Corporate bonds A guide to investing

Post on: 17 Май, 2015 No Comment

comments

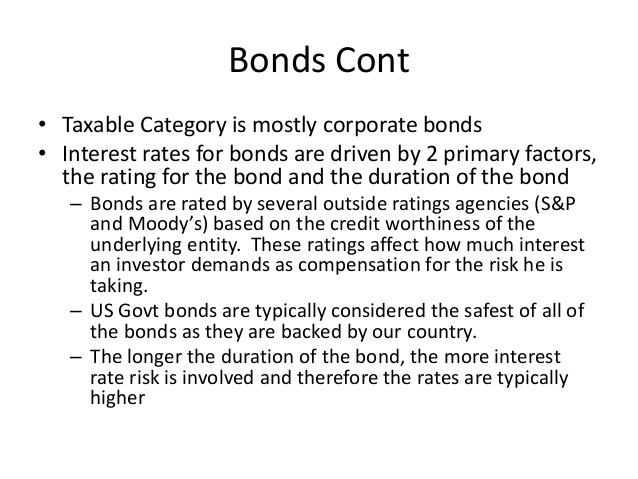

Bonds: Bonds are forms of debt issued by companies that act as IOUs

Corporate bonds are popular among investors, typically offering lower risk and higher income than shares.

A new route to investing direct in companies has opened up in recent years from the retail bond market as well as the more risky mini bonds.

Meanwhile, many corporate bond funds have done better than expected as interest rates have stayed lower for longer.

We explain why investors like corporate bonds and how to invest

What is a corporate bond?

Corporate bonds are issued as a way of raising money for businesses — it’s essentially a certificate of debt issued by major companies

When you buy bonds you are lending money to a company in exchange for an IOU. The IOU has a term and at maturity (typically five or ten years) the sum invested is returned in full.

The only thing that might stop this is if the company actually goes bust. The bond also has a coupon — the amount of interest paid, say 5 per cent.

RELATED ARTICLES

Share this article

Share

As long as you hold that bond you are paid that coupon every year and if you keep it to maturity you will get your capital back.

Crucially, the coupon is a fixed percentage of the cover price of the bond.

So if you buy a £10,000 ten year bond with a 5% return, you will receive £500 each year in interest, and after ten years you will get your £10,000 back.

So far this is not so different from a fixed-rate savings account or savings bond, except your bond is an investment and not a savings product, so it is not covered by the Financial Services Compensation Scheme £85,000 individual savings protection cover.

Crucially, this means that your bond is only as safe as the company issuing it — something reflected in smaller, more risky firms having to offer higher rates to tempt investors.

But you can get out early

The key difference in flexibility between a corporate bond and fixed rate savings is that during its lifetime a market-traded corporate bond can be bought and sold and its price will change according to the market.

So if you hold a ten-year corporate bond you personally don’t have to wait ten years to cash-in the bond — you could sell it at any point.

But if you do want to sell it on, between its issue and maturity date the bond’s price will rise and fall and at any given moment it may be worth less than you paid for it, perhaps you would only get £95 for every £100 you invested.

On the other hand it may be worth more and you will be able to make a capital gain on the investment as well. An example of this is Tesco Personal Finance’s 5.2% bond issued in early 2011, which runs for seven years. It is currently trading above face value, at £104.20, highlighting investor’s appetites for the interest paid.

When bonds are trading above or below their initial level they are said to be trading above or below par. If you buy a corporate bond second-hand, you will get the right to be repaid its value at maturity and its coupon interest rate until then, but paying above or below par for the bond itself will change the income return.

This means that with traded second-hand bonds a yield to maturity is also typically quoted. If you buy at a discount your yield to maturity will be higher than the original coupon rate, if you buy above par it will be lower.

How to buy and sell corporate bonds: direct investing vs bond funds

Typically retail investors have bought corporate bonds through funds. These invest in a number of different firms and help spread risk accordingly, you will end up paying fund manager fees though.

A bond fund manager aims to take advantage of swings in the markets and deliver a return based both on the income from the bonds held in the fund and the extra boost from buying traded bonds below par, or selling them above par.

The problem with a corporate bond fund is that its value depends on its varied holdings and dealings and can be affected by the market’s view on what will happen to interest rates.

Buy in as interest rates are rising and the value of the bonds it holds may fall and so will your holding in the fund. Likewise, if the manager makes a bad call on buying bonds in companies that fold, or if his view that a certain company’s below par bonds will bounce back is wrong, the fund can lose money.

Manager’s ability to trade bonds can give a fund a turbo-charge along with its income return.

But if you bought into a bond fund now and sold out in five year’s time you could also find that you do not get back the capital that you put in if it has not done well. Whereas if you bought an individual bond you will get back your capital in full, as long as the issuing firm doesn’t go bust.

On the flipside, a good bond fund could rise in value thanks to some nifty trading and deliver a solid income return and capital growth. Holding a bond fund also spreads risk among many different companies.

By comparison if you just buy a corporate bond from one individual firm you are putting all your eggs in one basket and not spreading risk, but you will also know that if you hold it to maturity (and the firm doesn’t go bust) you will get your money back.