Cheap Stock Updates to the AICPA Practice Aid

Post on: 16 Март, 2015 No Comment

Primary links

When reviewing Form S-1 registration statements for companies pursuing an initial public offering (“IPO”), the Securities and Exchange Commission (“SEC”) frequently targets stock-based compensation grants and the associated financial reporting requirements. Commonly referred to as “cheap stock” issues, the SEC is on the lookout for stock-based compensation grants that are substantially below Fair Value in the pre-IPO period, as well as inadequate disclosures of the grant-date fair values. SEC comment letters will cover all periods disclosed in the registration statement, including previous periods in which the company may have not yet pursued an IPO in earnest. Furthermore, the cheap stock issue may have significant tax consequences under Internal Revenue Code Section 409A (“IRC 409A”).

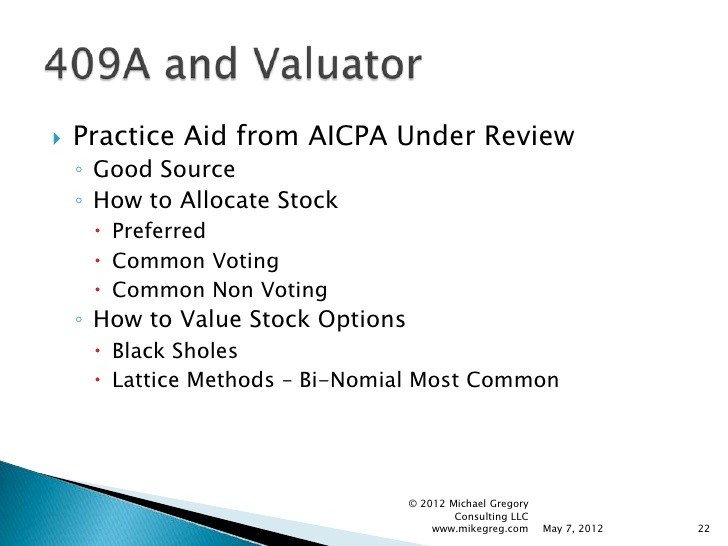

In an effort to provide best practices for the valuation of and disclosures related to the issuance of privately held company equity securities issued as compensation, the American Institute of Certified Public Accountants (“AICPA”) issued guidance in the form of a practice aid in 2004 (the “2004 Practice Aid”). Since its publication, the 2004 Practice Aid has become a critical resource for valuation experts, audit firms, and regulatory bodies.

In March 2011, the AICPA issued a new edition of the practice aid, Valuation of Privately Held Company Equity Securities Issued as Compensation (the “2011 Practice Aid”), for public comment. This article highlights the overall concepts underpinning both the 2004 Practice Aid and 2011 Practice Aid, as well as the key changes and best practices outlined in the new edition.

Overview of Value Allocation Techniques

Common equity reflects a residual interest in a company’s value after considering senior securities such as debt and preferred stock. Typically, valuation analysts determine common equity value by first valuing the business as a whole, and then subtracting the senior securities in the capital structure. For example, debt and straight preferred stock are deducted from enterprise value (“EV”) to derive common equity value. This method of allocating EV is referred to as the Current Value Method. A chart illustrating typical components of EV and total capital is presented on the following page.

By its very nature, the Current Value Method assumes that the company is sold on the valuation date and the proceeds are distributed in accordance with investors’ liquidation rights. This approach may be appropriate in certain circumstances, but most companies operate as going concerns without an imminent liquidity event (e.g. a sale of the company, an IPO, or liquidation) and noncontrolling shareholders have no ability to unilaterally pursue a sale of the business.

Moreover, in situations where the subject company’s capital structure consists of complex securities (e.g. convertible preferred stock) or is highly leveraged, the valuation professional must take care to apportion EV or equity value to each security class based on their relative rights and preferences, considering that future increases (or decreases) in value may affect each security class differently.

To address these issues, the 2011 Practice Aid outlines two additional methods of allocating a company’s value to the various components of its capital structure. These methods are based on two key premises. First, the value of each class of securities should result from the security holders’ expectations about future economic events and the amounts, timing, and uncertainty of future cash flows. Second, at least some nominal value must be assigned to the common shares unless the enterprise is being liquidated and no cash is being distributed to the common shareholders (i.e. there exists option value). These value allocation methods are:

Probability-Weighted Expected Return Method

(“PWERM”): The PWERM estimates common equity value based upon an analysis of various future outcomes, such as an IPO, merger or sale, dissolution, or continued operation as a private enterprise until a later exit date. The future allocated value is based upon the probability-weighted present values of expected future investment returns, considering each of the possible outcomes available to the enterprise, as well as the rights of each security class.

Option Pricing Method (“OPM”): The OPM treats securities as call options on the enterprise’s value or overall equity value. The value of a security is based on the optionality over and above the value of securities senior in the capital structure (e.g. preferred stock).

One of the key differences between the 2004 Practice Aid and the 2011 Practice Aid is the manner in which the “stay private” scenario is incorporated into the PWERM. Previously, the stay private scenario assumed that no future liquidity event was foreseeable and essentially valued the security under the Current Value Method (i.e. the value of the security as if the company were sold today, taking into account discounts for lack of control and marketability, as appropriate). In practice, however, almost all venture capital-backed and private equity-backed companies will ultimately seek a liquidity event via an IPO or sale of the company.

Newly introduced in the 2011 Practice Aid is a Hybrid Method whereby the concepts of the PWERM and OPM are employed in a single framework. For example, suppose that the three scenarios considered in the PWERM were (a) an IPO, (b) a merger or sale of the business, or (c) remaining private. Just as before, the first two scenarios would be incorporated by (i) estimating the future equity value under each case, (ii) allocating the future value in each scenario according to the subject company’s capital structure, (iii) weighting each scenario, (iv) discounting the value to a present value equivalent using a risk-adjusted discount rate, and (v) considering discounts for lack of control or marketability, as appropriate. In a departure from the 2004 Practice Aid, the 2011 Practice Aid suggests that the third scenario, remaining private, is modeled using the OPM over a reasonable timeframe until the senior securities (e.g. preferred stock) are redeemed or repurchased. In effect, the “stay private forever” scenario has been eliminated and replaced with the “stay private longer” scenario.

For a detailed example of the PWERM and OPM (following the guidance of the 2004 Practice Aid), please refer to a separate article published in the Fall 2009 edition of the SRR Journal entitled, “A Piece of the Pie: Alternative Approaches to Allocating Value,” available at www.srr.com .

PWERM and OPM Clarifications

The 2011 Practice Aid provides a greater level of detail in terms of the application and use of the PWERM and OPM in contrast to the previous edition, including detailed examples in the appendices. The following outlines key changes or clarifications in the newest edition.

PWERM. Because future outcomes must be explicitly modeled, the PWERM is generally more appropriate to use when the time to a liquidity event is short, making the range of possible future outcomes easier to predict. For example, a company may employ the OPM when the future liquidity events are uncertain, and begin to apply the PWERM (or a Hybrid Method) when its board of directors begin to evaluate exit opportunities in earnest by hiring investment bankers. In this regard, however, it is important to highlight that an IPO scenario is not a prerequisite in order to apply the PWERM. The PWERM may still be an acceptable approach in cases where the only two expected outcomes include (a) a sale or merger and (b) remaining private over a longer timeframe.

One particular area of diversity in practice among valuation professionals has been whether the discount rate used to present value the future expected values should be either the risk-free rate (under the assumption that the probability weightings accounted for projection risk) or a “risky” rate analogous to equity returns. The 2011 Practice Aid clarifies that, when employing the PWERM, the weighted average discount rate across all equity classes should equal the company’s overall cost of equity (based on the leverage employed). Furthermore, it is noted that it is not appropriate to select a different discount rate for each event scenario, as investors cannot choose between these outcomes. Rather, a discount rate should be selected such that each share class accounts for the risks inherent in the probability-weighted cash flows to the class.

OPM. The volatility factor selected in an OPM is a critical assumption that requires a significant degree of judgment. The 2011 Practice Aid outlines several key factors to consider when estimating volatility.

For early stage companies, the selected volatility factor will often approach the upper end of the observed volatilities for the guideline public companies (especially for shorter timeframes), as the guideline public companies are likely larger, more profitable, and more diversified. Over the longer term, an appropriate volatility assumption may trend more toward the mean or median of the smaller guideline public companies (i.e. mean reversion).

The effects of leverage can have a material impact on the selected volatility factor. As leverage increases, volatility increases. The 2011 Practice Aid provides examples whereby observed market volatilities are unlevered and relevered to better align with the subject company’s debt capitalization.

Valuation analysts may also perform the OPM by using the firm’s enterprise value as the underlying asset. Under this approach, the zero-coupon bond equivalent of the debt over the assumed term is set as the first breakpoint, with the company’s total equity value modeled as a call option on the enterprise value. In this approach, the volatility measure should reflect unlevered (i.e. asset) volatility rather than equity volatility.

In addition to the above discussion on the impact of leverage on volatility, building an OPM model often involves modeling the impact of debt on the residual equity value. As outlined in the 2011 Practice Aid, debt may be incorporated in an OPM analysis by either (a) subtracting the Fair Value of debt from the company’s enterprise value to derive total equity, and then allocating that equity value between preferred and common stock via the OPM, or (b) building the OPM model on an enterprise basis and allocating enterprise value between debt, preferred stock, and common stock, taking care to ensure that the value allocated to the debt securities in the OPM is consistent with the Fair Value of the debt. In theory, both approaches should result in consistent value conclusions, although option (b) – building the OPM on an enterprise basis – may have the effect of shifting value away from the senior equity securities to the junior equity securities.

For this reason, while the 2011 Practice Aid is clear that either method is acceptable, the task force believes that using the total equity value as the underlying asset, after deducting the Fair Value of the debt (option (a)), provides a better indication of the relative value of the junior and senior equity securities.

Backsolve Method

New to the 2011 Practice Aid is the “Backsolve Method.” The Backsolve Method, a form of the Market Approach to valuation, derives the implied equity value for one type of equity security (e.g. common equity) from a contemporaneous transaction involving another type of equity security (e.g. preferred stock).

In a PWERM framework, the Backsolve Method involves selecting the future outcomes available to the enterprise, and then calibrating the future exit values, the probabilities for each scenario, and the discount rates for the various equity securities such that value for the most recent financing equals the amount paid for that security class.

In an OPM framework, the Backsolve Method involves making assumptions regarding the time to liquidity, volatility, and risk-free rates, and then solving for the value of equity such that value for the most recent financing equals the amount paid for that security class.

The resulting value from the analysis above may then require adjustment for any stated or unstated rights and privileges of the transacted security relative to the security being valued, including relative control and marketability attributes. 1

To illustrate the application of the Backsolve Method, assume that ABC Company, Inc. (“ABC”) issued 10.0 million shares of Series A convertible preferred stock on June 30, 2011, with a liquidation preference of $1.00 per share (the “Preferred Stock”). The Preferred Stock has a conversion ratio of 1:1, is not entitled to dividends, and is voluntarily convertible upon a sale or merger of the company and automatically converts into common stock upon an IPO. Prior to issuing the Preferred Stock, ABC had issued 14.0 million shares of common stock (the “Common Stock”) and the company issued an additional 1.0 million shares of Common Stock to its employees upon raising the new capital.

In order to comply with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, Compensation – Stock Compensation (“FASB ASC 718”) and IRC 409A, ABC retained an independent valuation firm to estimate the Fair Value and Fair Market Value of its Common Stock on June 30, 2011.

After giving effect to the transactions described above, ABC’s total equity value will first be allocated to the Preferred Stock up to $10.0 million, with no value being allocated to the Common Stock. The Common Stock holders are then allocated 100% of ABC’s incremental equity value, up to an additional $15.0 million ($25.0 million in aggregate). Above a total equity value of $25.0 million, it is economically advantageous for the Preferred Stock to convert into Common Stock; thus, holders of the Preferred Stock and Common Stock will share in any equity value above-and-beyond $25.0 million based on their relative ownership of ABC’s fully diluted shares.

The OPM was selected to value the Common Stock via the Backsolve Method. To do so, the Black-Scholes Option Pricing Model is employed whereby the value of the Common Stock is based on the value of the optionality over and above the value of the Preferred Stock at each of the three breakpoints above. Table 3, on the following page, outlines the key inputs to the OPM.

The results of the OPM are outlined in Table 4. The analysis is performed by way of solving for the total equity value that results in an allocated value to the Preferred Stock equal to $10.0 million (i.e. the issuance price). Based thereon, the total equity value is approximately $18.5 million, and the value allocated to the Common Stock is approximately $8.5 million. Dividing by the number of shares outstanding results in an indicated value for the Common Stock of $0.57 per share. 2

Other Highlights

In addition to the technical issues highlighted in this article, several other areas deserve review. Other highlights from the 2011 Practice Aid include:

Recommended financial statement and pre-IPO disclosures

A discussion surrounding adjustments for control and marketability

Updated guidance for new financial reporting standards (e.g. FASB ASC 718 and 820)

Updates for AICPA valuation standards

Best practices for the valuation of privately held equity securities continue to evolve and the 2011 Practice Aid provides a far more comprehensive set of guidelines for boards of directors that issue these securities, valuation experts, auditors, and other interested parties (such as creditors). Still, the technical rigor and analytical proficiency required to meet these standards remains high. Private companies issuing stock-based compensation are well-served by coupling equity grants with a comprehensive valuation of the securities in order to meet financial reporting requirements, to avoid any unintended IRC 409A tax consequences, and to avoid delays in an IPO due to additional disclosures, restatements, and added professional fees.

1 The Backsolve Method indicates an equity value that is consistent with the private equity or venture capital investors’ expected rate of return, given the degree of control they have over theenterprise and the degree of marketability of their investment.

2 Before adjustments for differences between preferred and common shares in terms of control rights and liquidity.