Caterpillar Has Pull for Growth Income and Value Investors

Post on: 9 Июнь, 2015 No Comment

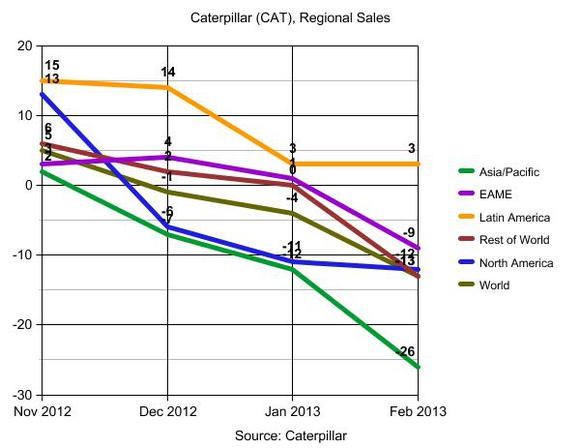

Caterpillar (NYSE: CAT), the world’s largest heavy equipment maker, is unique in its appeal to growth, income and value investors . Much of the outlook for Caterpillar is hinged on how well China and other emerging market nations are doing economically. Since growth in China is off, Caterpillar is down for the last week, month, quarter, six months and year of market action. Caterpillar has already fallen by more than 5.6%% for 2015.

Even though Caterpillar is a member of the Dow Jones Industrial Average, it is a very volatile stock with a beta of 1.66. That means that “The Big Cat” stock price moves up and down 66% as much as the market as a whole. For savvy investors, that presents the opportunity to buy Caterpillar on a dip at a discount.

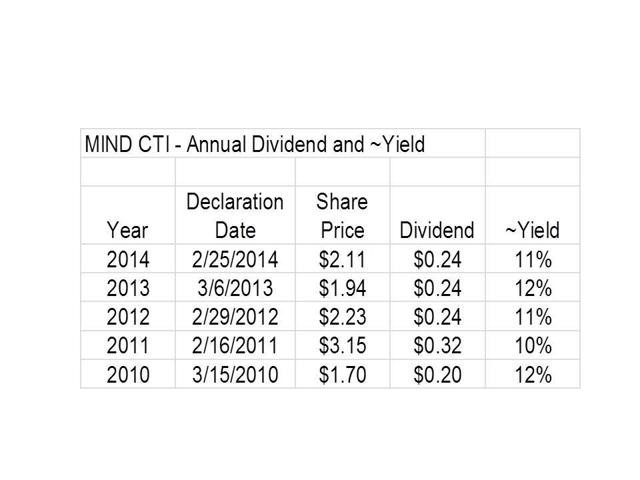

That should especially appeal to income investors as it allows for buying Caterpillar stock when the dividend yield is higher. At present, the dividend yield for Caterpillar is 3.24%. over 60% higher than the average dividend yield for a member of the Standard & Poor’s 500 Index (NYSE: SPY). The dividend growth rate for Caterpillar is 6.12%, so it pays to be a long-term investor.

Poised for Growth

Even though China’s economy is sputtering, strong growth is projected for Caterpillar.

Earnings-per-share growth for Caterpillar this year is down by 32.30%. Next year, it is expected to rebound to being up by 4.34%. For the next five years, earnings-per-share growth for Caterpillar is estimated to rise by 11.09% by the analyst community. That is a very bullish trend and projection that should please growth investors.

In terms of net income per employee that results from the earnings, Caterpillar tops the industry average by better than 20%. The projected earnings growth should increase that margin for Caterpillar, too. It will also add to the superior free cash flow for Caterpillar that already tops the industry average.

There is much for value investors to like about Caterpillar, too.

The price-to-sales ratio is 0.94. That means that each dollar of sales for Caterpillar is trading at a 6% discount in the stock price. In addition, the forward price-to-earnings ratio is expected to fall to 12.61 from 13.98. That has obviously not been factored into the share price as earnings growth is expected to be so strong.

Caterpillar is trading around its 52-week low at around $86.40 a share.

On Nov. 14, 2015, the brokerage firm Stiffel initiated coverage of Caterpillar with a buy rating of $122 a share. The mean analyst target price for Caterpillar is $106.53. The 52-week high is $110.44. For long-term investors, The Big Cat should deliver a rewarding total return with the healthy growth projected and the robust dividend that is already in place.

Fill up your car for free

Here’s something you don’t see every day – the US Government actually doing something good for citizens. You may not know this, but there’s a special government program that forces certain oil companies to pay average Americans to help reduce the costs of fuel. It’s a form of gas rebate, paid exclusively by a select group of companies. And these payments mandated by the US Government. Find out if you’re eligible for the next payout – which could be up to $310. Click here to start receiving Gas Rebate checks.