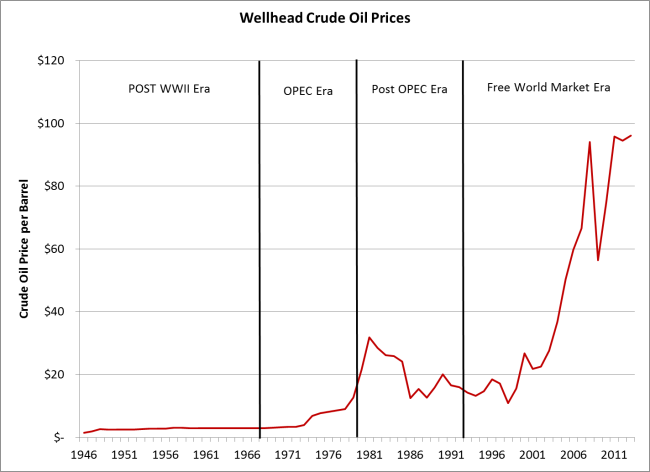

Changing behavior of crude oil futures prices

Post on: 15 Апрель, 2015 No Comment

Ive just finished a new research paper with my former student (and now University of Chicago Professor) Cynthia Wu. In our new paper, we study how increased purchases of crude oil futures contracts by financial investors may have affected the prices on those contracts.

A crude oil futures contract is an agreement between two parties to purchase oil at a future date at a price agreed upon today. For example, on Friday the November contract closed at a price of $88.18, meaning that if both parties were to hold on to the contract until expiry (which for this contract happens to be October 21), the seller would be obligated to deliver 1,000 barrels of crude oil to the buyer some time in November at a location in Cushing, Oklahoma at a price of $88.18 per barrel. Most people who buy or sell these contracts dont actually hold them to expiry, but sell their positions to somebody else between now and then. The easiest way to think about this is if on next Wednesday, Fridays buyer ends up selling the November oil contract back to the original seller, after which they both walk away clean. If the price of the contract goes up between Friday and Wednesday, the original buyer will have made a profit and the original seller will have made a loss.

If both parties dont care about the risk, the price they agree to today would be the same as the price theyd expect to pay if they were just to wait until October 21 before making any agreement. However, providing a way of coping with risk that one of them would prefer to avoid is one of the principal reasons these contracts exist. For example, a producer of crude oil might be worried about its ability to maintain cash flow if the price of oil were to fall. They might then want to sell a futures contract. If the price of the oil they produce subsequently falls, the futures price will likely fall with it, and they will receive a cash gain from their futures position to offset the lower revenues from sales of oil. From their point of view, selling a crude oil futures contract is like buying an insurance policy. As with any insurance policy, if youre risk averse youd be willing to pay a premium for the policy that is greater than the expected value of the cash flow you receive from the policy.

But who would take the other side of the contract? The would-be buyer also faces various risks, and taking the long position in a crude oil futures contract may expose the buyer to risks that are hard for them to diversify away. If lots of oil producers are anxious to sell futures contracts for purposes of hedging, what we might see is that the price today of a November futures contract gets depressed a little bit below the rational expectation of what the price will actually be on expiry. That difference means that the buyer of the contract expects to receive some gain, on average, as compensation for the risk. The seller, on the other hand, is willing to pay that premium in order to achieve the desired hedging.

This was the basis for Keynes (1930) theory of backwardation, according to which hedging pressure from commodity producers might typically lead to a current futures price that is below the expected expiry price. Keynes theory has received empirical support from studies by

The graph below plots the total open interest on NYMEX light sweet crude oil contracts since 1983. There was tremendous growth in use of these contracts after 2004. Part of this growth resulted from increased use of these contracts as a financial investment. One popular strategy is to buy a November contract today, and plan on selling that November contract in October in order to turn around and buy a December contract. Such a strategy would leave you always with a long position in oil, from which you would benefit when the futures price rises and lose when the futures price falls. The strategy might provide some portfolio diversification. For example, when oil prices rise, other assets in your portfolio such as stocks might do poorly. Price pressure from such purchases of futures contracts as an investment vehicle could have a similar effect as traditional hedging from producers but in the opposite direction. Purchases of futures contracts by financial investors basically forces arbitrageurs to take the short position on contracts, whose compensation might then come in the form of a futures price that is above the expected expiry price.

Total number of outstanding crude oil futures contracts of all maturities, daily observations March 3, 1983 to July 17, 2011. Vertical lines drawn at January 1, 1990 and January 1, 2005.

In a new research paper with Cynthia Wu. we develop a simple model of how selling pressure from commercial hedgers or buying pressure from financial investors would interact with risk-averse arbitrageurs to determine the relations between futures prices of different maturities. One of our innovations is a full characterization of the dynamics and the role that risk premia seem to play in influencing those relations. We find that there have been very dramatic changes in these relationships over time, which we allow for by estimating different parameters for the model over the 1990-2004 and 2005-2011 subsamples.