Consistent income with options XJO Iron Condors

Post on: 19 Июнь, 2015 No Comment

Happy New Year! It is already 10 days into the New Year so I guess it is time to get out of holiday mode and work on our next income strategy for 2014!

No option income website would be complete without a discussion on Iron Condors which is a very popular income strategy for people seeking to generate a consistent income with options. The Iron Condor is a non-directional income strategy which involves selling an OTM bull put spread and an OTM bear call spread. It is typically traded using index options such as options on the SPX and RUT (or their ETF equivalents such as SPY and IWM) in the US market. A subscription service that has been successfully trading Iron Condors in the US market is 10percentpermonth.com. Their target is to make 10% per month (yes per month, not per year)! Their performance since 2007 is published on their website. As you can see, they frequently manage to achieve this target. In a good year such as 2009, they made over 100% in a year as shown in the table below (click to enlarge):

However, there are of course downsides to this strategy you can also lose a lot more than 10% in a bad month using this strategy. The worst month they had was in May 2010 (flash crash) when they lost 69.5% in a single month!

In the past year, I have received a number of enquiries from readers who are looking for a mechanical trading system to generate consistent monthly income which does not require a large amount of capital. The iron condors might fit the bill, hence I thought it would be an interesting exercise to try to replicate what 10percentpermonth.com does in the Australian market by trading iron condors using XJO (ASX 200 index) so I have started a model portfolio to do this.

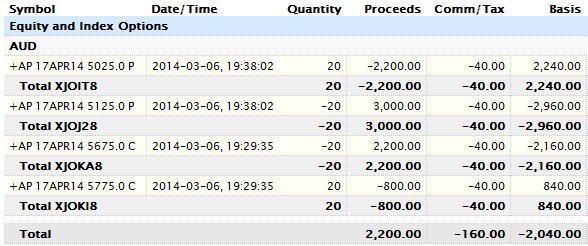

On 3 Dec 2013, I managed to sell an iron condor with 6 weeks to expiration for $2000 of premium (before commission) as shown below:

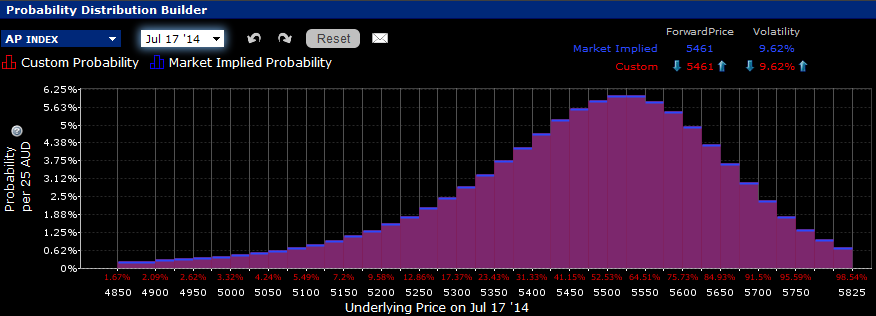

This $2000 is our maximum profit which we will get if XJO is trading between 5000 and $5475 when these options expire on 16 Jan 2014. The margin required for this trade is $18,000. This is also our maximum loss which we will incur if XJO is trading below 4900 or above 5575 upon option expiry. Hence the potential return for this trade is around 11% ($2,000 / $18,000) before commissions. When I opened the trade on Dec 3, XJO was trading at around 5250 and each of the short options was trading with a delta of 0.1 which means this iron condor has roughly an 80% chance of expiring worthless. With XJO trading at 5312 less than one week to expiration, there is a good chance that all the options will expire worthless which is exactly what we want to happen.

Our trade management strategy for the XJO iron condors is to do nothing and wait for the options to expire. We will simply let probabilities work in our favour and our trades should simply expire worthless 80% of the time. The main reason for not doing any adjustments is the high cost of commissions. At $2 per contract, the cost of opening this iron condor was $160. It will cost us $160 each time we roll a 20 contract spread.

Trading iron condors is not for the faint-hearted as you could see large draw downs in your account especially when the market takes a dive, like it did shortly after I opened the January Iron Condor. The ASX 200 fell over 200 points in a week as shown in the chart below. The January trade was showing large unrealised losses when XJO was trading close to 5000.

While it is nice to rake in 10% profits in a winning month, we should always remember that the maximum loss is 100% in a losing month, even though the probability of that happening is small. The key to successfully trading iron condors is money management. The performance shown in 10percentpermonth is achieved by putting on the same size trade every month. Hence if you are doing $20K positions, you should have sufficient cash set aside to allow you to put on a similar sized trade the next month. A conservative money management strategy would be to trade with only half of your account each month. This will enable you to survive a few consecutive losing months, if required. However, this will also lower your overall returns.

I will provide another update after the January trade expires on Jan 16. If there are any readers out there who are trading XJO iron condors, I would love to hear from you. Please share your experience by leaving a comment or sending me an email.

Disclaimer. This post is for educational purposes only and should not be treated as investment advice. This strategy would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek investment advice if required.