Comprehensive Income Reporting Preferences of Public Companies

Post on: 6 Сентябрь, 2015 No Comment

In June 1997, FASB released SFAS 130, Reporting of Comprehensive Income. effective for fiscal years beginning after December 15, 1997. This statement established certain standards for reporting and presenting comprehensive income in the general-purpose financial statements. SFAS 130 was issued in response to users concerns that certain changes in assets and liabilities were bypassing the income statement and appearing in the statement of changes in stockholders equity. The purpose of SFAS 130 was to report all items that met the definition of comprehensive income in a prominent financial statement for the same period in which they were recognized. In accordance with the definition provided by Statement of Financial Accounting Concepts No. 6, comprehensive income was to include all changes in owners equity that resulted from transactions of the business entity with nonowners.

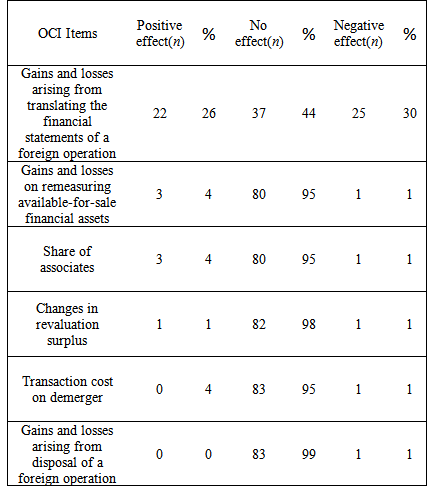

According to SFAS 130, other comprehensive income (OCI) is part of total comprehensive income but generally excluded from net income. Prior to SFAS 130, these three itemsforeign currency translation adjustments, minimum pension liability adjustments, and unrealized gains or losses on available-for-sale investmentswere disclosed as separate components of stockholders equity on the balance sheet. Under SFAS 130, they are to be reported as OCI. Furthermore, they must be reported separately, as FASB decided that information about each component is more important than information about the aggregate. Later, net unrealized losses on SFAS 133 derivatives were also included in the definition of OCI. The intent of SFAS 130 was that if used with related disclosures and other information in financial statements, the information provided by reporting comprehensive income would assist investors, creditors, and other financial statement users in assessing an enterprises economic activities and its timing and magnitude of future cash flows.

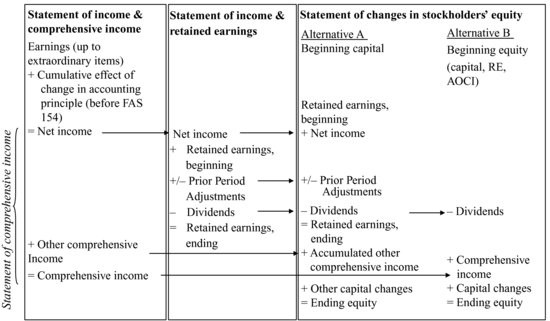

While FASB required that an enterprise shall display total comprehensive income and its components in a financial statement that is displayed with the same prominence as other financial statements that constitute a full set of financial statements (FASB 1997, para 22), it did not specify which format was required, except that net income should be shown as a component of comprehensive income in that financial statement. According to SFAS 130, three alternative formats are allowed for presenting OCI and total comprehensive income:

- Below the line for net income in a traditional income statement (as a combined statement of net income and comprehensive income);

- In a separate statement of comprehensive income that begins with the amount of net income for the year; or

- In a statement of changes in stockholders equity.

Under SFAS 130, FASB encourages reporting entities to display the components of OCI and total comprehensive income using the first or second format above. Cumulative total OCI for the period should be presented on the balance sheet as a component of stockholders equity, separate from additional paid-in capital and retained earnings.

Presentation of Comprehensive Income

Since the release of SFAS 130, several studies have examined the presentation of comprehensive income. Campbell et al. (Ohio CPA Journal. JanuaryMarch 1999) studied a sample of 73 early adopters of SFAS 130 and found that the majority of companies chose to report comprehensive income in the statement of stockholders equity. The same researchers found that the firms that chose the statement of stockholders equity format had a materially negative amount of OCI (page 18). Bhamornsiri and Wiggins (The CPA Journal. October 2001) found that a significant number of firms in the S&P 100 reported comprehensive income in the statement of changes in stockholders equity, regardless of whether the OCI was negative or positive. They also found that foreign currency translation adjustments represented the largest component of OCI.

The purpose of the current study was to examine the presentation of comprehensive income in the financial statements of a sample of companies listed on the New York Stock Exchange (NYSE) to determine which format predominates five years after the release of SFAS 130. The significant decline in stock prices during the years 20002002 might have caused several companies to experience huge unrealized losses on their investment portfolios, a potential component of OCI if those investments were categorized as available-for-sale securities. Using the third format for reporting comprehensive income would enable those companies to obscure any undesirable impact of a negative OCI component on the annual financial statements by hiding it in the statement of changes in stockholders equity. In order to confirm this expectation, the authors also examined if the reporting of OCI and total comprehensive income in one of the three prescribed formats was highly correlated with a positive or negative OCI. Finally, the study also found other items pertaining to reporting comprehensive income in the financial statements of the sample companies. Overall, five years after SFAS 130 was adopted, reporting comprehensive income in the statement of changes in stockholders equity remained the most popular presentation format for the NYSE companies in the sample.

The data for this study were collected from a random sample of 100 annual reports of NYSE-listed companies. Annual reports for fiscal periods ending on or after December 31, 2002, were examined for the presentation of OCI and total comprehensive income.

The study showed that 89 of the 100 companies used the third format, which included OCI and total comprehensive income in the statement of changes in stockholders equity. Only nine of the sample companies chose the second format and presented a separate statement of comprehensive income. The remaining two companies chose the first format and presented comprehensive income as a component of their income statements. These finding were consistent with those of the two studies mentioned earlier. Reporting comprehensive income in the statement of changes in stockholders equity is still the predominant presentation. This may be because this format requires very little change from the former practice of presenting the components of OCI under stockholders equity.

Of the 89 companies that used the statement of changes in stockholders equity to report OCI, only 31 companies reported overall positive OCI, while the remaining 58 companies reported overall negative OCI. This finding is largely consistent with that of Campbell et al. in that a significant percentage65%of the companies in the current sample that chose the third reporting format had negative OCI. Companies with negative OCI were almost twice as likely to present it in the statement of changes in stockholders equity, despite FASBs preference that these items be shown either in the income statement or in a separate statement of comprehensive income. Both companies that used the first format had negative OCI, whereas, of the nine companies that used the second format, six had negative OCI and three had positive OCI.

The study also furnished other observations pertaining to the presentation of OCI and total comprehensive income. For example, a total of six companies did not provide details of OCI in the body of their financial statements as presented in the annual reports. Instead, these details were presented in the notes to financial statements, despite the FASBs preference that components of OCI be presented prominently in the financial statements. Furthermore, 14 companies included the term Comprehensive Income in the title of the financial statement where OCI and total comprehensive income were presented, while the other 86 companies did not. Also, there was not complete uniformity among the companies in the sample as to the use of the term comprehensive income. For example, while IBM referred to it as Gains and (losses) not affecting Retained Earnings, GE called it Changes other than transactions with shareowners. Ruddick Corporation prepared a separate statement of comprehensive income but called it Statement of Non-owner Changes in Equity.

Among the components of OCI, unrealized loss on available-for-sale investments and minimum pension liability adjustment were by far the more significant items for a large number of companies that reported overall negative OCI. One reason for this could be the recent decline in the stock market, which probably caused the values of investments to weaken. Furthermore, the decline in the fair values of pension fund investments may have caused those pension plans to be underfunded and required the companies to report increased adjustment to their minimum pension liability.

Among the companies that chose to report OCI in the statement of changes in stockholders equity, the presentation of total comprehensive income in the financial statements was not uniform. While four companies presented total comprehensive income in the notes to financial statements, as mentioned earlier, approximately 40% of the companies presented total comprehensive income in a separate column, while the remaining companies reported total comprehensive income within the total stockholders equity column in the statement of changes in stockholders equity.

Transactions with Nonowners

While all NYSE companies in the sample were reporting the changes in stockholders equity from transactions with nonowners in accordance with SFAS 130, there was a very strong preference among these companies for using the third presentation format, which was to report it in the statement of changes in stockholders equity. This may be because it is closer to what the companies were accustomed to using before the adoption of SFAS 130, or it may be less prominent in this display, given the negative character of the other comprehensive income. Moreover, there was a lack of uniformity among these companies in adhering to the language recommended by FASB. In general, some companies, especially the larger ones in the sample, chose to follow their own preferences when referring to comprehensive income or presenting the details of the required information pertaining to OCI.

Currently, there is not sufficient evidence to indicate that comprehensive income is a better predictor of future cash flows or has an impact on stock prices. Less sophisticated investors, however, are apparently more likely to use comprehensive income information for corporate and management performance assessment if it is included in a separate statement of comprehensive income (Maines and McDaniel, 2000). Furthermore, financial analysts are more likely to detect evidence of earnings management on certain items only if presented in a separate statement of comprehensive income (Hirst and Hopkins, 1998).

If investors place more emphasis on OCI and total comprehensive income in the future, companies should be required to uniformly present details of comprehensive income. If comprehensive income becomes an important input for financial statement users, more FASB guidance may be needed about the format for its presentation.

Ganesh M. Pandit, DBA, CPA, CMA. is an associate professor of accounting, and Jeffrey J. Phillips, PhD, CPA. is an associate professor and chairman of accounting, both at the school of business administration, Clark Atlanta University, Atlanta, Ga.