Cashflow of a Rental Property An Example

Post on: 11 Апрель, 2015 No Comment

Buy Right, Manage Well, and Profits Follow

If you came to this article in a search, it is part of our Rental Property Investment Analysis. Start there to walk through a detailed analysis of a sample property.

If you’re considering investing in real estate rental property. there is a lot of research to do. You should also be sure that you’re suited to being a landlord, and that you have the time to manage properties. However, all that aside for now, what we want to do here is to examine the way that a property generates cash flow from rental operations .

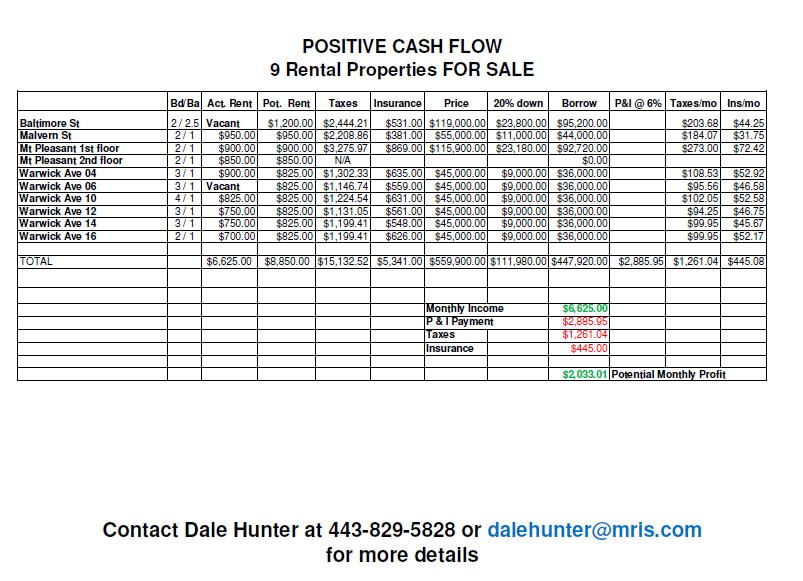

For our example, we’ll use a fourplex. with all four units being destined for full-time rental. This is a simple cash flow calculation to illustrate the potential of real estate as an investment. Critical to this, as with most investments, is an intelligent and well-researched purchase on the front end. We’ll assume for our example that this buyer did their research and made a good buy on our fourplex. Here are the purchase and rental particulars:

1. Purchase price of the fourplex is $325,000.

2. Buyer places 20% down, or $65,000, financing $260,000.

3. 30 year loan is at 6.5%, with Principle/Interest payment of $ 1643 per month.

The buyer did their research and sees a steady rental demand for these units, all of which stay occupied most of the time. However, to be prudent in their calculations, a 6% vacancy and non-payment risk will be calculated to anticipate real cash flow. The units are all identical and rent for $900 per month each. Let’s see how our calculation breaks down:

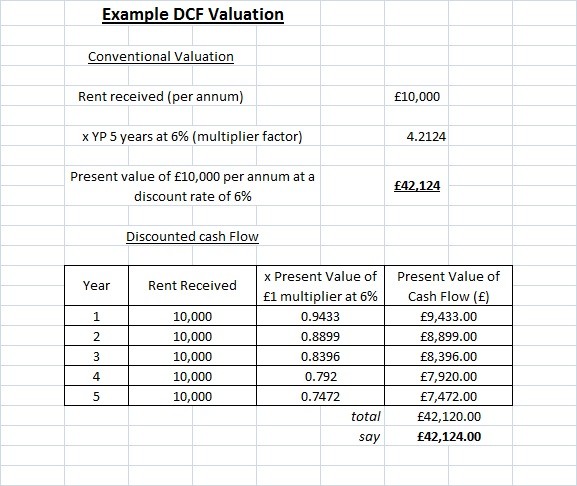

1. Gross rental income is $900 X 4 X 12 months, or $43,200 per year.

2. Payments are $1943 X 12 = $23,316 per year.

3. Previous owner’s repair expense has averaged $1700 per year.

4. Vacancy and credit loss is estimated at 6% of rents or $2592 per year.

5. Owner spends about $400 each year in miscellaneous and advertising costs, and manages the property on their own.

Those are the basic operational items that go into our cash flow calculation. Let’s take our calculation to the profits:

Analyzing your return as cash on cash invested. you would divide your actual cash investment of $65,000 down into the annual return of cash, or $15,192. This is a yield of 23% on your cash invested! There are few investments out there that yield this kind of return. Check out the rest of this rental property investment series to see the other ways in which this example property provides tax and other incentives and returns.