Collateralizeddebt obligation

Post on: 24 Апрель, 2015 No Comment

Collateralized-debt Obligation

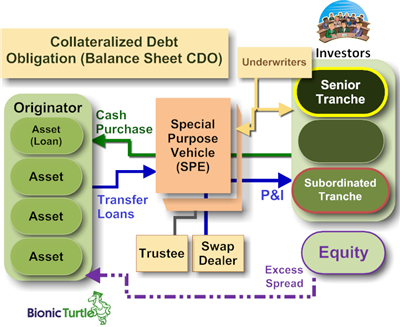

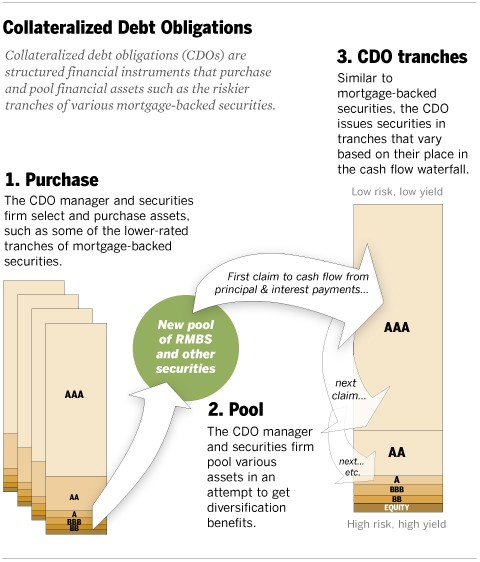

‘Collateralized debt obligations are simply collections of loans that are bundled together and sold to investors. The loans can range from short-term corporate business debts to home mortgages.

The key is that the debts are grouped together and sold in slices, known as tranches, according to their expected level of risk. The safest levels, known as the senior tranches (AAA), carry the least risk of non-repayment and generally pay the lowest interest rates. The next levels, known as mezzanine debt, are riskier and carry a higher payout. The riskiest levels, known as equity debt (unrated), pay the highest periodic interest payments but also carry the highest risk of default.

In theory, everyone benefits from when risk is spread among the largest number of investors possible. Investors in the riskiest equity tranches are the first to lose their payments if loans in the pool start to default, but they get the highest payouts in the meantime. Investors in the mezzanine class get the high payouts they might expect from relatively risky loans and senior investors get the benefit of higher payouts than they would normally get from super-safe bonds, because they are, after all, invested in a grouping of loans that includes lower-quality borrowers. But they are the last to suffer the consequences of loan defaults, because the mezzanine and equity investors will take their lumps first.’ (David Fisher

beginnersinvest.about.com/lw/Business-Finance/Personal-finance/Collateralized-Debt-Obligations-CDOs-A-Complicated-Way-to-Spread-Risk.htm

en.wikipedia.org/wiki/File:Risk%26ReturnForInvestors.svg //////////edit pic

Example

Bank AAA securitize 1400 similar mortgages based on credit-worthiness of homebuyers into a pool (CDO) worth $1 million (payments from homebuyers) and divide the pool into 7 slices (200 mortgages each), ranging from senior trench (entitled for first payment) to equity debt (entitled for last payment). Bank BBB decide to invest in the equity (unrated) trench due to the higher expected yield, but it is also the riskiest as it is the last trench to receive payment, thus if there are defaults, BBB will receive less payments.

Credit Default Swap

Credit Default Swap (CDW) is a type of Over-the-counter (OTC) derivative. It is a bilateral contract in which a buyer (insured) agrees to pay a periodic fee (premium) and/or an upfront payment to a seller of CDS (insurer) in exchange for default protection (insurance). The insurer also has to post collateral as securities to support its payment obligation. The value of the collateral must be adjusted as the value of the contract changes.

In situation where there is a credit event (defined in the contract), the seller are obligated to compensate the buyer of CDW, either through cash settlement where the difference in price between current and nominal value of the reference asset or through physical settlement where the value of the bond is specified in the CDS contract. The CDW contract will be automatically stop and the settlement process will proceed.

Thus, in a way, CDS transfer the risk of a reference entity defaulting from the buyer to the seller in exchange for the payment of a premium.

Types of credit events that can be found in a CDS contract:

* Bankruptcy

* Failure To pay

* Restructuring

* Repudiation

* Moratorium

* Obligation Acceleration

* Obligation Default

* Overview Of How CDS Works

Example of CDS

Company AAA (insured) buy CDS from YYY (insurer) to cover credit risk of Company BBB (reference entity) in order to hedge risk. AAA will pay YYY a premium periodically and AAA require YYY to post collateral as securities, if the collateral value drop by 30%, YYY have to post more collateral to top up to the original value.

Soon after, BBB went bankrupt (credit event), and under the terms of CDS, YYY is obliged to pay AAA to cover its losses.

AIG’s Risk-management Blunders

There are several interlinking factors that contribute to the fall of American International Group Inc (AIG) that leads to the liquidity crisis. The blind reliance of the risk management models created by Mr. Gary Gorton to gauge the risk of AIG’s CDS is probably the foundation of the crisis as the risk model itself is flawed.

AIG uses the model to calculate the risk of whether an investment would default thus hedging the risk of a potential payout, but the risk model do not cover the higher risk of posting collateral or write-downs in the event of the decline of value of securities that had yet to default. (5)Neither did the risk model take into consideration how market forces such as the subprime mortgage crisis and the rise of mortgage frauds could turn the swaps into huge financial liabilities (ref wsj), but the biggest culprit here is not the model itself, but the senior management of AIG, who acknowledge the weakness in the risk model and instead of consulting with Mr. Gorton, they choose to ignore them. In the end it was the AIG executives and not Mr. Gorton who decide which swap and what value to sell them at.

A combination of underwriting weakness and lack of due-diligence on CDS further showed the poor risk management practice by AIG on a largely unregulated market, which just hasten the downfall of AIG.

It was only till 2nd half of 2007( find exect date) than AIG started implementing a more effective model for valuing swaps and collateral risk, which was already too late as thousands of swaps are already sold (find num). thus without protecting itself through hedging, AIG was expose to large collateral claims, which nearly bankrupt AIG before the Federal government step in with a bailout.

What Other Insurance So Right?

The fundamental reason why most insurance companies survive the financial crisis is because they focus only on their core business, which is insurance, something that had been practice for years, instead of dabbling in the derivative market (e.g. CDS). American International Assurance (AIA), a subsidy of AIG, is still able to record quarterly profit earning despite the woes of its parent company during the credit crunch as they only concentrate on their core business, insurance.

CDS, unlike insurance, is also largely unregulated. there is no standard contract, no standard capital requirements, and no standard way of valuating securities in these transactions. Thus, only a few insurance companies include them in their financial product, and majority of these companies are bankrupt because of CDS.

Having a healthy capital adequacy ratio (CAR) also helps insurance companies to reassure the public about its solvency and ability to pay claim, something American Home Assurance (AHA), AIG’s general insurance unit in Singapore, does right by raising their capital ratio to 205% in march 2009, well above the minimum 120% required by the Monetary Authority of Singapore.

www.asiaone.com/Business/News/My%2BMoney/Story/A1Story20090305-126394.html

CHECK BK ON INSURANE LAW OF LARGE NUM

References

www.crm-software-guide.com/history-of-CRM.htm (Accessed: 1 December 2009).

Eric H.Shaw, William Lazer and Stephen F.Pirong III. (2007) ‘Wroe Alderson: Father of Modern Marketing.’ European Business Review, 19(6), 440-451.

www.exforsys.com/tutorials/crm/the-history-of-crm.html (Accessed: 1 December 2009).

marketing.wharton.upenn.edu/news/info/dept_history.cfm (Accessed: 1 December 2009).