Comparable Companies Analysis

Post on: 16 Март, 2015 No Comment

Valuation Methods Precedent Transactions Analysis

Comparable companies analysis involves the comparison of operating metrics and valuation multiples for public companies in a peer group (the comparable universe) to those of a target company. Peers may be grouped based on any number of criteria, such as industry focus, company size, or growth characteristics, for example.

Comparable companies analysis has application in M&A advisory, fairness opinions, restructuring, IPOs and follow-on offerings, and share repurchases. Consider an IPO of a private company that does not have a public market valuation. To determine how public markets might value the company, an investment banker will establish the comparables universe, which may consist or one or more peer groups. He or she will use the operating metrics and valuation multiples of the public comparables to determine an appropriate valuation multiple for the private company.

Exhibit A Practical Application

Suppose you are an investment banker positioning a technology-focused third-party logistics company (your client) for an IPO. The company has no direct comparables, but can be legitimately positioned as either a pure-play logistics firm or a business process outsourcing (BPO) company. You expect your client to trade on an EV/EBITDA multiple. Comparable pure-play logistics companies currently trade at 8.1x LTM EBITDA, on average. Comparable BPO firms currently trade at 9.6x, on average.

You would probably want to position your client as a BPO firm to take advantage of higher EBITDA multiples in that peer group and boost your client’s valuation. 9.6x LTM EBITDA would therefore be your starting point is determining an appropriate multiple, and you might adjust the multiple upward if your client has better growth characteristics than comparable BPO firms, or downward if your client’s business model is especially risky, for example.

The valuation determined through comparable companies analysis does not reflect:

- The control premium a buyer typically pays in an M&A transaction, or

- The discount the public markets may apply to newly issued shares from an IPO.

Selecting the Peer Group

To select the comparables universe, you must understand the target company’s business. Comparable companies will usually share the similar industry, business, and financial characteristics with the target. The following sources can be used to help identify suitable comparable companies:

- The target’s annual report, 10-K (especially the section on competition), prospectus, and web site

- Proxy statements in which the target compares its stock price performance with a that of peers

- Analyst research reports

- S&P tearsheet, Value Line, and Moody’s company reports

- Bloomberg

- Recent news

- SIC code lookup

You will be able to make the most meaningful comparisons among valuation multiples of companies in the comparables universe when peers have similar prospects for growth and return on invested capital (ROIC).

Data Collection

Once you have identified the comparables universe, the next step is to collect the necessary information on each comparable company to perform the analysis. You will need the following information for each company, as a minimum:

- The most recent 10-K, 10-Q, and/or 8-K earnings release (or Form 6-F and/or 20-F, in the case of some foreign companies)

- Consensus financial projections or a recent analyst research report with financial projections when consensus figures are unavailable

- News of any material events since the last reporting period for which you must make pro forma adjustments

Next, plug the information you have collected into your comparable companies analysis spreadsheet.

Pro Forma Adjustments

Making pro forma adjustments to comparable companies’ balance sheet items is often the trickiest part of comparable companies analysis. For example, if one of the companies you are analyzing announced a acquisition since its last earnings release, and the company intends to pay for the acquisition with cash, stock, and the assumption of debt, you must adjust the numbers in your spreadsheet accordingly. Specifically, you would increase the debt balance and basic shares outstanding, and lower the cash balance. Material events for which you should make pro forma adjustments include, but are not limited to:

- Acquisitions and divestitures/disposals

- Stock repurchases

- Debt financings

- Legal settlements

Projected income statement items such as revenue, EBITDA, and net income usually exclude non-recurring items and are pro forma for corporate events like planned divestitures, so you won’t likely have to adjust these figures.

Analyzing the Results

To compare comparable companies effectively, you must understand why their multiples are different. Reasons why one company’s projected EV/EBITDA multiple might be lower than that of a peer could include slower projected growth, declining margins, or higher risk, for example. Although metrics such as growth, margins, and risk are not explicit inputs to the EV/EBITDA calculation, they are implicit in equity value, which is a determinant of EV.

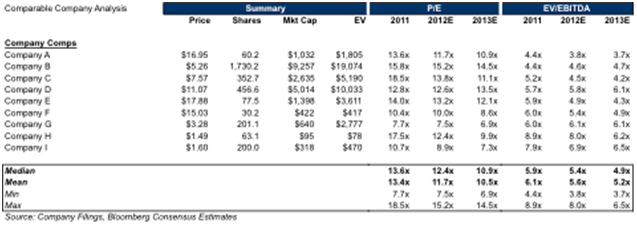

It is often useful to compare one company’s multiples to those of the peer group, collectively. To do so, calculate the high, low, mean, and median summary statistics for the group as shown in Example 5.4. The median is generally the most meaningful metric, because it naturally screens outliers.

Example 5.4 Comparable Company Analysis

Based on the following comparable company analysis, why might company Charlie trade at a premium to its peers?