Covered Calls

Post on: 27 Апрель, 2015 No Comment

Beginning Option Strategies/Hedging

Writing Covered Calls

Andrea Kramer (akramer@sir-inc.com)

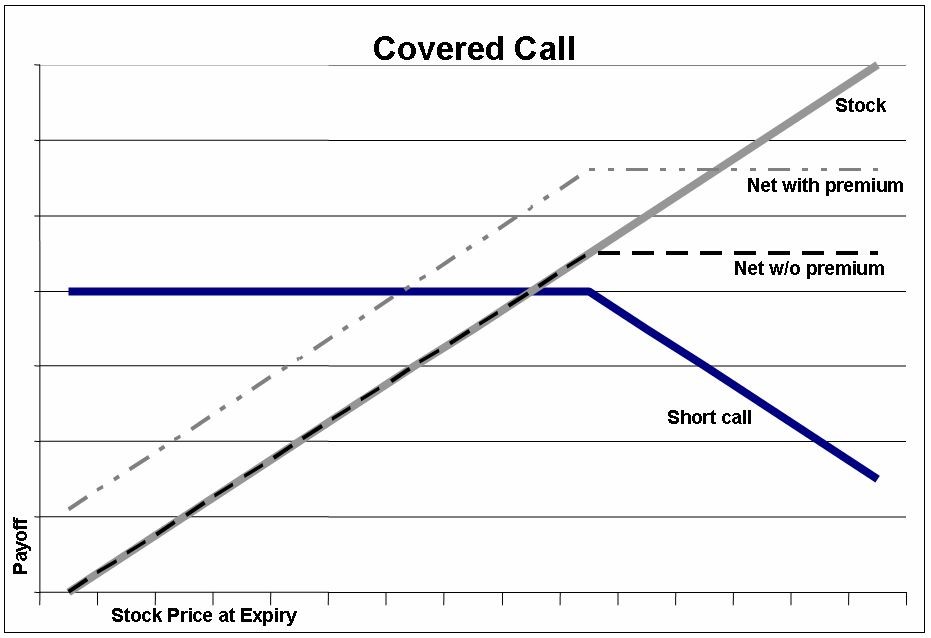

Even rookies to options trading seem to know about covered calls, and it’s a very popular strategy. No wonder: the risks are minimal, and it generates income right up front. It’s not a home run strategy, but home run strategies also entail a lot of strikeouts, and not all traders are comfortable with that level of risk. In this article, we�re going to learn how shareholders can protect against a potential pullback in the short term, and possibly generate cash on a stagnating stock, by writing covered calls.

Who should tune in? For a call to be �covered,� the option player must already own at least 100 shares of the underlying stock. There are two primary users of the covered call strategy: shareholders who remain long-term bullish on the stock, but want to protect their portfolios from a potential pullback; and shareholders expecting lackluster price action in the near term, and want to earn some extra income on the position in the meantime.

How does it work? First, the investor would single out a stock in his portfolio. The trader would avoid selecting a stock in which he�s long-term bullish, and should select a security in which he�s comfortable possibly unloading 100 shares. Next, the trader would then determine his expectations for the particular stock in the near term, which would then help him establish his specific objective for writing a covered call.

If the investor expects a moderate pullback on the charts, his objective may be to offset some of his portfolio losses and lock in an appealing price to unload his shares by selling an in-the-money call on the equity. These types of calls would generate the largest premium at initiation, and offer the most downside protection in case of a decline. However, in-the-money calls harbor the greatest risk of being called away, meaning the chances of keeping his 100 shares of the stock are slim.

On the other hand, if the investor is expecting the underlying stock to remain somewhat apathetic or post a slight decline in the near term, his objective may be to generate income during a time of stagnation or protect against a minor dip on the charts. When this is the case, the trader may write an at-the-money call, which generates a moderate amount of both initial income and portfolio protection. However, in the case of a short-term rally, writing an at-the-money call would prevent the shareholder from participating in the stock�s appreciation.

Finally, if the investor expects the underlying stock to stagnate or post a moderate rise in the near-term, he may write an out-of-the-money call. These types of options generate the least amount of both initial premium and downside protection, but allow the trader to participate in a stock�s upward trajectory up to the strike price of the call.

What�s in it for me? The reward of this strategy depends on the trader�s original objective. If his objective was to sell the covered calls to earn extra cash on his stock position, then he wants the underlying shares to remain as close to the strike price as possible without going over. Simply put, if the underlying stock remains below the strike price of the covered call by options expiration, the investor can pocket the initial premium received from the sale � as well as the original 100 shares of the underlying.

On the other hand, if the investor�s objective was to unload his shares of the stock at a predetermined price, then he wants the stock to finish slightly above the call strike at expiration so the option will be assigned. However, the trader doesn�t want the stock to surpass the call strike by too much, as he may regret not simply holding on to his stake in the stock from the get-go.

What do I have to lose? The losses from this strategy can be quite substantial if the underlying stock declines, but most of that hit is due to the stock ownership � not necessarily the written call. In fact, should the security take a significant hit in the near term, the covered call will actually provide a slight cushion for the trader, as he can still pocket the initial premium received from the sale.

On the other hand, if the underlying stock unexpectedly rallies in the near term, the trader could miss out on the potential portfolio gains. As previously mentioned, in this scenario, the covered call would be assigned in the wake of a rally beyond the call strike. As such, the investor would have to sell his 100 shares at the strike price � which would represent a discount to the stock�s worth in the open market.

(Don�t forget to include any brokerage fees or commission costs. )

Before you begin

In conclusion, covered-call writers should hone in on options with elevated implied volatility levels. When an option�s implied volatility is significantly higher than the stock�s historical volatility, it means the option is relatively expensive at the moment � which is a boon for the option seller, who is looking to collect a hefty amount of premium on the sale.

That said, writing covered calls can provide a shareholder some peace of mind in the near term, as this strategy helps protect against a potential pullback. Furthermore, this conservative option play can provide additional income during a stock�s stagnation, and can even enhance a trader�s return on investment in the case of a slight rally.

However, keep in mind that by selling a call on a stock you already own, you could prevent yourself from truly capitalizing on a significant rally. As such, investors that remain strongly bullish on the underlying stock in the near term may want to avoid writing a covered call altogether.