Colorado PERA considering asset allocation changes Pensions & Investments

Post on: 26 Апрель, 2015 No Comment

Sponsored Links

Colorado Public Employees’ Retirement Association. Denver, is working on an implementation plan for potential asset allocation changes, spokeswoman Katie Kaufmanis said in an e-mail.

Investment consultant Aon Hewitt Investment Consulting (formerly Hewitt EnnisKnupp ) and PERA staff will develop an implementation plan for the following changes proposed by Aon Hewitt:

Aon Hewitt also recommended that a new infrastructure or hedge fund allocation be considered to improve portfolio efficiency or return per unit of risk.

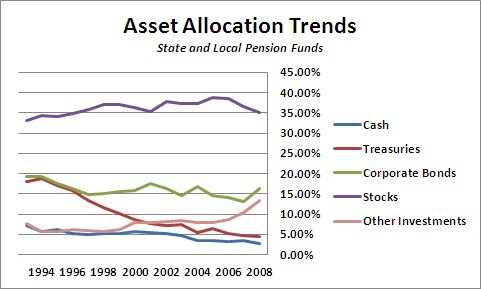

The proposed allocation is 53% global equity, 23% fixed income composed of 2.5% return-seeking and 20.5% risk-reducing assets 8.5% each real estate and private equity, 6% opportunity fund and 1% cash. The opportunity fund is composed of timber, commodities, risk parity, private equity, broad real estate and high-yield bonds.

The pension fund currently has a target asset allocation of 56% global equity, 25% fixed income, 7% each real estate and private equity, and 5% opportunity fund.

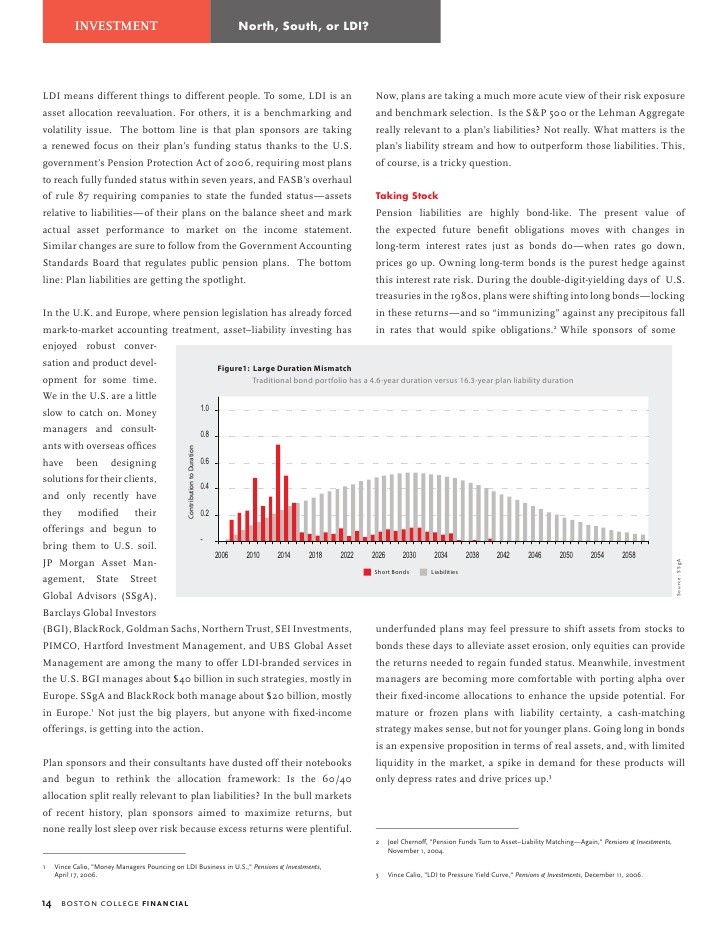

On the proposed fixed-income changes, eliminating the long-duration allocation will simplify the fixed-income portfolio and reduce the overall duration marginally, a presentation Aon Hewitt prepared for the Jan.16 board meeting said.

Aon Hewitt further noted while long-duration bond portfolios are common for corporate pension plans, their hedging benefits are not as direct for public pension plans, and the allocation is currently very small.

Additionally, dividing the remaining fixed-income allocation into return-seeking and risk-reducing strategies will better acknowledge the role these investments play in investment strategy, as high yield and emerging markets debt, which are part of the current fixed-income portfolio, do not serve the same risk-reducing function as core, investment-grade bonds, the presentation said.

On the new 1% target allocation to cash, Aon Hewitt said cash is a practical reality for funds like PERA that regularly manage cash flows for benefit payments, contributions, capital calls and distributions.

Ms. Kaufmanis declined to provide additional information because the proposed changes are still under review.