Covered Warrants TD Direct Investing

Post on: 16 Июнь, 2015 No Comment

Choose an investment

What are Covered Warrants?

Covered warrants are issued by large financial institutions who maintain buy and sell prices for covered warrants on the London Stock Exchange (LSE).

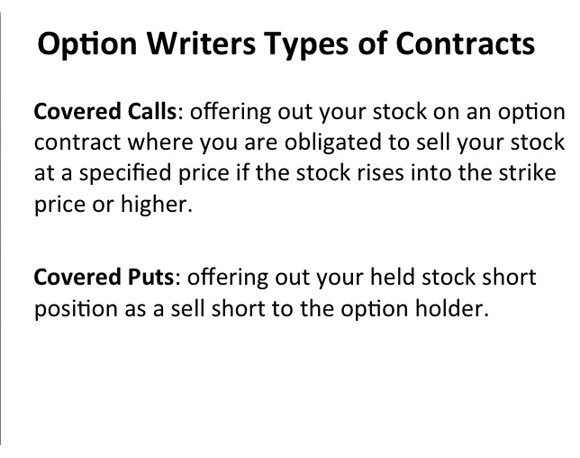

Covered warrants give the buyer the right, but not the obligation to buy (Calls) or sell (Puts) in a certain underlying asset, at a pre-determined price, on or before a pre-determined date.

Covered Warrants Benefits

Covered Warrant Guides

We offer covered warrants in partnership with the leading issuers; Société Générale'(SG) and Royal Bank of Scotland (RBS).

SG’s Guide

%img src=/

/media/UK/images/sg-thumbnail.ashx?w=113&h=113&as=1 /%

RBS’s Guide

%img src=/

/media/Images/RBS-Brochure-cover.ashx?w=113&h=113&as=1 /%

How do Covered Warrants Work?

Covered warrants provide the same level of exposure as buying ordinary shares but you only pay a fraction of the cost of the underlying asset.

Just like shares covered warrants can be bought and sold at anytime, online or by telephone. Unlike shares they have a limited life span — between 3 months and 3 years at issue. After which the cash value (if positive) of the warrant is automatically paid out to the holder.

How risky are Covered Warrants?

Before trading you should fully understand the nature of covered warrants and your exposure to the risk involved.

The geared nature of covered warrants means that a relatively small movement in the share price of the underlying asset will result in larger movements in the value of the warrant. Therefore, covered warrants provide the opportunity for greater returns than ordinary share dealing but also greater risks and potential losses. If you are in any doubt you should consult an Independent Financial Advisor.

How much do Covered Warrants Cost?

Covered warrants are traded like shares and are charged at normal online commission rates, which start from just £5.95 for active traders. See full rates and charges .

As you don’t own the underlying asset and only cash is exchanged rather than shares, there is no stamp duty that is usually charged on UK share purchases.

Which Account do I need to trade Covered Warrants?

Covered warrants can be traded through our Trading or SIPP Accounts. HMRC (Her Majesty’s Revenue and Customs) do not allow covered warrants in a Trading ISA.

Existing Customers — to start trading covered warrants you can upgrade your account to trade Covered Warrants online today. Login now and go to My Profile > My Details and Preferences > Appropriateness Assessment Form.