Cash Flow Statement

Post on: 22 Апрель, 2015 No Comment

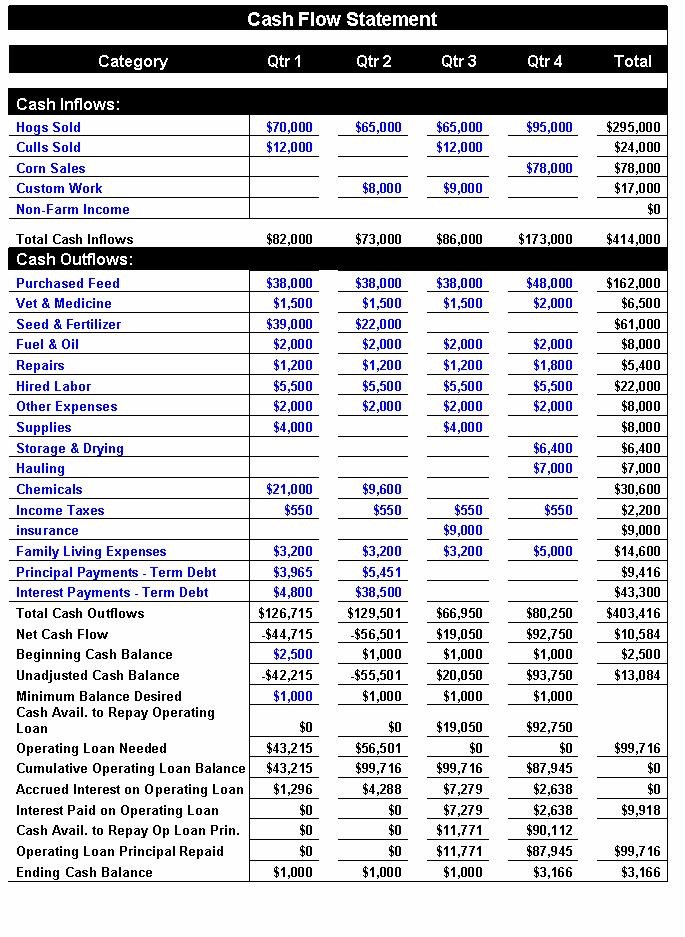

As we have known, the income statement is the best measure of a company’s economic perfomance for a period of time. However, anyone knows that bills must be paid with cash, not with “economic performance”. Investors also want to know how much actual cash a company’s operations generate during a period and how the cash is used. The statement of cash flow shows the cash inflows and cash outflows of a company during a period of time.

In the statement of cash flow, individual cash flow items are classified according to three main activities: operating, investing, and financing.

Operating Activities

Operating activities are those activities that are part of the day-to-day business of a company. Cash receipts from selling good or from providing services are the major operating cash inflow. Major operating cash outflow include payments to purchase investory and to pay wages, taxes, interest, utilities, rent and other expenses.

Indirect Method

We already know that the income statement depicts a company’s revenues, expenses, and profitability arising from its daily operations, while cash flow from operations attempts to capture cash movement associated with these daily activities.

Accordingly, we must convert the income statement from accrual accounting (by which it is prepared) to cash accounting (which governs the cash flow statement). This conversion of the income statement from accrual to cash accounting can be performed via two methods:

- Indirect method :the indirect begins with net income as reported on the income statement and then details the adjustment made to arrive at cash flow from operations.

- Direct method :using direct method, the operating activities section of a statement of cash flow is, in effect, a cash-basis income statement. Unlike the indirect method, the direct method does not start with net income.

The Financial Accounting Standards Board (FASB) allows companies to use both methods, which result in the same “Cash Flow from Operating Activities” figure; however, the indirect method is used by a majority of companies and will be our focus throughout this section.

The two methods apply only to the preparation of the operating activities section of the cash flow statement.

Getting from Net Income to Cost from Operations

As mentioned earlier, the first line of the cash flow statement of most companies is net income from the income statement, which, as we know, is prepared in accordance with the accrual method of accounting. The subsequent lines should be thought of as adjustments to this accrual net income, in order to arrive at the amount of cash generated from operations during the same period.

For example, since depreciation expense reduces net income on the income statement, but does not reduce cash, an adjustment must be made on the cash flow statement to exclude this noncash expense from net income since the ultimate goal of the cash flow statement is to determine how much cash was generated (vs. accounting profit).

Common adjustments made in the cash flow from operations section include depreciation, changes in working capital (calculated as current assets less current liabilities), and changes in deferred taxes.

Net Income

+ Depreciation & Amortization

-Changes in working capital

=Cash Flow from Operations

Investing Activities

The primary investing activities are the purchase and sale of land, buildings, and equipment. You can think of investing activities are those activities associated with buying and selling long-term assets.

Components

Several accounts are typically found in the investing cash flow section:

- Capital expenditures: organic expansion of fixed assets (cash outflow)

- Acquisitions: purchased fixed and intangible assets (cash outflow)

- Asset sales: disposal of fixed and intangible assets (cash inflow)

- Purchases of investments: acquisition of debt/equity securities (cash outflow)

- Sales of investments: disposal of debt/equity securities (cash inflow)

Financing Activities

Financing activities are those activities whereby cash is obtained from or repaid to owners and creditors. For example, cash received from owners’ investments, cash proceeds from a loan, or cash payments to repay loans would all be classified under financing activities.

Components

Several accounts are typically found in the financing cash flow section (Exhibit 7.15):

- Issuance of debt: increase in the level of borrowings (cash inflow)

- Repayment of debt: decrease in the level of borrowings (cash outflow)

- Common stock issued: issuance of equity (common stock—cash inflow)

- Common stock repurchased: repurchase of equity (treasury stock—cash outflow)

- Payment of dividends: distribution of cash (cash outflow)