Comparing Valuation Methods DDM DCF Book Value And Earnings

Post on: 28 Апрель, 2015 No Comment

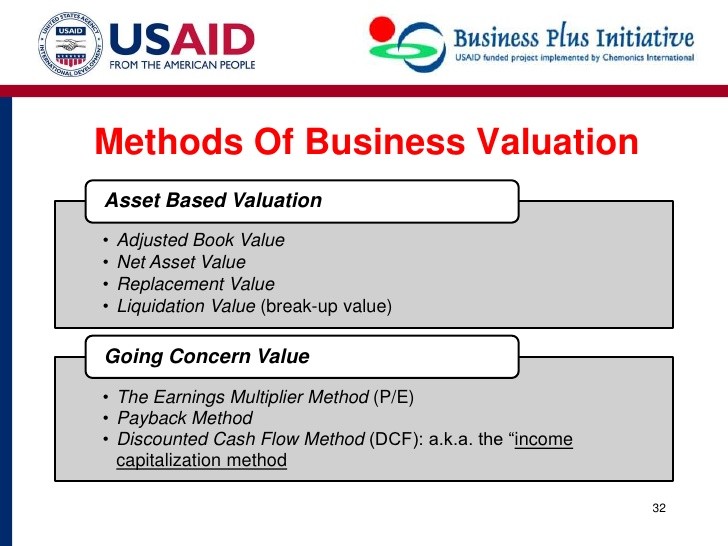

Which valuation method or methods should you adopt to estimate the value of a stock? Today, many methods are used in practice. These include discounted cash flow to equity (DCF) calculations, dividend discount model calculations (DDM), price to earnings multiple (P/E) methods, and price to book multiple (P/B) methods.

Analysts who value shares of different stocks might be forced to switch from one method to another. Here is a brief introduction to each:

Valuation by discounted cash flow to equity (DCF)

Concept: The value of a share is assumed to be the same as the sum of future cash flows to the equity, each discounted for risk and time. The value of the share is essentially the net present value (NYSE:NPV ) of cash flows per share.

Weaknesses:

1. If cash flows are erratic and unpredictable this method isnt appropriate.

2. Small changes in the risk-adjusted rate of return or future growth rates will change todays value dramatically.

3. Investment returns depend on other investors buying your shares at a higher price and the companys management not going nuts. They control the equity, you dont. If you cant find a buyer, you have no way of converting your shares into cash.

Valuation by dividend discount model (DDM)

Concept: The value of a share is assumed to be sum of future dividends paid to the shareholder, each discounted for risk and time. The value of the share is essentially the net present value (NPV ) of per share dividends.

Weaknesses:

1. Dividends must be predictable and sustainable. If dividend growth or payout ratios change dramatically, the DDM model will not work.

2. How dividends are reinvested are very important to cumulative returns, but are ignored by the model.

3. Dividends are taxed based on the year they are incurred. Capital appreciation is not taxed until it is realized as a capital gain.

Valuation Price to Earnings (P/E) methods

Concept: Stocks are valued based on their earnings times a P/E ratio deemed appropriate based on historical averages or the current P/E ratios of peer firms.

Weaknesses:

1. P/E ratios based on one year of earnings are volatile and change dramatically over time for firms, industries, and the entire stock market.

2. P/E ratios cannot be used to value firms with negative earnings.

3. As with DCF, your returns depend on other investors buying your shares at a higher price and the companys management not going nuts.

Valuation Price to Earnings (P/B) methods

Concept: Stocks are valued based on the accounting value of their equity times a P/B ratio deemed appropriate based on historical averages or the current P/B ratios of peer firms. Academic studies have shown in multiple time frames, in multiple markets, that there is a P/B effect. Stocks that sell at the deepest discounts to accounting values of their equity have enjoyed higher returns that stocks that sell at the highest premiums to their equity values. On the basis of overwhelming empirical evidence, the price to book ratio is a useful starting point for value investing.

Weaknesses:

1. P/B ratios are based on accounting values, not economic values based on future returns.

2. Book values do not capture the value of internally created intellectual property. Marketing efforts, popularity, mindshare, and other critical activities do not have line items on the balance sheet. Industries with more assets which are off-balance sheet will appear more attractive than industries with fewer off-balance sheet assets.

3. As with DCF, your returns depend on other investors buying your shares at a higher price and the companys management not going nuts.

Clearly, the choice of valuation depends on the stock in question. None of them are applicable to all stocks, all the time. To illustrate this, I plotted required returns inferred from DDM, DCF, and discounted earnings for industry-wide averages of beta, growth estimates, and price multiples from FinViz.com. There should be a meaningful relationship between beta and required return (r). On the contrary, the plots are terrible, and demonstrate that these models really should not be applied universally.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.