CFD Trading FAQ

Post on: 26 Апрель, 2015 No Comment

- What are Contracts for Difference (CFDs)?

- How do I trade CFDs?

- Where can I trade CFDs?

- Why should I trade CFDs?

- Why should I trade CFDs with easy-forex?

- Which CFDs do you offer?

- What is the margin required to trade CFDs?

- Can I specify the leverage for my CFD trades?

- How do I calculate my profit and loss for index and commodity CFDs?

- When can I trade CFDs?

- What are the expiry dates for CFDs?

- What are the costs of trading CFDs?

- Are there any rolling fee charges for CFDs?

- What are Contracts for Difference (CFDs)?

A contract for difference (CFD) is a contract between a buyer and a seller. When you open a CFD you are either buying or selling a contract with easy-forex. CFDs are the easiest and most popular way to trade commodities and indices due to their simplicity, ease of trade, leverage, ability to short sell and cost effectiveness. You can diversify your portfolio by trading CFDs on all easy-forex platforms as both spot deals and options.

Like forex, CFD trading is cash-settled. When you buy a CFD you are buying a contract for a certain price; you don’t take possession of the physical product, e.g. when you buy 100 barrels of oil these will not be delivered to your door. And when the time comes to sell it back, you make a profit (or loss if the market is not in your favour).

By trading CFDs, you can potentially profit whether a market moves up or down. If you believe an asset’s price is going to rise, you open a buy position (known as ‘going long’). If you think the asset’s price is going to fall, you open a sell position (known as ‘going short’). The performance of the market governs not just whether you make a profit or loss, but also by how much. So let’s say you think a particular market will rise, and you buy a CFD — your profit will be greater the further the market rises, and your losses greater the further it declines. The same rule applies if you expect a market to fall; you’ll make more the further the market drops, and lose more the further the market rises.

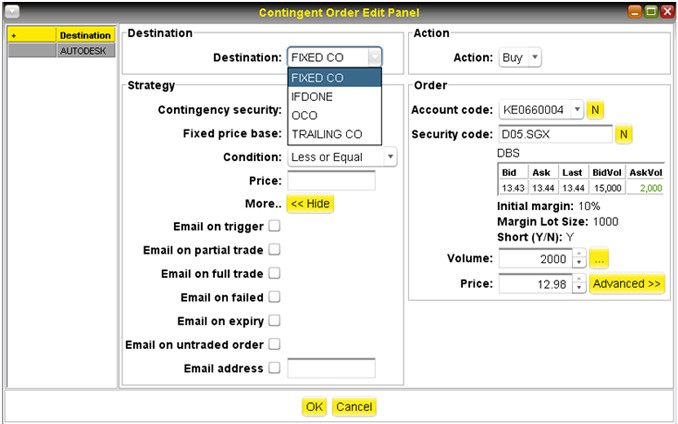

Where can I trade CFDs?

You can trade a range of CFDs on your easy-forex web trading platform, mobile platform and on MT4 and TradeDesk .

CFDs on the easy-forex web trading platform

Login to the trade zone of your web trading platform. You will find the different CFDs under their individual category tabs on the trade ticket — Currencies, Commodities, Indices and Options.

CFDs on the easy-forex mobile platform

Login to your easy-forex account on your mobile phone. When you select ‘Quotes’ from the top menu you will get a drop-down list of products to trade — currencies, commodities, indices and options.

Why should I trade CFDs?

CFD trading gives you a wider choice of products to access the excitement of the financial markets. Whether you have insights into agriculture, energy products, global currencies or equities, you can now get easy access to trade them. Trade CFDs with a low margin requirement (remember — with greater leverage comes greater profit or loss). CFDs provide an excellent alternative to suit a variety of trading styles or methods e.g. short or long-term investors can find the right product to complement their preferences.

Why should I trade CFDs with easy-forex?

easy-forex has one of the broadest selections of commodities and indices available as CFDs on the market and offers some of the most competitive spreads. Combining that with top class customer service and education makes us the preferred platform for both new and experienced traders.

As well as being able to trade over 70 currency pairs, you can trade 15 indices, 5 metals, 5 energy and 7 agricultural commodities on our trading platforms — the same way you trade forex. Your trades are executed automatically, with absolutely no requotes and you get fixed spreads and guaranteed stops on the web-based platform.

Which CFDs do you offer?

At the time of publishing, you can trade the following CFD products. We are always working to expand our range of products so contact us for any questions or for product updates.