Complete Guide to Gold ETFs

Post on: 5 Апрель, 2015 No Comment

Поделиться с друзьями

%img src=http://i.ebayimg.com/00/s/NTY0WDg1MQ==/z/KXIAAMXQATlRZzft/$T2eC16R,!zEE9s3!(YZoBRZzfssOv!

60_35.JPG?set_id=880000500F /%

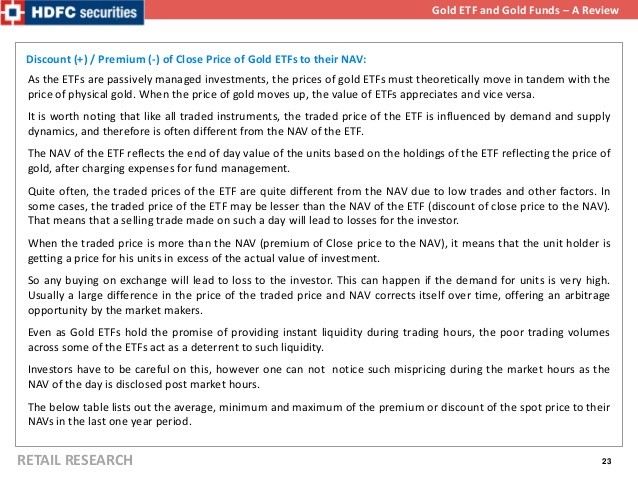

ETF stands for Exchange Traded Fund, and a gold ETF is designed to closely follow the price of gold. Investment firms use and trade ETFs because it essentially allows investors to invest in the physical bullion without the drawbacks that come from owning the physical asset.

However, make no mistake: An investor who invests in a gold ETF does not actually own any gold. Most commonly, gold ETFs are composed of gold derivative contracts that are only backed by the physical asset. People who invest in gold ETFs will never receive any form of the metal, even when the ETF is sold. Because the ETF is a paper asset, an investor will only receive an equivalent amount of money once the contracts are sold.

While most people believe that buying shares of a gold ETF will only allow them to gain exposure to precious metal commodities, there are gold ETFs that allow people to gain exposure to several gold mining companies. Not only can these ETFs give an investor exposure to the underlying physical asset of gold, which drives the profits and performance of gold mining companies, but these ETFs will also give an investor a chance to gain exposure in the mining industry sector.

Why Own Shares of a Gold ETF?

Owning a gold ETF can be great for anyone who is looking to diversify their investment or retirement portfolio. Many investment fund managers often recommend that individuals have at least 10 percent of their investments tied to physical assets, and some investment fund managers even suggest that a portfolio contain 20 percent or more worth of physical assets. Because gold ETFs are designed to follow the price of gold closely, owning a gold ETF is very similar to owning physical gold bullion.

Because gold tends to rise as the dollar falls, owning shares of a gold ETF can give investors protection against economic downturns and financial crises that occur both domestically and internationally. Investors can even buy inverse gold ETFs that assume the price of gold is going to fall. In this case, investors will profit when the price of gold goes down, and they will lose money if the price of gold rises. Investors might want to buy inverse gold ETFs if they research market trends and determine that the economy will do well over a certain period of time.

What Are Some Advantages of Owning Gold ETFs?

There are several advantages to owning gold ETFs rather than physical gold bullion or gold stocks, including storage issues, liquidity, and ties to the physical asset.

Storage

The main advantage of owning a gold ETF rather than owning gold bullion is that storage isn’t a concern. At most, someone who owns a gold ETF might obtain a paper certificate that acknowledges ownership of a certain number of shares. More commonly, the number of ETF shares that someone owns will automatically be tracked by a brokerage or other investment firm in an electronic portfolio.

While gold bullion can be easy to store and transport, there is always the concern of putting it somewhere safe. While bank safe deposit boxes are often a good choice, the contents of these boxes cannot be insured against theft or loss. Another option would be to keep the gold bullion at home, but then owners run the risk of being a target for thieves. A good, fireproof home safe can be heavy and expensive, and a large one must be bought if someone owns a large amount of bullion.

By owning shares of a gold ETF, investors get most of the benefits of owning the physical asset without having to worry about where to store it or how to keep it.

Liquidity

Anyone who has bought gold knows that when it is time to sell, it can be somewhat difficult to find a buyer who is willing to give a fair price. While there are plenty of cash for gold stores around, these businesses pay sellers only a fraction of the spot price of gold. Pawn shops aren’t much better, and it can even be somewhat difficult to find a coin dealer or a bullion dealer who will offer sellers the sport price of gold without charging a premium.

Tied to the Physical Asset

The purpose of a gold ETF is to give an investor exposure to the price of gold. As the price of gold rises and falls, so too does the value of the ETF. An investor can use a gold ETF to help diversify his or her portfolio without having to worry about storage worries or cashing out an investment in a market with low liquidity.

Commission Versus Premium

All gold ETFs will charge a commission fee, but this commission fee is often very minimal. When buying physical bullion, on the other hand, many dealers consider a 4 percent premium to be fair, and other dealers might charge larger premiums as they see fit. Buying shares of a gold ETF can be great for a person who cares more about keeping costs down and potentially maximizing an investment rather than claiming the advantages that come with owning physical bullion.

Diversification

Gold ETFs are a great way for an investment or retirement portfolio to gain exposure to different classes of financial assets. In addition to gaining exposure to gold as a commodity, buying an ETF that features gold mining companies can also give a portfolio exposure to the mining industry, which is not completely tied to the performance of gold. For people who are invested heavily in certain industry sectors or who do not have any commodities or physical assets in their portfolios, buying a gold ETF can be a way to balance a portfolio and reallocate money.

What Are Some Disadvantages of Owning Gold ETFs?

Despite all of the advantages that owning gold ETFs carry, there are a few disadvantages to be aware of as well. In addition to being a substitute for a hard asset, profits from a gold ETF can also be taxed at a surprisingly high rate.

Gold ETFs Aren’t Real Bullion

Although gold ETFs do track the price of gold, they can be a poor substitute for owning real bullion. Gold bullion is a tangible, physical asset that can be divided into smaller pieces. It can also be used to barter for and purchase goods and services no matter what state the economy is in. Gold ETFs, on the other hand, are paper assets and can only be redeemed for cash when possible.

Tax Rates

Gold ETFs also can carry surprising tax rates. Many people might think that because gold ETFs are paper assets like stocks are, they will be taxed at a similar rate. However, since the ETF uses a commodity as its backing, many gold ETFs are taxed at a higher rate based off of collectibles. Talk with a tax professional or an investment planner to understand how owning a gold ETF might impact future tax returns.

Finding Gold on eBay

Anyone who is looking to buy a gold ETF will have to do so through a brokerage or investment firm. However, even though gold ETFs can’t be found on eBay, it is easy to find gold bullion when using eBay. Start off by visiting the eBay homepage. On the left side of the page, beneath the search bar at the top of the page, is a broad list of shopping categories. Find the Collectibles & Art tab from this selection. When the mouse is hovered over this tab, a list of subcategories will appear. From the choices that are available, select either the Coins & Paper Money option if looking for bullion coins, or select the Gold & Silver Bullion Center option if looking for bullion bars, coins, and rounds.

On the Coins & Paper Money page, shoppers can search for gold coins that have been minted in the United States, like the American Gold Eagle. or they can search for gold coins minted in countries around the world, like the South African Krugerrand. Use the search tools on the left side of the page to find gold coins in various conditions, that have been certified by various groups, and in specific price ranges. Check the Free Shipping option to display only results from sellers who offer Free Shipping. The search bar can also be used to find certain results. Simply type in a keyword or two into the bar and hit the Enter key. The keyword search tool can be used along with the search tool check boxes on the left side of the page to return very specific results.

On the Gold & Silver Bullion page, there are a few ways to search for gold bullion. In addition to finding bullion within a certain price range by using the price tool on the left side of the page, people can also use the quick search tools near the top of the page to search for gold bars or gold coins. The search bar can also be used to search for bullion that has been listed with specific keywords. Shoppers can also select the Buy It Now option from the drop down menu on the left side of the page to pay a fixed price for an item.

Conclusion

Gold ETFs can be a great way to invest in gold for anyone who is looking to make an investment in the precious metals sector or who is looking to diversify an investment or retirement portfolio. Although gold ETFs do come with several advantages and conveniences compared to owning the backing physical bullion, there are a few drawbacks to consider. Be sure to do plenty of research before buying a gold ETF or gold bullion as market conditions can change quickly, and investing in precious metals and ETFs isn’t right for everyone’s situation.