Column Day of reckoning coming over national debt

Post on: 16 Март, 2015 No Comment

We Americans are stuck in domestic purgatory for reasons other than raw partisanship, although the Cain-like desire to dominate is part of the reason our political system is not working so well. We also are in economic limbo because of competing views of our problems.

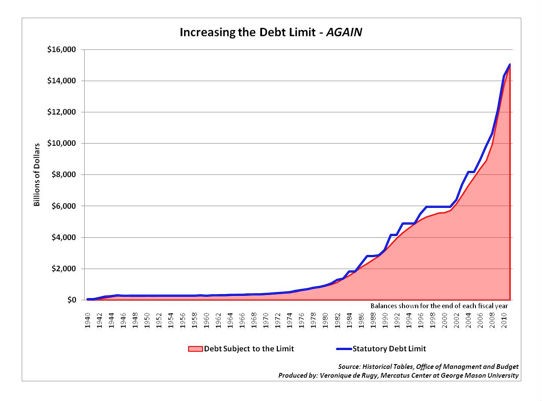

One camp believes the growth of our federal debt is the biggest worry. This group contends Washington should start curbing growth in spending.

Another camp believes the economy needs more pump-priming, not budget-squeezing. These advocates promote Keynesian measures, such as government spending to juice up growth.

A third camp contends economic inequality trumps other worries. Its disciples believe the gap between not only the rich and poor but also affluent and middle class threatens our stability.

GOP Rep. Jeb Hensarling of Dallas, head of the Houses financial services committee, epitomizes the first camp. He summarizes the problem this way: The consequence of failing to address our spending-driven debt crisis is no less than the economic freedom and security of future generations.

New York Times columnist Paul Krugman leads the second camp. Hes writing that Washington should spend more to rejuvenate the economy.

President Barack Obama embodies the third camp, although he also speaks up for the Krugman clan. National health care. Higher minimum wages. Taxing the rich. Theyre Obamas ways to create greater equality.

To me, the debt camp has the best arguments. Were getting to where it will be very hard to make the spending and tax choices required to reverse the debt held by the public in relation to our overall economy.

The public debt now makes up about 73 percent of U.S. gross domestic product. Economists Carmen Reinhart and Kenneth Rogoff have produced a study that shows economies grow less when public debt burdens get beyond 90 percent of GDP.

That figure should get our attention, especially when pitted against the pump-priming camp. The spending the Krugmans want could help temporarily, but it also could run up the debt and paradoxically make it harder to sustain growth.

Debt loads arent easily reduced when they get big, either. At lower levels of debt, an economy produces enough goods and services to generate the revenues needed to pay off creditors and still invest in the technologies, roads and schools that help grow an economy.

But at higher levels of debt, the goods and services an economy produces generate tax revenues that go almost solely to pay back the debt. It becomes a sponge that soaks up available capital.

Fortunately, were not there yet, but were headed that way. The sensible Committee for a Responsible Federal Budget explained last week that America is on course to a 79 percent debt-to-GDP ratio by 2023 and more than 100 percent in the early 2030s.

In short, the debt remains a big challenge, even if the Keynesian camp contends otherwise. A day of reckoning is coming because we havent shown any will to confront the underlying causes that will keep growing the debt.

Even if youve read this a million times, its still true: The growth in entitlement programs like Medicare, Social Security and Medicaid is our real problem. Until we confront it, we wont combat the expensive concoction of more seniors needing more services that keep costing more.

Yes, Congress has taken some steps to rein in the debt. And Obama says we only need to save another $1.5 trillion.

But thats not enough. The Committee for a Responsible Federal Budget released yet another report this month that says the budget needs at least $2.4 trillion more in savings over the next decade to put the debt on a clear downward path relative to the economy.

We dont have to roll back the debt all at once. But the longer we wait, the harder it becomes to solve this problem.

Lets, then, take initial steps now. For example, Congress should change the age at which seniors in the future could access Medicare. This is arguably the easiest Medicare decision because most Americans are living longer.

The other camps have legitimate arguments. But the debt is our biggest problem because it limits our ability to sustain economic growth.

William McKenzie is an editorial columnist for The Dallas Morning News. Readers may write to him at the Dallas Morning News, Communications Center, Dallas, Texas 75265; email: wmckenzie@dallasnews.com.

Don’t settle for a preview.

Subscribe today to see the full story!

- Hybrid $11/month

- Sat / Sun Delivery

- Sat / Sun Coupons

- Weekend Magazines

- Full Digital Access

- E-Edition Access Buy Now

- Premium $16/month

- 7-Day Print Delivery

- All coupons

- Special Magazines

- Full Digital Access

- E-Edition Access Buy Now

- Digital Only $11/month

- -

- -

- -

- Full Digital Access

- E-Edition Access Buy Now