Cautious optimism on the economy The Washington Post

Post on: 1 Апрель, 2015 No Comment

Buck up, America.

For many months we had galloping stock-market growth that seemed at odds with the underlying strength of the U.S. recovery. The S&P 500 kept rising while employers remained reluctant to increase employment, builders to increase building and consumers to increase consuming. The whole situation was confusing, to say the least.

Catherine Rampell is an opinion columnist at The Washington Post. View Archive

Now we seem to be facing the opposite conundrum: On many measures, the economy is looking much healthier than it did a year or so ago. Yet markets are suddenly getting skittish. There was more market volatility last week than there had been in almost three years .

Explaining or predicting market movements is a fool’s errand. Animal spirits. “thought viruses” and other voodoo can dissuade markets from behaving in ways that reflect the underlying health of the economy. Which is why I suggest not getting too spooked by the stock ticker, and instead offer a few reasons for cautious optimism about the U.S. economy.

Let’s start with your pocketbook. Wage stagnation has been one of the more frustrating features of this recovery, with gains just barely outpacing inflation. Recently I wrote about a few explanations for this, focusing on the high amount of “shadow” unemployment out there. My colleague Harold Meyerson also weighed in. emphasizing long-term institutional changes such as the decline of unions.

Whatever the cause, survey data released since we both wrote on this subject suggest that raises may be right around the corner.

Last Friday, the Thomson Reuters/University of Michigan consumer sentiment index reported that 54 percent of Americans believe their household income will rise in the next year. That’s the highest share since September 2008, the time when Lehman Brothers imploded. The median expected income increase reported by all households is still quite modest — 1.1 percent – but the last time it was higher was November 2008.

Businesses say they plan to dole out wage hikes, too, according to a separate survey released last Tuesday.

Each month the National Federation of Independent Business ’s small business optimism index asks businesses whether they plan to change average worker compensation in the coming three months. The net share saying they expect to raise compensation was 15 percent in September; the last time the share was higher was October 2007, before the recession started. Employers may not be happy about the prospect of higher labor costs, but these survey numbers suggest that they’ve resigned themselves to the fact that they might need to start ponying up more cash to retain or hire good workers.

This bodes well for consumers, as does the recent news at the pump. Gasoline prices have fallen sharply, from about $3.80 per gallon this summer to about $3.30 per gallon last week. Capital Economics estimates that the drop in oil prices to four-year lows of about $80 a barrel could cause retail gasoline prices to plummet to about $3 a gallon. Lower gas prices would free up a lot of consumer cash for other purchases.

Good news awaits on other domestic fronts, too. Manufacturing activity has been relatively robust. The housing market, which had dragged earlier this year, is looking healthier, with housing starts up and mortgage rates down. Household finances are likewise getting better, with debt-service-to-income ratios lower now than they were at any time before the financial crisis, going back to at least 1980 (when the Federal Reserve first started keeping track).

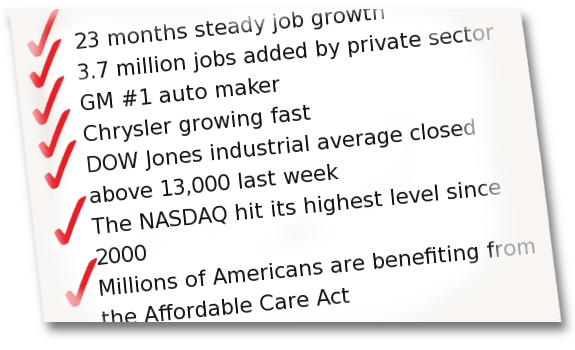

And of course job growth is finally, finally building momentum. We’ve added more than 2 million jobs this year already, and the unemployment rate has slid much faster than the Fed expected. touching 5.9 percent in September. Jobless claims also just reached their lowest level in 14 years.

That said, we’re not out of the woods yet: Deflation remains a very real risk, particularly in Europe; Chinese growth has slowed; the labor force participation rate in the United States is distressingly low, even after accounting for baby boomer retirements; and U.S. credit markets are loosening up but still not yet healed (colorfully illustrated by recent reports that even former Fed chairman Ben Bernanke couldn’t refinance his house. and that former White House economic adviser Alan Krueger was denied a mortgage on a new home entirely).

Those are the big short-run cyclical challenges. Longer-run changes, like the rise in inequality, might hold back growth. too, although the jury is still out on that one. In the meantime, try not to sweat the market noise. Optimism is good for the economy, especially when it’s grounded in actual data.

Read more on this issue: