Costco Dividend Stock Analysis

Post on: 16 Март, 2015 No Comment

Company Overview

Costco Wholesale Corporation (NASDAQ: COST) operates an international chain of membership warehouses, that carry quality, brand name merchandise at substantially lower prices than are typically found at conventional wholesale or retail sources. As of 2010 Costco operated 582 warehouses in the US, Canada, Puerto Rico, UK, Taiwan, Korea, Japan, Australia, and Mexico. They also operate a website, Costco.com.

*Note: Costcos fiscal year ends in August. So Fy 2010 ended in August, 2010. All calculations in this analysis are based on the latest annual report, released August 2010, except for expected eps and current dividend yield.

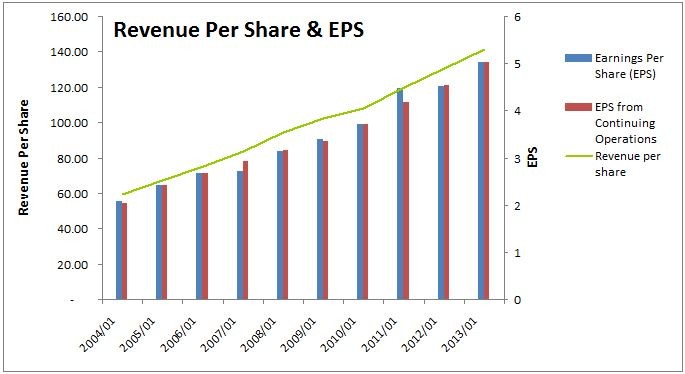

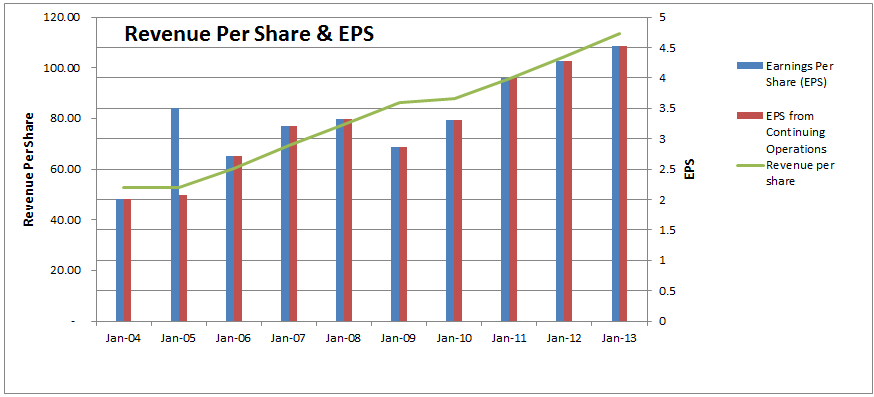

EPS, Dividends, FCF

Expected Earnings

Balance Sheet

Returns

Stock Price Valuations

p/e (forward) - 21.22

p/cash flow - 18.23

5 year high dividend yield - 1.44%

dividend yield - 1.16%

Conclusion

If you have ever shopped at a membership warehouse like Costco, you know how easy it is to get hooked. The place is enormous, and offers you larger quantities of goods than you ever imagined you could buy at once. Whats that, you need a gallon of mayonnaise? Check. A 100 pack of paper towels? Check. And while your there, you can also grab a computer, a bbq, and get your photos printed while you shop.

In addition to the super-deals you get, you can only shop there if you buy a membership, and buying a membership pretty much guarantees repeat customers.

I like Costco. Its got international exposure, a great business model, and its profitable. Margins are a little low, even for this industry, but their balance sheet is super-clean, and they have plenty of debt coverage. The dividend history is a little short, but Costco is a relatively young company, and the fact that they continued to grow their dividend, even during the recession, shows managements commitment to shareholder return. I do think its a bit pricey at the moment, and would like to see the price come down before I consider buying.

For comparison, see my analysis of other discount retailers Target and Walmart

To get all my updates, please subscribe to my rss feed

Full Disclosure: I do not own any COST. My Current Portfolio Holdings can be seen here