Cost Benefit Analysis

Post on: 16 Март, 2015 No Comment

aka Running The Numbers

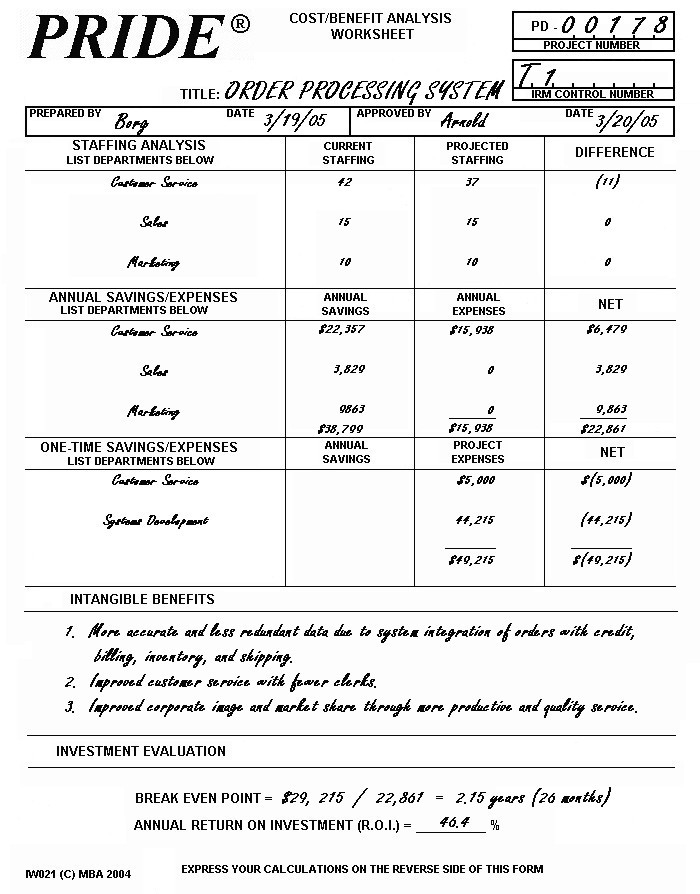

A cost benefit analysis is done to determine how well, or how poorly, a planned action will turn out. Although a cost benefit analysis can be used for almost anything, it is most commonly done on financial questions. Since the cost benefit analysis relies on the addition of positive factors and the subtraction of negative ones to determine a net result, it is also known as running the numbers.

Cost Benefit Analysis

A cost benefit analysis finds, quantifies, and adds all the positive factors. These are the benefits. Then it identifies, quantifies, and subtracts all the negatives, the costs. The difference between the two indicates whether the planned action is advisable. The real trick to doing a cost benefit analysis well is making sure you include all the costs and all the benefits and properly quantify them.

Should we hire an additional sales person or assign overtime? Is it a good idea to purchase the new stamping machine? Will we be better off putting our free cash flow into securities rather than investing in additional capital equipment? Each of these questions can be answered by doing a proper cost benefit analysis.

Example Cost Benefit Analysis

As the Production Manager. you are proposing the purchase of a $1 Million stamping machine to increase output. Before you can present the proposal to the Vice President, you know you need some facts to support your suggestion, so you decide to run the numbers and do a cost benefit analysis.

You itemize the benefits. With the new machine, you can produce 100 more units per hour. The three workers currently doing the stamping by hand can be replaced. The units will be higher quality because they will be more uniform. You are convinced these outweigh the costs.

There is a cost to purchase the machine and it will consume some electricity. Any other costs would be insignificant.

You calculate the selling price of the 100 additional units per hour multiplied by the number of production hours per month. Add to that two percent for the units that aren’t rejected because of the quality of the machine output. You also add the monthly salaries of the three workers. That’s a pretty good total benefit.

Then you calculate the monthly cost of the machine, by dividing the purchase price by 12 months per year and divide that by the 10 years the machine should last. The manufacturer’s specs tell you what the power consumption of the machine is and you can get power cost numbers from accounting so you figure the cost of electricity to run the machine and add the purchase cost to get a total cost figure.

You subtract your total cost figure from your total benefit value and your analysis shows a healthy profit. All you have to do now is present it to the VP, right? Wrong. You’ve got the right idea, but you left out a lot of detail.

Running The Numbers Means All The Numbers

Lets look at the benefits first. Don’t use the selling price of the units to calculate the value. Sales price includes many additional factors that will unnecessarily complicate your analysis if you include them, not the least of which is profit margin. Instead, get the activity based value of the units from accounting and use that. You remembered to add the value of the increased quality by factoring in the average reject rate, but you may want to reduce that a little because even the machine won’t always be perfect. Finally, when calculating the value of replacing three employees, in addition to their salaries, be sure to add their overhead costs, the costs of their benefits, etc. which can run 75-100% of their salary. Accounting can give you the exact number for the workers’ fully burdened labor rates.

In addition to properly quantifying the benefits, make sure you included all of them. For instance, you may be able to buy feed stock for the machine in large rolls instead of the individual sheets needed when the work is done by hand. This should lower the cost of material, another benefit.

As for the cost of the machine, in addition to it’s purchase price and any taxes you will have to pay on it, you must add the cost of interest on the money spent to purchase it. The company may purchase it on credit and incur interest charges, or it may buy it outright. However, even if it buys the machine outright, you will have to include interest charges equivalent to what the company could have collected in interest if it had not spent the money.

Check with finance on the amortization period. Just because the machine may last 10 years, doesn’t mean the company will keep it on the books that long. It may amortize the purchase over as little as 4 years if it is considered capital equipment. If the cost of the machine is not enough to qualify as capital, the full cost will be expensed in one year. Adjust your monthly purchase cost of the machine to reflect these issues. You have the electricity cost figured out but there are some cost you missed too.