common time frame. There are no limits on the size of a credit default swap contract, though most contracts fall between $10 million and $20 million. The underlying corporate entity may be autonomous corporate entities, state governments, financial institutions and other investment or sub-investment grade corporations.

Once the specified credit-related event, like the insolvency of a underlying corporate entity, occurs, a ‘Credit Event Notice’ is delivered either by the buyer or seller. Usually, the settlement conditions for the default payments of credit default swap are established at the time of writing the relevant credit default swap. In case the particular credit-related event is triggered, cash settlement or physical settlement is settled upon:

Physical Settlement. In a physical settlement, the seller actually takes delivery (or buys) the defaulted bond or loan from the buyer at the par value. Physical settlement takes place within 30 days after the credit event.

Cash Settlement. Cash settlement is the payment equal to the difference between the market value of the bond (or the final value of the underlying credit asset for the initial notional amount) and the par value of the bond.

The main difference between a physical settlement and cash settlement is that in a physical settlement the seller has remedy to the underlying corporate entity as well as the chance to take part in the workout procedure as the holder of the defaulted underlying credit asset.

The most common Credit Events of credit default swaps are:

Bankruptcy. The underlying corporate entity becomes insolvent or is unable to repay the debt.

Failure to pay. The underlying corporate entity is unable to make the outstanding interest or principal payment.

Debt Restructuring. The underlying corporate entity negotiates changes in the terms of the debt obligations with its creditors to avoid default on existing debt. The changes may include postponement of payment, reduction in the principal amount or interest payable under the obligation, etc.

Obligation Acceleration or Obligation Default. The debt obligations of the issuer become due and payable before their initially scheduled maturity date as a result of default by the underlying corporate entity.

Repudiation/Moratorium. The underlying corporate entity rejects or challenges the validity of the related debt obligation, in effect refusing to pay interest and principal.

The market of credit default swaps is divided in three segments of bank credits, rising market autonomous corporate entities and corporations. Credit default swaps contracts can drawn by single issuer or multiple issuers. Multi-credit Credit default swaps can reference a portfolio of credits decided by the buyer and the seller or a credit default swap index.

Credit default swaps are customized to protect against risks of bankruptcies, defaults and credit rating downgrades. Mainly, corporate bond investors purchase credit default swaps to hedge against default by the issuer of the corporate bond. In general, credit default swaps are able to lessen risks in bond investing by shifting the specified risk from one party to another without turning over the underlying bond or the given credit asset.

The most common users of credit default swaps are banks. Usually, a bank’s business revolves around credit risk stemming from loans to businesses. Through the credit default swap market, banks can shift risk without involving borrowers and without removing the assets from its balance sheet. Insurance companies are progressively becoming leading participants in the credit default swaps market, to boost investment yields as sellers.

The performance of credit default swaps is directly linked to the changes in the credit spreads, thus making them valuable hedging instruments to take up exposure to default risk as well as changes in credit spreads. By purchasing credit protection through credit default swap, one can create a short position without the requirement of initial cash expenditure. In short, credit default swaps can be utilized as a vehicle to diversify or hedge credit portfolio.