CFA Level I Review Understanding the Statement of Cash Flows

Post on: 23 Апрель, 2015 No Comment

You are here

This is the third of three articles reviewing the financial statements for the Level I curriculum of the CFA exam. Please refer to the last two articles for notes on the income statement and balance sheet.

While the Statement of Cash Flows is just as important, or more so in the practical world of analysis, the CFA curriculum does not spend as much time on it as with the other two financial statements. I don’t think it is a short-coming of the material, only that there is less to cover on the statement. It is relatively less ‘manipulated’ than the income statement and there are not as many adjustments needed as with the balance sheet.

There are some absolutely key concepts and formats that you need to remember about the statement, whether for the tests or for practical analysis. Understand the direct and indirect format and how to arrive at both using the other two statements. This is one of the best ways to understand how the company operates, i.e. how the company uses assets, liabilities and income to generate cash for equity holders.

Cash versus Accrual Accounting

While the other two statements follow an accrual method of matching expenses and revenues made during the period, the Statement of Cash Flows shows the cash receipts and payments during the period. It is a reconciling statement in the company’s cash and cash equivalents during the period. Because it shows actual inflows and outflows, it is much more difficult to manipulate by management and widely used by analysts.

The general structure for the statement is that,

- Change in Cash = Cash from operations (CFO) + Cash from Investing (CFI) + Cash from Financing (CFF) + any effects of exchange rates

Cash Flow from Operations

Besides cash from sales of goods or services, an important part of CFO is the adjustments from items on the balance sheet and income statement. These adjustments happen because of the accounting difference between accrual-based and cash accounting.

- Depreciation for assets, expensed on the income statement as a use of a capital asset, is not a use of cash so must be added back to net income.

- Change in operating assets and liabilities that have already been accounted for on the balance sheet but had not yet settled in cash. (i.e. accounts receivable, inventories, accounts payable, etc)

- One confusing aspect of the statement is remembering how dividends and interest are shown. Dividends received and interest received and paid are shown as cash flow from operations, while dividends paid are shown as financing.

Cash Flow from Investing

While operating assets and liabilities, or working capital, is shown as cash flow from operations, cash flows for the purchase or sale of long-term assets is shown as investing. This makes intuitive sense if you think of these assets as an investment in long-term production. Items include fixed assets, long-term investments and business acquisitions or divestitures.

Cash Flow from Financing

Financing includes borrowing or repaying debt principal but not interest which is taken as a cost of operations and shown under CFO. Similarly, since equity capital (common and preferred stock) is raised as a financing vehicle, issuing or repurchasing shares and paying dividends is shown as CFF.

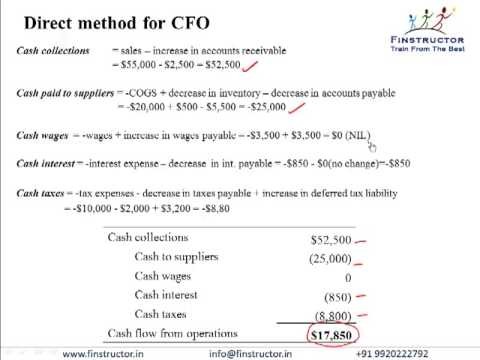

Converting the Statement to Direct Method

Most firms use the indirect method to prepare cash flows so the most common need is to convert the statement to the direct method. Firms reporting under the direct method must also present a reconciliation to the indirect method (for U.S. GAAP). The direct method details the firm’s operating cash receipts and payments from customers, suppliers, employees, etc. while removing a lot of the effects of accrual accounting. CFI and CFF are the same for both methods.

You must be able to arrive at CFO using the direct method.

Start with Revenues

+/- Change in Accounts Receivable

= Cash collected from customers

+ Investment income in cash

Cost of goods sold

+/- change in inventory

+/- change in wages payable

= Cash paid to employees

Other operating expenses

+/- change in prepaid expenses

+/- change in accrued liabilities

= Cash paid for other operating expenses

- cash paid for interest

- cash paid for income taxes

= Cash Flow from Operations

Investment income in cash is usually the difference between other income and the gain or sale of property, plant and equipment. Cash paid for interest is the interest expense from the income statement.

Free Cash Flow

Free cash flow is an extremely important measurement and you will need it extensively in the equity section of the exam, especially at level II. It represents the cash available to either equity investors or all capital providers after all working capital and fixed capital needs have been accountable. Basically, it is the extra cash available to owners (of debt or equity) after the company’s future operations have been funded.

Free Cash Flow to the Firm (FCFF) is the cash flow available to all capital providers (debt and equity) and equals:

Net income + Net noncash Charges (depreciation and amortization) – Investment in working capital – Investment in Fixed capital + after tax interest expense

Free Cash Flow to Equity (FCFE) is the cash flow available to common shareholders and equals:

Net income + Net noncash Charges (depreciation and amortization) – Investment in working capital – Investment in Fixed +/- net borrowing

- Notice that FCFE is FCFF except without adding back interest expense and taking net borrowing into account.

- Understand how to arrive at FCFE or FCFF with CFO

- FCFF = CFO + INT (1-t) – invest fixed capital

- FCFE= CFO – invest fixed capital +/- net borrowing

Hopefully, these last three articles will help you understand the basic idea behind the three main financial statements. Some of the accounts and relationships within the statements can be extremely confusing, especially if you do not have a solid base in accounting. Here, I’ve tried to outline the structure and a few key concepts to get you started. Financial Reporting & Analysis at the first CFA exam is mostly conceptual so understanding what these statements show and how analysts use them is imperative.

I’ve seen a lot of candidates forming online study groups and talked with a few about their experience. For Wednesday’s post, we’ll cover some of the comments and suggestions how you can make an online study group just as effective as a live one.