Corporate Valuation Overview

Post on: 7 Май, 2015 No Comment

The Spring 2008 section of Corporate Valuation will focus on the financial analysis and valuation of public companies. The course will be segmented into four major sections.

· During the first few weeks of class, we will discuss the drivers of corporate value, specifically return on investment and organic revenue growth. We will examine how the world’s most valuable companies have created value, and how they have protected their competitive position (the key to high value). We will next examine how to build an ROIC-based valuation model, and how this differs from and complements the traditional discounted cash flow model.

· The second section will cover financial analysis using the 10-K. We start with the traditional DuPont Formula and next move to current metrics such as return on invested capital (ROIC) and economic value added (EVA). Our primary goal will be to build a clean understanding of operating performance across business units and for the entire company. An in-depth discussion of the accountant’s cash flow statement and free cash flow follows.

· In the third section, we document selected accounting issues that affect our perception of financial performance, free cash flow, and risk. We will cover issues related to off-balance sheet financing, retirement obligations, and deferred taxes. We also examine similar issues related to revenue growth, such as how to separate accounting affects from true organic growth. We conclude the section by deriving non-financial key performance indicators (such as retail basket size and aircraft turnaround time) and discuss their linkage to financial ratios.

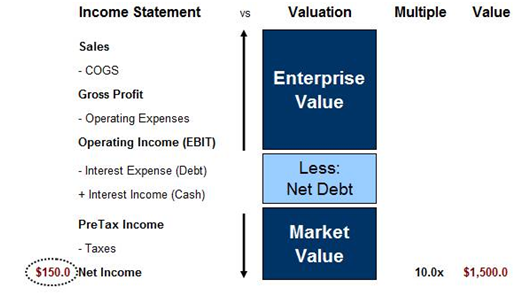

· In the final section, we build an integrated valuation model using discounted cash flow. The section starts with the fundamentals of forecasting, how to determine the appropriate forecast period, and issues related to continuing value. We next move to issues related to discounting. We will discuss alternative methods of discounting, such as the weighted average cost of capital (WACC), adjusted present value (APV), capital cash flow, and equity valuation methodologies. The section will cover each component of the cost of capital (the cost of equity and the cost of debt) in detail.

The course will rely on a textbook, a supplemental reader, and article downloads (which can be found on the download website ). The textbook can be purchased on Amazon.com:

Valuation (4rd Ed) by Koller, Goedhart, and Wessels, 2005, John Wiley & Sons, Inc, NY.

Lecture notes and articles will be distributed in class and will be available on the download website . There will be a lot of additional material (mostly lecture notes), so you should purchase a binder for course slides and articles. Related articles will be pulled from Business Week, the Economist, Forbes, Fortune, and the Wall Street Journal. Articles that are handed out in class will not be covered by the exams. I try to provide timely articles to better prepare students for interviewing. I believe when asked about what you are studying, it is always helpful to have a practical story associated with the academic material we are covering.

Your course grade will be based 15% on class participation, 25% on the case write-ups and presentations, 30% on the midterm examination, and 30% on the final examination (which will be non-cumulative and similar in format to the midterm). Assignments can be found on the following page: Assignments Page .

Assignment presentations and write-ups must be completed in teams (three to five per team) and must be turned in on paper at the start of class on the due date. Assignments will be graded out of ten points. Late assignments will have a deduction of one point per business day.