Cashflow financial definition of Cashflow

Post on: 25 Апрель, 2015 No Comment

(redirected from Cashflow )

cash flow

The amount of net cash generated by an investment or a business during a specific period. One measure of cash flow is earnings before interest, taxes, depreciation, and amortization. Because cash is the fuel that drives a business, many analysts consider cash flow to be a company’s most important financial statistic. Firms with big cash flows are frequently takeover targets because acquiring firms know that the cash can be used to help pay off the costs of the acquisitions. See also free cash flow .

Case Study Financial analysts generally consider cash flow to be the best measure of a company’s financial health. Increased cash flow means more funds are available to pay dividends, service or reduce debt, and invest in new assets. On the other hand, reported net income is heavily influenced by a firm’s accounting practices. Reduced income generally means lower taxes and more cash, thus the same accounting practices that reduce net income can actually increase cash flow. A firm with large amounts of new investments and corresponding high depreciation charges might report low or negative earnings at the same time it has large cash flows to service debt and to acquire additional assets. Cable companies have huge investment requirements and are typical of firms that may be quite healthy in spite of reporting net losses. In early 1996, TCI Communications, at the time the nation’s largest cable operator, reported fourth-quarter results that included a net loss of $70 million, more than double the loss reported in the year-earlier quarter. At the same time, the firm added more than a million new customers and reported a 25% increase in revenues. It also reported a 5% increase in cash flow. Thus, although TCI reported an additional loss, the quarter was generally considered quite successful. Operating cash flow, calculated as cash flow (the sum of net income and noncash expenses such as depreciation, depletion, and amortization) plus interest expense plus income tax expense, is an important consideration in corporate acquisitions because it indicates the cash flow that is available to service a firm’s debt.

Cash flow.

Cash flow is a measure of changes in a company’s cash account during an accounting period, specifically its cash income minus the cash payments it makes.

For example, if a car dealership sells $100,000 worth of cars in a month and spends $35,000 on expenses, it has a positive cash flow of $65,000. But if it takes in only $35,000 and has $100,000 in expenses, it has a negative cash flow of $65,000.

Investors often consider cash flow when they evaluate a company, since without adequate money to pay its bills, it will have a hard time staying in business.

You can calculate whether your personal cash flow is positive or negative the same way you would a company’s. You’d subtract the money you receive (from wages, investments, and other income) from the money you spend on expenses (such as housing, transportation, and other costs).

If there’s money left over, your cash flow is positive. If you spend more than you have coming in, it’s negative.

cash flow

(1) Noun:The cash available from an investment after receipt of all revenues and after payment of all bills.(2) Verb:The process of creating cash flow,as in “I think that property will start to cash flow in about a year.”A property can have positive cash flow (good) or negative cash flow (usually bad).Cash flow is not the same thing as profitability.A property can be profitable,meaning gross income less expenses, depreciation, and interest on debts results in a positive number. That same property can have a negative cash flow because of the need to pay principal payments on loans or expend money for something that represents a capital expenditure,like a new roof.

Cash Flow

What Does Cash Flow Mean?

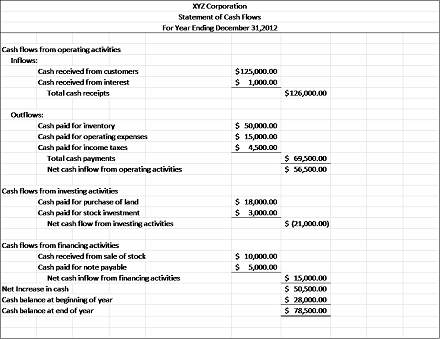

(1) A revenue or expense stream that changes a cash account over a specific period. Cash inflows usually arise from one of three activities—financing, operations, or investing—although they also occur as a result of donations or gifts in the case of personal finance. Cash outflows result from expenses or investments. This holds true for both business and personal finance. (2) An accounting statement called the statement of cash flows shows the amount of cash generated and used by a company in a specific period. It is calculated by adding noncash charges (such as depreciation) to net income after taxes. Cash flow can be attributed to a specific project or to a business as a whole. Positive cash flow indicates a company’s financial strength.

Investopedia explains Cash Flow

(1) In business as in personal finance, cash flows are essential to solvency. They can represent past activities, such as the sale of a particular product, or forecast what a business or a person expects to take in and spend in the future. Cash flow is crucial to an entity’s survival. Having ample cash on hand will ensure that creditors, employees. and others can be paid on time. If a person or business does not have enough cash to support its operations, it is said to be insolvent and a likely candidate for bankruptcy if the insolvency continues. (2) The statement of a business’s cash flows often is used by analysts to gauge the business’s financial performance. Companies with ample cash flow are able to invest the cash back into the business to generate more cash and profit.