Compound Interest Savings When Does it Pay Off

Post on: 16 Март, 2015 No Comment

The day we begin investing money into interest bearing accounts we begin to earn interest on that money. But for most of us the interest amounts earned on our savings can be pretty minute for quite a few years. Oftentimes piddly interest amounts earned can discourage investors and savers alike causing many to fore go saving altogether, opting instead to use their discretionary income on the here and now.

To help us avoid this huge mistake, lets spend some time studying the meaning and payoff schedules of compound interest.

Kick-in = when we start seeing our yearly interest payments supersede our savings contributions themselves.

If we contribute to our savings regularly, when will compound interest finally kick-in?

Lets take a look

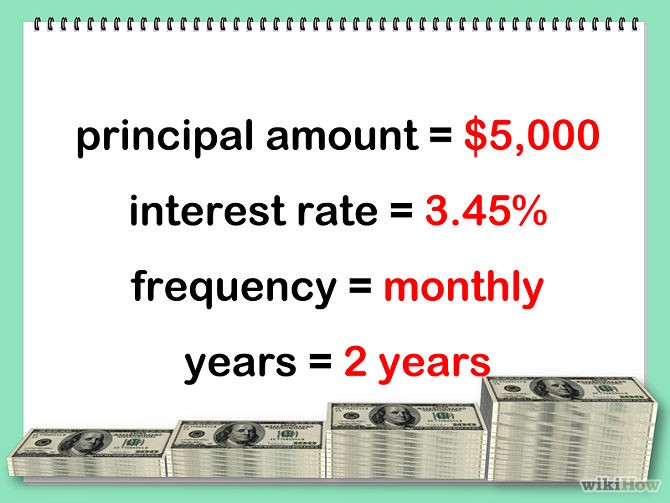

Compound interest explained

Compounding The ability of an asset to generate earnings, which are then reinvested in order to generate their own earnings. In other words, compounding refers to generating earnings from previous earnings. Also known as compound interest. source: Investopedia

Compound Interest Interest that accrues on the initial principal and the accumulated interest of a principal deposit, loan or debt. Compounding of interest allows a principal amount to grow at a faster rate than simple interest, which is calculated as a percentage of only the principal amount. source: Investopedia

Example : We have an annual salary of $50,000/year and save 12% of our pay. At the end of the year we have $6,000, which earns us a 7.5% return in our retirement account leaving us $6,450. If we continue to invest this money we earn interest not only on our original $6,000 but also on the $450 gained in interest on the original principal.

Why we should care

It can work for us

Through the rough numerical examples above we are able to see how compound interest can be a very powerful savings tool that stands to benefit us more the longer we employ it. That is why you always hear people saying to invest as early in life as possible. The sooner we get compound interest working in our favor, the sooner we can live employment optional (my term for working when you want.)

Or it can work against us

Anyone who has a mortgage is all to familiar with what I am about to say. Lets say your purchase a home for $150,000 with $0 down and finance it for 30 years at 5%. You will have monthly payments of $805.23, with the majority going toward interest all the way until year 16 when your principal payments will begin to be larger than your interest payments. When its all said and done, you will pay $139,883.68 in interest and your $150,000 house will end up costing you $289,883.68.

When does it pay off?

If we continue to save regularly, when will the yearly interest on our savings begin to supersede our savings contributions themselves?

The answer to that question is always going to be relative to how much we are earning and how much we are saving, but should generally conform to the secret of two times pay .

The Secret of Two Times Pay is a concept I recently came across while reading Your Money Ratios . Author Charles Ferrell says that, our finances hit a tipping point at about two times pay. Charles goes on to say, After you have saved two times your pay, the earnings from your capital will generally add more to your total wealth than the amount you save each year.

Lets consider our example from above once more:

Lets assume we have been saving for 10 years and have $100,000 saved in our retirement account, or twice our annual pay. With our 7.5% return the earnings on our $100,000 will be $7,500 which now exceeds our annual savings amount of $6,000. This year we increase our retirement savings by $13,500 and more than half of it came from earnings on our capital.

How long will it take?

That all depends on you!

Dont forget about the Rule of 72

The Rule of 72 is a simplified way to determine how long an investment will take to double, given a fixed annual rate of interest. By dividing 72 by the annual rate of return, investors can get a rough estimate of how many years it will take for the initial investment to duplicate itself. source: Investopedia

Example : a 10% investment will take 7.3 years to double ((1.10^7.3 = 2).

Set a goal to save twice your annual income so you can begin watching your money work harder for you than you do! This is a goal that is attainable with just a few years of disciplined, consistent saving. Lets use this as further motivation to stay on track.

All I know is the sooner we get out of debt and get started investing. the sooner we will be able to watch our capital work for us instead of us working for our capital!

Betterment is one of my two favorite ways to earn interest on my savings! They have an awesome program for the Average Joe to save and invest simply and effectively. There are no minimum balance requirements and no transaction fees. Read my Betterment Review or open an account to get started earning now.