Climate change

Post on: 8 Июль, 2015 No Comment

Climate change is one of the most significant challenges of our time. The world’s key environmental and social challenges, such as population growth, energy security, loss of biodiversity and access to drinking water and food are all closely intertwined with climate change. This makes the transition to a low-carbon economy vital.

We recognize that financial institutions are increasingly expected to play a key role in the transition to a low-carbon economy and, we are determined to support our clients in preparing for success in an increasingly carbon-constrained world. We are one of the leading wealth management firms worldwide, and the leading universal bank in Switzerland, backed by a top asset management business and a client-centered investment bank. Therefore, our climate change strategy focuses on the areas of risk management, investments, financing, research and in-house operations. It is in these areas that we believe we can make the greatest contribution to the transition towards a low-carbon economy.

Our contribution in 2013 to these areas include:

Risk management

Seeking to protect our clients’, and our own, assets from climate change risks, within our sphere of influence.

Recognizing that the transition to a low-carbon economy will take time and that fossil fuels will continue to dominate energy production for decades to come, we are determined to understand the risks that our clients’, and our own, assets are exposed to in the context of uncertain policy and technology developments addressing climate change. This includes developing a metrics-based approach to measure our exposure to climate change risks in high-risk sectors such as real estate and energy.

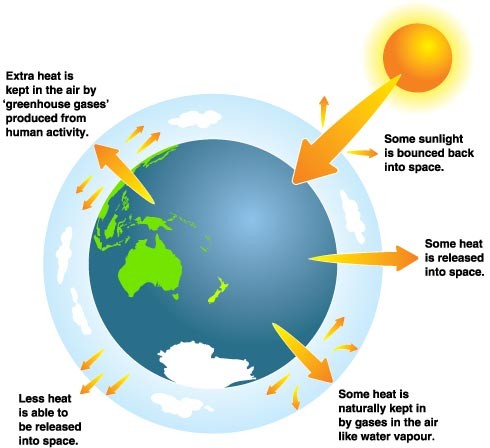

We committed to participate in the international efforts led by the Greenhouse Gas Protocol and the United Nations (UN) Environment Programme Finance Initiative to develop a greenhouse gas accounting and reporting guidance for financial intermediaries.

We helped our clients manage their exposure to the emissions markets and offer execution and full service clearing for contracts on, for example, EU Emissions Trading System allowances and UN Certified Emissions Reductions in Europe and North America.

Investments

Helping to mobilize private and institutional capital towards investments facilitating climate change mitigation and adaptation.

Our clients will continue to look for investment opportunities and some will increasingly focus on investments facilitating climate change mitigation and adaptation.

We launched an Impact Investing Private Equity fund for small- and medium-sized enterprises (SME) in emerging and frontier markets. With a volume slightly in excess of CHF 50 million at closure, it is one of the largest impact funds in the sector funded by clients and private capital. The fund represents a unique investment opportunity for wealthy clients and is expected to generate significant social and environmental impact.

Our UBS Portfolio Screening Services helped Wealth Management clients align their portfolios to their values by assessing portfolios using specific sustainability criteria (including environmental issues). Based on increased interest among our clients, we screened CHF 4.2 billion of client assets in 2013.

The UBS Clean Energy Infrastructure Switzerland offers institutional investors unprecedented access to a diversified portfolio of Swiss infrastructure facilities and companies in the field of renewable energies and energy efficiency. Capital commitments had reached approximately CHF 350 million on 31 December 2013.

Six of Global Asset Management’s Global Real Estate funds, with CHF 20 billion gross assets under management, obtained the top ranking (”green star”) and two of them were awarded “sector leader” status by the 2013 Global Real Estate Sustainability Benchmark, thus recognizing our efforts in defining and implementing a sustainability and responsible property investment strategy (RPI). All six funds rank within the first and second quartiles of their respective peer set (among more than 540 real estate portfolios).

Financing

Supporting this transition as corporate advisor, and/or with our lending capacity.

We are helping corporate clients raise capital on domestic/international capital markets in order to meet the high investment levels required for the transition to a low-carbon economy. In Switzerland, we are also supporting private clients in renovating their private homes sustainably and innovative small and medium-sized enterprises (SMEs) in providing solutions for climate change mitigation and adaptation.

We supported Swiss SMEs to save energy, promoted by the Swiss Energy Agency’s SME Model. Clients profited from the agency’s ”energy check-up for SME” at reduced costs and were granted cash premiums if they commit to an energy reduction plan within this scheme. 116 companies signed-up by end of 2013.

In supporting Swiss private clients when renovating their private homes sustainably, we redistributed CHF 2.9 million in cash benefit, funded by proceeds from the Swiss CO2 levy refund. Swiss private clients could also benefit from the UBS “eco” mortgage when building energy-efficient homes.

Expressing our commitment to be a financial partner for the energy transition in Switzerland, we sponsor the Swiss Energy and Climate Summit 2013 and 2014 as a Premium Partner.

In 2013, the Investment Bank supported 190 clients that provide a positive contribution to climate change mitigation and adaptation, either in equity and debt capital market transactions (total deal value CHF 28.5 billion) or as financial advisor (total deal value CHF 49 billion).

Research

Offering world-class research capacity to our clients on climate change issues.

Building on our renowned expertise, we act as a thought leader and expert advisor to our clients on financial impacts of, and solutions for, climate change.

Our Chief Investment Office (CIO) Wealth Management research provided regular research updates on renewables, agribusiness, energy efficiency and water. The latter was the sustainable investment theme promoted in the 2013 UBS CIO House View.

In-house operations

Reducing our own greenhouse gas emissions.