CenturyLink In Here s the Surprising Reason Behind This Earnings Miss (CTL)

Post on: 25 Июль, 2015 No Comment

Image source; CenturyLink.

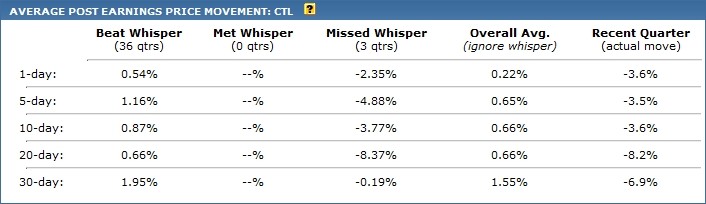

Shares of specialist telecom CenturyLink ( NYSE: CTL ) took a 2.3% dive in after-hours trading on Wednesday, following the release of disappointing fourth-quarter results. Despite the quick price correction, CenturyLink investors are still looking back at a 37% gain over the past year.

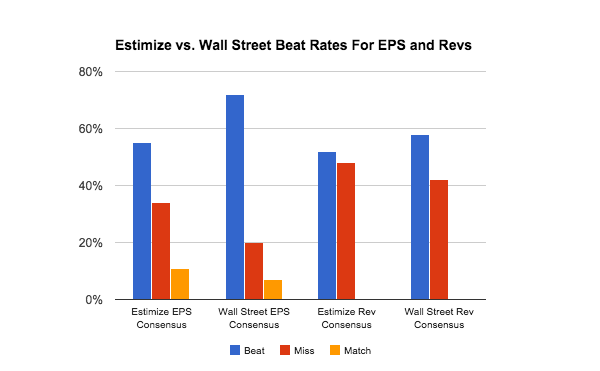

Analysts had been looking for adjusted earnings of $0.63 per share on $4.5 billion in total revenue. CenturyLink missed the mark on both counts, posting adjusted earnings of $0.60 per share and sales of $4.4 billion.

Looking ahead, guidance for the current quarter also fell short of the current analyst consensus. For the full year of 2015, however, the midpoint of CenturyLink’s revenue guidance matched the analyst view exactly at $18.0 billion. On the bottom line, full-year guidance points to earnings of $2.60 per share. Again, that’s ahead of the current Wall Street consensus which stops at $2.51 per share.

CenturyLink CEO Glen Post admitted that the fourth quarter’s results came in weaker than expected. However, he also noted that the 2014 fiscal year landed above the full-year projections he had offered a year ago and said that the second half of 2015 should deliver a brighter picture.

We anticipate stronger revenue generation in the second half of the year and expect to reach revenue stability for the full year, Post said in a prepared statement. We believe revenue growth will benefit from strategic product expansion and our recently implemented organizational realignment.

Digging deeper into the fourth quarter’s weak spots, CenturyLink lost more of its legacy landline phone subscribers than expected. Additions under the Prism-branded fiber-based broadband and TV package were about as strong as expected, but not enough to make up for the lost phone accounts. These legacy lines may be on their last legs, but they offer a high-margin revenue stream while they last.

In 2015, that picture is expected to change a bit. So-called strategic revenues tied to high-speed consumer and business services ended 2014 on a relatively soft note but will receive strong marketing support this year. Profit margins are likely to swoon as the high-speed focus takes effect, but revenues should stop falling and stabilize at roughly $18.0 billion.

CenturyLink’s shares now trade for 8.3 times trailing free cash flows, which is a large discount compared with many other American telecoms. Shares of Verizon Communications ( NYSE: VZ ) command a price-to-cash flow ratio north of 15 times, and AT&T ( NYSE: T ) trades for 18 times free cash. Among CenturyLink’s larger rivals, only Windstream ( NASDAQ: WIN ) offers a comparable cash flow ratio, but that’s against the backdrop of a game-changing REIT spin-off with many questions unanswered.

In short, CenturyLink’s investors seem nervous right now, even after helping the stock back up from a deep trough in 2013 and 2014. The promise of a good second half in 2015 simply wasn’t enough to spark a fresh fire under the stock tonight.

Wall Street hacks Apple’s gadgets! (Investors, prepare to profit.)

Apple forgot to show you something at its recent event, but a few Wall Street analysts and the Fool didn’t miss a beat: There’s a small company that’s powering Apple’s brand-new gadgets. And its stock price has nearly unlimited room to run for early in-the-know investors. To be one of them, just click here !