Cash Flow Statement The Direct Method Financial Education Everything You Need To Know About

Post on: 16 Март, 2015 No Comment

Meta

Cash Flow Statement The Direct Method

The cash flow statement summarizes all activity in the cash accounts of the corporation. The statement user can imagine that, if one had access to the bank statements for the year, the cash flow statement could be created by sorting all transactions and summarizing them into categories. The checks would be sorted by what type of bill was being paid, the deposits would be sorted by the source of the inflow, and the resulting statement would create a cash flow statement in what is called the direct method format. This is the format presented below.

In the direct method format, each line of the operating activities section represents a sum of all checks or deposits in a particular category. For example, the operating activities section would include such items as cash received from customers; cash paid to suppliers; cash paid for interest; cash paid for wages; cash paid for research and development; cash paid for selling, general, and administrative costs; and any other relevant summary lines.

The investing activities section would include such items as cash paid for acquiring capital assets and cash received from disposals of the same classes of assets. Also included in this section would be the cash paid to invest in the stock of another firm, as well as the proceeds from the subsequent sale of the stock.

The financing activities section would include cash received from stockholders’ investing in the firm and any cash returned to stockholders, whether in the form of stock repurchases or dividends paid. The liability component of financing activities would include cash received from debt holders who have loaned money to the firm during the period and any principal payments made by the firm back to those debt holders.

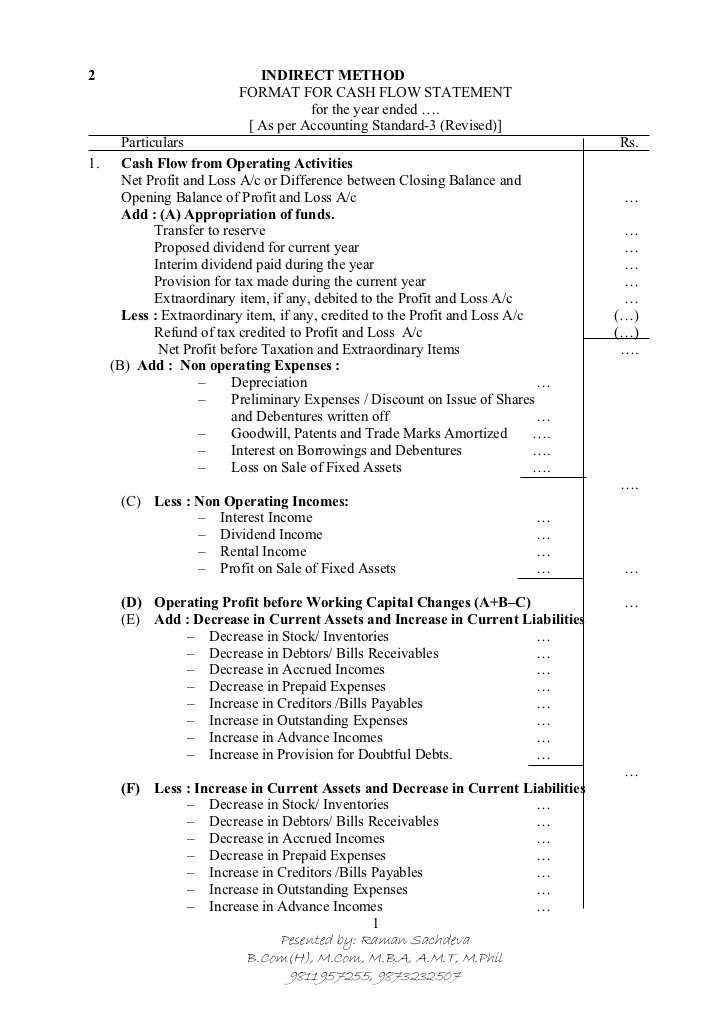

Both U.S. GAAP and IAS encourage companies to present operating cash flows using the direct-method format, but another format, the indirect method, is also available. The direct format would provide the summarized detail from the cash account, as described above, corresponding to deposits made and checks written. The items in this intuitive format are straightforward and easy for the analyst to understand. In fact, under both IAS and U.S. GAAP, the financing and investing activities sections are presented in just this manner.

The Intelligent Investor: The Classic Text on Value Investing

Financial Statement Analysis: A Practitioner’s Guide, 3rd Edition

Managing Investment Portfolios: A Dynamic Process (CFA Institute Investment Series)