Companies cash piles trapped by tax code

Post on: 22 Апрель, 2015 No Comment

Story Highlights

- Company cash piles continue to mount, head for new record Dividend hikes, capital spending, stock buybacks barely making dent Companies not as aggressive as they could be

Companies have a problem many people would envy: They can’t get rid of cash fast enough.

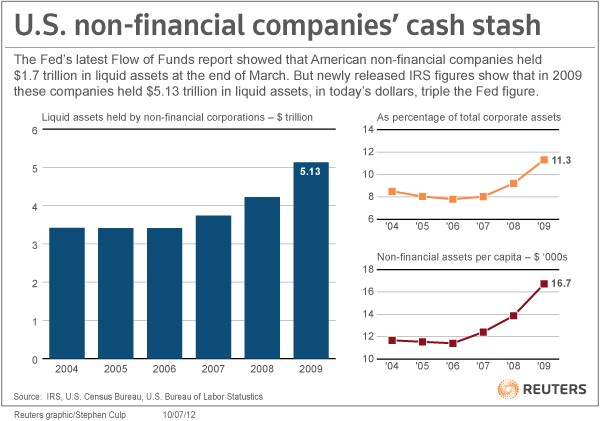

After a fourth year of higher profit, companies’ piles of cash is approaching yet another all-time high. They’re on pace to have $1.06 trillion in cash, based on estimates from S&P Dow Jones Indices.

Cash is piling up despite companies’ efforts to dispense of it by buying back stock, increasing dividends and investing in capital and equipment. However, they’re not being as aggressive as they can afford to be. Companies are examining different ways to put cash to work, says Charles Crane of Douglass Winthrop Advisors. But they’re still generating buckets of cash.

Cash continues to accumulate despite efforts by companies to reduce it because:

• Capital spending isn’t ramping up as much as it could. Companies are being timid investing cash in new equipment to generate growth in the future. Capital spending is up 13% from the fourth quarter of 2011, based on the 45% of companies that have provided data, says Howard Silverblatt of S&P Dow Jones Indices. But much of that is replacement spending, not expansion, he says, such as spending by AT&T and Verizon to replace storm-damaged equipment. Some big companies, such as Apple, have actually slashed their capital spending.

• Dividends are still low relative to earnings. Dividends soared in the fourth quarter by 21%, but companies are still paying out a smaller percentage of their earnings than they have historically. They’re paying out just 36% of earnings as dividends, near a low, and well below the 52% of earnings they usually do. Stinginess is due to cash being trapped overseas since it would be taxed if brought back to the U.S. to be paid as a dividend, says Michael Gumport of MG Holdings. The tax code is causing companies to hoard cash, he says.

• Buybacks not making a dent. Companies are loading up on their own shares with their cash. Buybacks are up 55% from where they were in the fourth quarter of 2011. But even at that frenetic pace, it’s hardly noticeable. The number of shares outstanding is down less than 1% from 2011 as companies create more shares, usually due to option-based pay.

Investors, though, shouldn’t complain too much, since it’s better for companies to have too much cash than not enough, Crane says. Balance sheets are in much better shape, he says. That’s not something to criticize.