Consider Prime Rate Funds For More Income Yahoo Finance Canada

Post on: 25 Апрель, 2015 No Comment

Prime-rate funds are closed-end mutual funds that seek to provide yields that match the prime rate. This attractive yield is often more than twice the federal funds rate and somewhat higher than the rate on five-year certificates of deposit (CDs). Read on to find out why investors seeking income-generating portfolios may find prime-rate funds worth a second look.

How Yield Is Generated

Pros

The bonds that prime-rate funds purchase are often referred to as senior debt, because they are backed by collateral, and, in the event the bond issuer goes bankrupt. holders of senior debt must be repaid before other creditors. While this status does not guarantee complete repayment, it generally means that investors receive the bulk of their money if bankruptcy occurs.

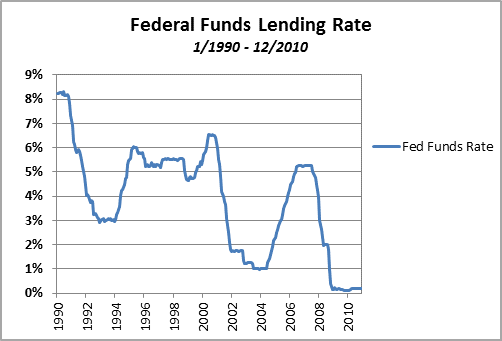

The yields rise and fall with changes in short-term interest rates, so the share price remains stable, generally not fluctuating by more than a few cents. Traditional fixed-rate bonds lose value when interest rates rise, because investors are willing to purchase the lower-yielding bonds only if they get a discount on the price. Not only do prime-rate funds tend to hold their value and enjoy low volatility, but they also provide a hedge against rate hikes, since their yield moves with the market.

Cons

At the other end of the spectrum, bankruptcy of any of the underlying bond issuers can result in a loss. While senior debt holders are first in line for a claim on assets, recovery will be less than 100%. Another factor to consider is that redemptions are permitted only on a monthly or sometimes quarterly basis. This illiquidity means that an investor’s ability to access money is restricted.

These funds also often charge higher-than-average expense ratios and levy redemption fees if investors seek to pull their money out prior to meeting a required minimum holding time.

Another potential cost is that, while these funds seek to maintain a steady share price, they sometimes trade at a premium or a discount. If you are buying when the fund trades at a premium or redeeming when it trades at a discount, you are either spending more than the underlying assets are worth or receiving less than full value for your holdings.

Trading strategies are another noteworthy item. In order to achieve their attractive returns, these funds invest in private loans issued to companies that, if they were rated by an agency, would have bond ratings classified as junk. Remember, the loans purchased by prime-rate funds are backed by collateral, unlike junk bonds, but the issuers themselves are in less-than-stellar financial health. To purchase these loans, the funds often engage in leverage. a practice that can magnify both gains and losses.

The Bottom Line

While prime-rate funds are accompanied by a host of potentially scary negatives, these funds have a solid track record of delivering on their promises. Returns often rank about 2% higher than the returns on money market funds. They may be worth consideration by investors seeking low volatility and a steady, predictable source of income based on interest rates that are higher than average. They are not a good choice for investors seeking easy and frequent access to their money.

Prime-rate funds are a bit more sophisticated than many other mutual funds. Their complexity results in a lot of factors that must be taken into consideration before making a purchase. Like all investments, whether simple or complex, investors should take the time to learn about all aspects of the investment before committing their cash. Taking measured risks is part of the investing process, but buying something that you do not completely understand is never a good idea.