Companies sell junk bonds to fund bankruptcy exit

Post on: 16 Март, 2015 No Comment

Related News

NEW YORK (Reuters) — High-yield bonds may be junk but they can be golden for bankrupt companies seeking cash to fund their exit from bankruptcy and pay down debt.

Reader’s Digest Association Inc and chemicals maker Lyondell Chemical Co ACCEIN.UL are two formerly bankrupt companies that have tapped the high-yield market to benefit from ravenous demand from investors for higher interest payments. There will likely be more to come.

We have at least another year of a very favorable backdrop to issue high-yield bonds, said Margaret Patel, senior portfolio manager with Evergreen Investments, who manages more than $1 billion in Boston.

When emerging from bankruptcy, companies need cash to pay down old debt, such as debtor-in-possession loans, and to fund ongoing operations. This financing, called exit financing, has traditionally come from banks.

But banks dramatically curtailed such lending in response to the U.S. economic recession and credit crunch. While there are signs of renewed lending, companies may still turn to high-yield bonds for the benefits they provide, including fewer restrictions on the loan terms and more time to repay.

While companies may pay higher interest on new junk bonds, it buys them wiggle room as the work through any lingering operational issues, strategists said.

If companies can extend maturities and pay down bank debt, it makes a lot of sense, said Patel. This is a way to ensure their liquidity in case the market (worsens). It’s opportunistic cash raising.

READER’S DIGEST READS MARKET

Reader’s Digest, publisher of the namesake general-interest magazine and other publications such as Every Day with Rachael Ray and Allrecipes.com, in February used the high-yield market to raise $525 million in bankruptcy exit financing, cutting interest expenses by $30 million annually. The interest rate is 9.5 percent.

Lyondell, meanwhile, sold $2.25 billion of senior secured notes yielding 8 percent to fund its bankruptcy exit.

As long as liquidity is good, and until the bank loan market becomes fully functional, I think people will continue to sell junk bonds to finance bankruptcy exits, said Sabur Moini, manager of the Payden High Income Fund in Los Angeles.

In the meantime, new money is pouring into the junk bond market.

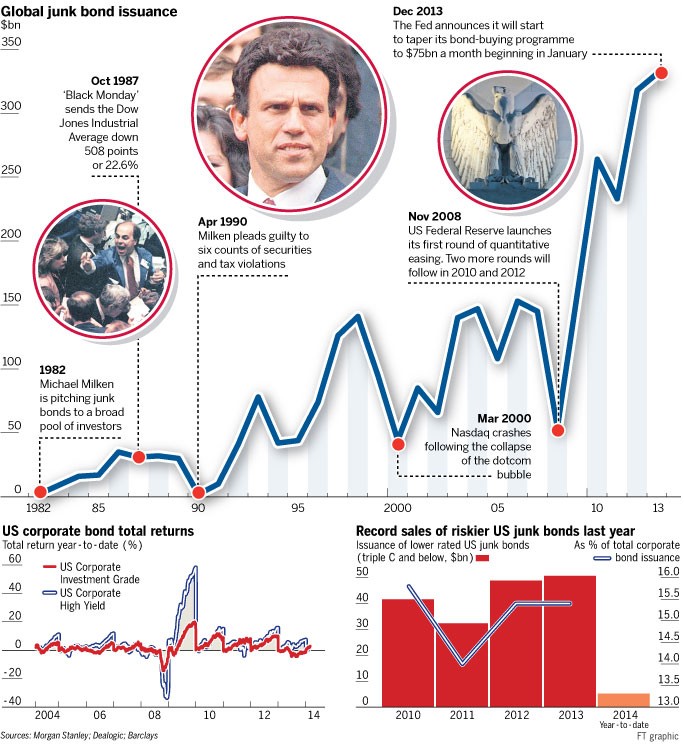

Junk bond sales have surged to records every month since December as companies contend with wall of maturity over the next few years, prompting a rush to refinance debt ahead of the quickly approaching repayment deadlines. In February, U.S. high-yield bond sales posted their busiest month on record, with $15.8 billion of new issuance, strategists said.

For bankrupt companies, high-yield is a real option, said Mark Podgainy, senior director in the New York office of Getzler Henrich & Associates. How long will the market be favorable for that to take place? For this year, as long as Fed keeps rates low.

INVESTORS LEAP

Investors, too, have incentives to snap up the junk bonds of formerly bankrupt companies.

Yield, said Podgainy. Everyone’s looking for yield.

Benchmark 10-year Treasury notes are yielding about 3.86 percent. As of March 26, the average junk bond yielded 5.8 percentage points more than Treasuries according to Bank of America and Merrill Lynch data.

Reader’s Digest senior floating rate notes, issued at 97 cents on the dollar, have risen to 101.25 cents, according to high-yield research firm KDP Investment Advisors. Lyondell notes now trade at 103.25 cents on the dollar, KDP said.

It’s pretty hard to live off what you’d make in a certificate of deposit or a Treasury bond, said Dwayne Moyers, chief investment officer of SMH Capital Advisors in Fort Worth.

Buying junk debt of companies exiting bankruptcy is definitely something we’d look at because the bankruptcy process pretty much cleanses the company, said Moyers.

(With additional reporting by Dena Aubin)

(Editing by Theodore d’Afflisio)