Collar Options Strategy

Post on: 27 Июнь, 2015 No Comment

March 18 2012

I have a request to comment upon the collar options strategy.

Would you comment on the use of the Collar Strategy? At least 1 writer has stated, The Collar should form the foundation for your trading strategy.

I don’t know who the one writer is, and it is quite possible that the quote was taken out of context. Having said that, I can think of quite a few successful traders that would likely disagree.

Basic Construction of a Collar Trade

A collar consists of three components: 1.) the underlying security, 2.) a long put option, and 3.) a short call option.

For purposes of this discussion, we will assume that the underlying security is 100 shares of stock. Owning stock poses a dilemma when you are faced with an uncertain market environment. To protect those shares an investor might consider buying a put option, which affords the right to sell the shares of stock at a guaranteed priced. If the stock price falls, you are protected. If the stock prices rises you still own your stock.

The problem with buying a protective put option is that once the put expires you have lost your protection and must purchase another put option if the stock is to remain protected. This can become expensive.

To offset the cost of the put option, an investor might also sell a call option against that same stock that they own. The positive cash flow from the sale of the call option will offset some or all of the cost of the put option. Most frequently, I see the position constructed with a short near money call and a slightly out-of-the-money put option so that the credit from the call pays for the entire cost of the put.

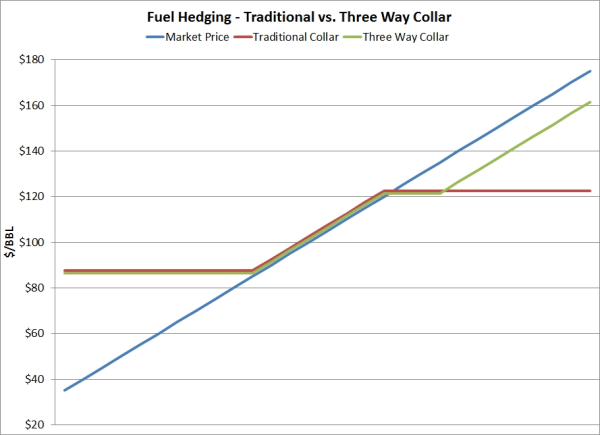

This long put and short call arrangement, when combined with the underlying stock, is referred to as a collar trade. The name describes the fact that the position can only lose a minimal amount if the stock falls in price due to the protection afforded by the put option and can only gain a limited amount if the stock price rises due to the limiting nature of the short call option. As such, the position is constrained.

Synthetic Collar Option Positions

Without diving too far into the concept of synthetic option position, we will start by acknowledging that a synthetic call option consists of 100 shares of long stock, plus a long put.

If this statement is confusing to you, it is probably because you have not heard of or have not studied synthetics in the context of options. Once you do, this portion of our collar discussion will make much more sense.

So, if the long stock and our put option is equivalent to a long call what happens when we sell a call to complete the collar?

The answer is that if the long put and the short call of the collar trade shared the same expiration and strike, you would have effectively closed the position. This is why collars are not built at the same strike.

The put always resides at a lower strike and the short call always at a higher strike. That long stock and long put combination is equivalent to owning a call at the strike of the put option. By selling the call at a higher strike, you now have a synthetic long call at the lower strike and a short call sold at a higher strike.

Sound familiar? It should.

The collar trade is equivalent to a vertical call spread.

Should the Collar be the Foundation of Your Options Trading Strategy?

The answer to this question is going to be no for a lot of options traders, simply because it involves owning stock.

A lot of options traders simply do not want to own stock, so the collar trade will never be a foundational aspect of their trading plan or system. For those of us who do own stock in our investment or trading accounts, we need to look a bit deeper and question what the collar trade is really about and what sort of returns we can expect from it.

There is only one reason to own stock.

Some might argue that dividends is a reason for owning stock on its own, but I will suggest that while a healthy dividend might be an incentive to buy a particular stock the dividends by themselves are not a reason to take on the risk of stock ownership.

The reason to buy stock is because you expect that it will increase in value over time. If you have no such expectation, you will likely choose to buy a different stock or shift to an entirely different class of investments if you are doubtful about appreciation of stocks on the whole.

The most significant risk of owning stock — dividend or no dividend — is a drop in stock prices. By collaring your stock positions you eliminate that risk in large part. Selling the call option covers some or all of the cost of eliminating the risk. But keep in mind that we now own a synthetic vertical call spread and even these vertical spreads can lose money. Granted, it’s a limited loss but the risk of loss exists nonetheless.

I have spent a fair amount of time evaluating whether a stock investor is better off over the long term simply buying stock or whether options have a legitimate role to play in a stock investor’s portfolio. The most convincing data I found was developed by the Chicago Board Options Exchange (CBOE) who have developed hypothetical indexes that track returns for covered call strategies, collar strategies, and even put selling strategies.

What these CBOE developed indexes allowed me to do is compare on an apples to apples basis the relative performance of owning the S&P 500 index versus selling calls against the S&P 500 index. I was also able to see the relative performance of a collar strategy being applied to the index over time.

Selling near money calls against the S&P 500 produced nearly identical yields over time as simply owning the index, but the volatility you would experience in your account was reduced significantly by writing calls. So, by selling call options you got the same yields as owning the stocks on their own but with less volatility.

Selling out-of-the-money calls produced a bit more volatility, but still much less than simply getting long the index. That slight up tick in volatility came with improved yields. By shifting from at-the-money to slightly out-of-the-money call options, over time the covered call writer should be able to beat the market with less portfolio volatility than simply owning the stock.

According to the CBOE back testing, the collar strategy reduced portfolio volatility even more than either covered write strategy. That reduction in volatility came with a significant cost, however. That cost was significantly reduced yield performance.

The real surprise was that the put selling strategy — simply selling cash secured puts on the components of the S&P 500 — not only had the best yield performance, but it also had the least amount of volatility.

Trading the collar strategy, you would not lose much money in your portfolio during market downturns. However, you miss out on much of the upside. Using the collar as the foundation of your options strategy essentially positions your account so that it will see very little volatility, which is a good thing. It will also likely cause you to under perform the market over time.

An attentive investor might choose to use the collar as a technique for weathering adverse market conditions in lieu of selling a stock position. It is very effective for taking a time out when market conditions raise concern because you have very little at risk. Eventually, you will either want to close out the stock position if it continues to drop in value or unwind the collar so that you can pursue a better yield.

To learn more on this subject I would suggest watching my video presentation on Strategic Portfolio Design . The video runs about two hours and if you would like to pursue the concepts discussed in that video further, then you might want to consider joining me in my Trading Room where we fully explore these concepts and learn how to apply them to meet our investing and trading objectives.