Chapter 5 The Behavior of Interest Rates

Post on: 24 Июль, 2015 No Comment

Chapter 5: The Behavior of Interest Rates

Now that we know how to measure interest rates, we want to examine why interest rates fluctuate up and down. The answer lies with the laws of supply and demand in financial markets. That’s right, there is no escaping supply and demand in an economics class.

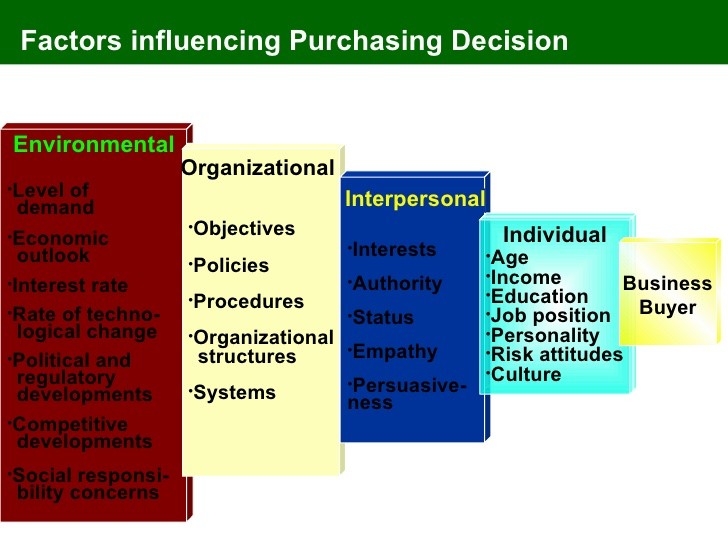

I. Asset Demand

Bonds are just one example of an asset, which can be any store of value. Other examples include money, stocks, real estate, and gemstones. In choosing which asset will be used to store and accumulate wealth, and how many, we look at the following factors:

A. Wealth

With greater wealth comes greater resources with which to purchase assets. So greater wealth means an increase in the quantity demanded of assets, other factors held constant.

B. Expected Returns

Recall from chapter 4 that the return on an asset measures the gain from holding an asset over a given period. When deciding whether or not to purchase an asset, we form an expectation of the return based on anticipated payments (coupon payments, dividends) and price changes. This is the expected return. If the expected return of an asset changes relative to other assets, this affects the decision whether or not to purchase the asset. An increase in the relative expected return of an asset will increase the quantity demanded of that asset, other factors held constant.

C. Risk

Risk is the amount of variation in an asset’s possible return. For example, suppose real estate in Oswego appreciates 2% annually half the time, and 5% annually half the time (yeah, right). The expected return is 3.5%. Now suppose real estate in Scriba appreciates 3.5% every year. Both assets have the same expected return of 3.5%. However, real estate in Oswego, in this example, is riskier because the actual return varies.

Evidence about investor behavior suggests that most people are risk-averse; i.e. for assets with identical expected returns, they will prefer the asset with lower risk. Thus, if an asset’s risk increases relative to other assets, the quantity demanded of that asset will fall, other factors held constant.

D. Liquidity

Recall that liquidity refers to how quickly and cheaply an asset can be converted to cash. Real estate is not liquid, since is takes time to find a buyer and sellers typically pay commissions of 6-7% to real estate agents to find a buyer. U.S. Tbills are very liquid, with many buyers and small bid-ask spreads. Larger markets, with many buyers and sellers are going to be more liquid. For example, real estate in New York City is more liquid than real estate in Oswego because the NYC market is so much larger.

The table below sums up the impact of the four factors on the quantity demanded of an asset: