Computerized Investing

Post on: 18 Август, 2015 No Comment

by Wayne A. Thorp, CFA

Financial statement analysis applies analytical tools and techniques to financial statements to determine the operating and financial success of a firm. The emphasis of the analysis depends on ones viewpoint. A credit analyst extending a short-term, unsecured loan to a company might emphasize the firms cash flow and liquidity. An equity investor, on the other hand, may look closely at growth in sales, earnings and dividends. He would be interested in the variables that might have a significant impact on a firms financial structure, sales, earnings production and dividend policy.

In this installment of Spreadsheet Corner, we present a template that uses data from the balance sheet, income statement and cash flow statement to produce financial comparisons of interest to investors. We have attempted to make the line items industry-neutral so they are adaptable across companies in differing lines of business.

As the spreadsheet is very long, it is broken into four parts for easier viewing here, labeled Figure 1 Parts A through D. Raw data is entered from the balance sheet and income statement is shown in Part A and Part C. The calculations appear in Part B and Part D. Data for the next year can be added by copying the previous years formulas two columns to the right and entering the new data. You can download the spreadsheet here. The formulas and steps necessary to program the worksheet appear in Table 1 .

Data Sources

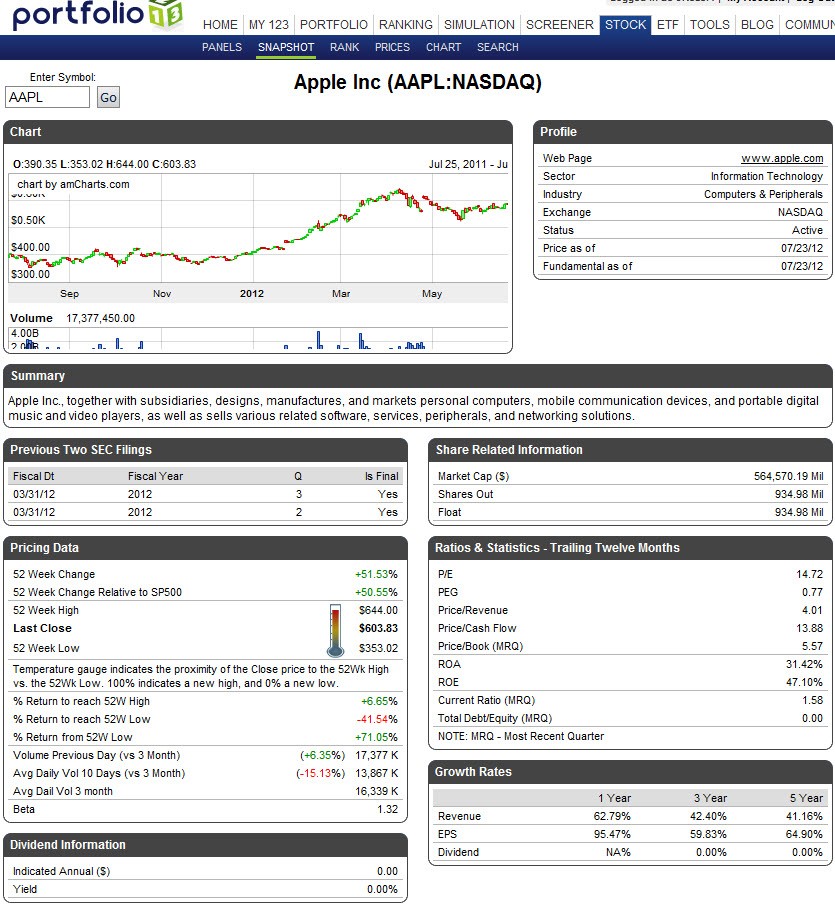

These days, it is easy to locate detailed financial statement data online. Our comparison of the top online fundamental stock screening services appearing in this issue shows which of these offers statement data. A detailed table specifying the financial statement items provided by an expanded list of screening services is available at the online version of the comparison article at ComputerizedInvesting.com. For this article, we used data from Reuters.com, which offers five years of detailed financial statement data to registered users.

When looking at the raw financial statements a company provides in their annual or quarterly SEC-filed reports, be aware that the level of detail will differ from company to company. For example, some firms may only list a net property, plant and equipment figure on their balance sheet, while others will present a gross figure along with accumulated depreciation. Similarly, many companies do not break out depreciation and amortization expense on their income statement, opting to lump it in with selling, general and administrative expenses and report it on the cash flow statement. Lastly, some firms, especially financial companies, do not report current assets or current liabilities.

Principal Analysis Tools

The worksheet employs two principal tools for financial statement analysiscomparative financial statements and common size statements.

Comparative Financial Statements

Financial statements for a firm are easily compared by setting them up next to each other and examining how line items change from year to year. This statement data spanning several fiscal years and quarters is readily available on many investing websites.

When comparing the financial statements of a company, the goal is to identify trends and their rate of change. This can be accomplished by examining the statements over a number of years. It is vital to compare the changes of related items. For example, while sales may be increasing at a rate of 10% a year, cost of goods sold may be increasing at a rate of 15% a year. Perhaps material costs are rising and a new competitor is preventing the company from passing the higher cost on to customers. This will have implications for the earnings growth rate and, eventually, the share price, reshaping investor expectations.