Certificate of Deposit Laddering

Post on: 1 Июнь, 2015 No Comment

Like dollar cost averaging into an equity security, you can reduce reduce the risk of adverse interest rate changes by dividing your intended CD investment into multiple CDs coming due over various time frames, instead of buying a single CD.

The basic premise of CD laddering is to always have a CD that is coming due in 1 year.

As you can see, the return starts off okay but at the end of the fifth year (2011), interest rates drop and you’re stuck investing at 1.2%

Had you broken the $100,000 into 5 different investments and placed $20,000 each in different term CDs (ranging from say six months to five years), you would have suffered significantly less from the low interest rates in 2010 and 2011, and presumably you would still have some of your money earning higher interest from the longer term CDs.

What laddering does do is smooth out your earnings potential. If rates are high today but drop precipitously in one year you will still have some higher yield, longer term CDs in your portfolio to boost your earnings. Effectively, laddering cushions a portfolio from the steep drop in rates like the one that we have recently seen. Laddering, of course, becomes less effective if rates remain low for an extended period as all of your CDs of various durations will roll over into lower rate replacements.

I n some years the laddered approach does better and in other years the non-laddered approach wins. In an extended low-rate environment like today, a laddered approach may be the best way to go. The laddered approach allows investors to earn a better yield on longer-term CDs while still keeping some money relatively liquid in shorter-term CDs should rates begin to rise. Keeping all of your money in shorter duration CDs is better when you are sure interest rates are going to rise, or rates have already begun to go up. Keeping all of your money in longer-term CDs is prudent if you expect rates to plunge, as they did starting in 2008. But, since most of us are not prescient enough to forecast the direction of rates, laddering provides a safe alternative that doesn’t require a crystal ball.

Another advantage of laddering is that money comes due every year. Investors that may need the cash at some point, have access to a portion of it every year without having to break a CD and incurring any resulting penalties.

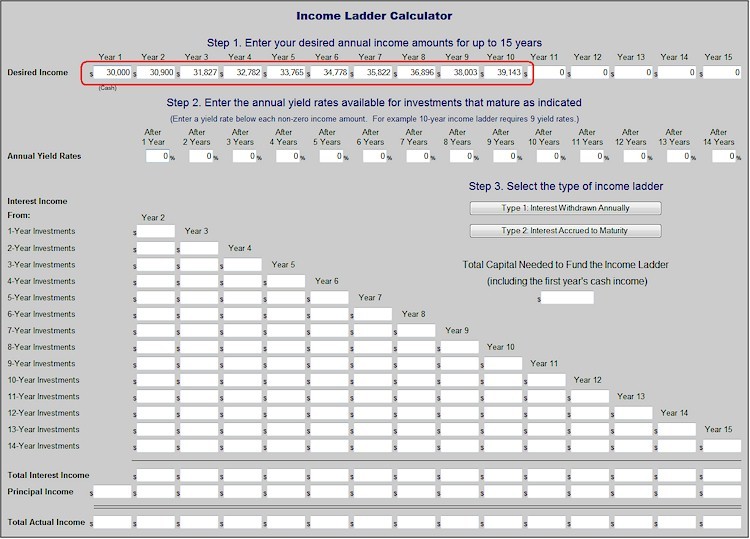

Designing a CD Ladder Today

If one wanted to design a hypothetical CD ladder today, here’s how it might look. To get the best rate, we’ll use CD rate data provided by BestCashCow. I’ve looked at both local banks and credit unions (I live near Boston) and online banks to get the best rates for each term. Although this requires a bit of driving around, I’ve made sure using BestCashCow data that all of the banks have branches relatively close to where I live — within 4 miles.

Investment amount of $100,000