Charitable Givers Turn to DonorAdvised Funds

Post on: 28 Апрель, 2015 No Comment

Carolyn T. Geer

December 9, 2012

With just a few weeks to go in the giving season, many investors are still struggling with when and how best to make their charitable donations.

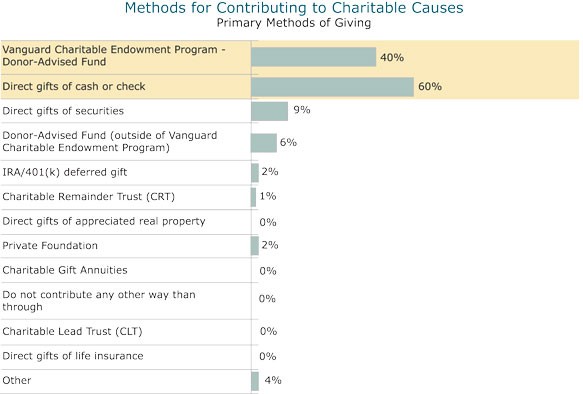

Among the apparent beneficiaries of all this uncertainty are donor-advised funds. These are individual accounts administered by tax-exempt organizations, such as community foundations and national charities. The charitable arms of investment firms Fidelity Investments, Charles Schwab and Vanguard Group are the biggest players.

ENLARGE

Jason Greenberg

Donors can lock in a full deduction today by contributing to an account before year-end, yet distribute the money, which grows tax-free, to their chosen charity or charities over time.

Accounts can be opened with as little as $5,000, and grants can be doled out in increments as tiny as $50.

Donor-advised funds are a small but fast-growing piece of the charitable-giving pie. Contributions to these funds made up just 3.2% of all charitable giving in the U.S. last year, but they were up 10.6% over 2010, according to the National Philanthropic Trust.

So far this year, some sponsors of donor-advised funds are reporting record-breaking inflows. Contributions to Fidelity Charitable were up 63% through September, compared with the same period last year. Schwab Charitable saw an almost 75% year-over-year increase in contributions through October.

Helping to spread the word are growing ranks of financial advisers aiming to broaden their relationships with clients and, not coincidentally, keep more assets under management.

When you contribute to a donor-advised fund, the money lingers in your account longer than if you write a check directly to a charity—growing tax-free but also incurring expenses.

So watch your fees. As a benchmark, Fidelity charges an annual administrative fee of 0.6% on the first $500,000 of assets. This fee declines as the assets in the fund grow. Donors with accounts up to $250,000 choose among various Fidelity-managed investment pools with expenses ranging from 0.07% to 1.17%.

Those with balances of $250,000 or more can have an investment adviser pick funds or individual securities for their accounts. (Fidelity generally requires that the adviser charge no more than 1% of assets as an overlay fee.)

If a donor-advised fund seems right for you, here are three strategies to consider:

Give more. If you give regularly, and if you have the financial flexibility to do so, consider increasing your donation this year to capture today’s tax benefits and prefund future gifts. Cash donations are typically deductible up to 50% of adjusted gross income. (You’ll need to itemize on Schedule A of your tax return to claim the deduction.)

Give stock. More than half of the contributions flowing into Fidelity’s donor-advised funds this year are in the form of appreciated securities, says Sarah Libbey, president of Fidelity Charitable.

Why? Under current tax law, you can deduct the full fair market value of donated securities, typically up to 30% of adjusted gross income.

Say you own stock purchased more than a year ago for $10,000 that is now worth $20,000. If you sell the stock and donate the proceeds, you’ll owe capital-gains tax on your $10,000 profit, or $1,500 (assuming you pay capital-gains tax at the 15% rate), leaving you with $18,500 to give and deduct. If you give the stock, however, you can potentially deduct the entire $20,000.

Do the Roth two-step. Many investors would like to convert their deductible individual retirement accounts to Roth IRAs this year in anticipation of higher income tax rates down the road. With a Roth, contributions are made after taxes but qualified withdrawals are tax-free.

The downside: Converting generates a big tax bill on the converted amount.

However, someone near the top of the 15% income-tax bracket who combines a $20,000 charitable gift with a $50,000 Roth IRA conversion could pay $5,000 less in taxes than without the charitable contribution, effectively keeping the tax rate on the conversion at 15%, according to an example from Fidelity. The investor’s actual cash outlay would be $15,000 more than without the gift, but giving appreciated securities instead of cash could avoid capital-gains taxes, further reducing the after-tax cost of the transaction.

investingbasics.wsj@gmail.com