Comparison of Economic Value Added and Residual Income

Post on: 16 Март, 2015 No Comment

Comparison of Economic Value Added and Residual Income

1. Intro

„Measuring the profitability and value of a business is very important because it is a key consideration when there is discussion of a merger or acquisition, when capital investment decisions are being considered, and in designing management incentive compensation plans.“ (Colley, Doyle, Hardie, Logan, Stettinius, 2007, p. 247) The efficiency with which profit centers (PC) of companies employ their assets to generate profits is often measured by the companies` Return On Net Assets (RONA). There are different way to evaluate the performance of PC’s, e.g. the Return on Investment (ROI), the Residual Income (RI), and the Economic Value Added (EVA).

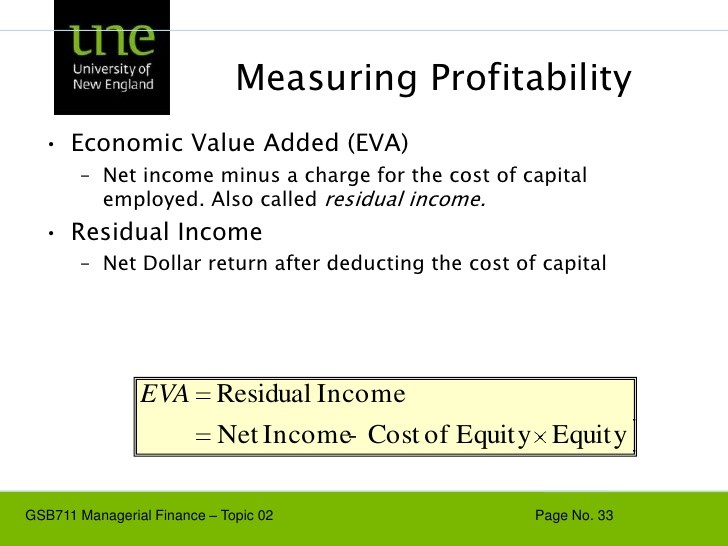

2. Residual Income

According to Colley, Doyle, Hardie, Logan, and Stettinius (2007, p.248) the residual income (RI) “…consists of the profit remaining after the suppliers of all of the resources that were consumed to generate revenues have been fairly compensated, including the supplier of the capital, the investor or the parent corporation.” Further, RI is calculated by assessing a corporate capital charge against the earnings of a PC, which is subtracted from division income, to arrive at division residual income. Anthony and Reece (1979, p. 513) defined RI as the “…profit (before interest expense) minus a capital charge rate (analogous to the return rate used in discounted cash flow techniques) levied on the investment in the center`s assets or net assets.” “The capital charge is calculated by multiplying the relevant investment base by a prescribed interest rate that reflects the required return to the suppliers of capital.” (Colley, Doyle, Hardie, Logan, Stettinius, 2007, p. 249) According to Anthony and Reece (1979, p. 513) the RI can be calculated as follows:

RI = Profit (pre interest) – (Capital Charge x investment)

Whereby the capital charge is the minimum required return or the levies on capital charge on assets employed; not the cost of capital.

Using RI, more investments seem to be attractive then using the Return On Investment (ROI); thus the ROI (net operating income / average operating assets) could decrease in an investment center (IC) or PC at certain investments, while IC or PC still create an residual income at the same investment. This and comparison to the capital employed makes RI a powerful tool to compare PC’s/IC’s which each other and more investments will be undertaken in comparison to the ROI (following LYCOS, 2009).

Economic Value Added (EVA)

According to 12manage (n.d.) EVA is defined as: “Economic Value Added (EVA) is a financial performance method to calculate the true economic profit of a corporation. EVA can be calculated as Net Operating Profit After Tax minus a charge for the opportunity cost of the capital invested.” The capital charges consist of both, equity and interest. Therefore, EVA also evaluates the Weighted Average Cost of Capital (WACC) times the invested capital. Thus the EVA is only calculated with the actual costs of investments. According to 12manage (n.d.) the EVA can be evaluated as follows:

EVA = Net Operating Profit After Tax (NOPAT) Capital Charges (Invested Capital x Cost of Capital)

Taking the all cost of capital into consideration EVA gives the real financial outcome of wealth, which businesses create or destroy in a reporting period. “If the shareholders expect, say, a 10% return on their investment, they earn money only to the extent that their share of the NOPAT exceeds 10% of equity capital.” (12manage, n.d.) Thus any number underneath 10% is not desirable for shareholders. Therefore, EVA can be used to increase shareholder wealth. Companies using EVA will try to improve their WACC, which can also result in a buyback of shares, if the expectations are high and the estimated EVA is high (ValueBasedManagement.net, 2009)

Similarities and differences between EVA and RI

EVA and RI are in terms of its calculation quit similar. The major difference is that RI uses the minimum required return (occurring from current assets employed), whereby EVA takes the WACC into consideration. This difference results in a range of other differences in the usage of both. EVA therefore seems to be more interesting for shareholder, since it is a measure for shareholder’s wealth. RI by contrast can be seen more as a tool for profit center calculations. Both measures can be use to evaluate investments accordingly to the additional profit of one company. RI is evaluates the residual income with internal figures (minimum required return occurring from capital employed), whereas EVA uses the WACC. At investment decisions, investments will be chosen that give a positive outcome. Assuming that the minimum required return of a company is 25% and the WACC is 10% the company will make more investments by using EVA. Thus EVA supports the number of investments and contributes more to the residual income of companies. This can be display by the following example:

Whereby the NOPAT is $10,000 and the investment is $50,000.

EVA = NOPAT WACC x investment = 10,000 – 10% x 50,000 = $5,000

RI = NOPAT – Minimum required return x investment = 10,000 – 25% x 50,000 = ($2,500)

If a company would undertake the investment decision with RI the investment would not be made, because the residual income appears negative. If same investment calculation would be made with the EVA, the investment would have been undertaken, because the investment gives a residual income of $5,000.

However, both measures are performance measurement tools for companies, which focus on wealth creation. Another similarity is that EVA and RI are measures for the residual income of a company, as it increases when the measures are positive. Throughout introductive literature of accounting both measure are treated the same, e.g. in Managerial Accounting by Garrison and Noreen (2003).

Conclusion

In order to undertake investment decisions and to measure the performance of companies many ratios and performance figure have been established. The ROI can be a misleading figure and leads ultimately to the result that companies only keep the most profitable products and undertake the most profitable investments. Nonetheless, the residual income also contributes to the performance of companies. The RI is based on the internal usage of current assets, which only point to residual income above the current usage of these assets. The ‘real’ residual income however is best measured by the EVA, since only real cost comparisons matter as it takes the WACC into consideration and not the minimum required return. EVA is also more useful to shareholders and allows in most cases more investments. Finally, RI is still a good measure to compare investments in IC’s and PC’s.

References

Anthony, R. N. and Reece, J. S. (1979). Accounting Principles. Havard University. Homewood Illinois: Richard D. Irwin, Inc.

Colley, J. A. Doyle, J. L. Hardie, R. D. Logan, G. W. and Stettinius, W (2007). Principles of General Management. The art and science of getting results across organizational boundaries. New York: Yale University.

Garrison, R. H. and Noreen, E. W. (2003). Managerial Accounting. Boston: McGraw Hill.

www.valuebasedmanagement.net/methods_eva.html

Young, S. D. and O’Byrne, S. F. (2000) EVA and Value Based Management. A practical guide to implementation. Mc Grawhill: New York