Cash Flow Statement_1

Post on: 23 Апрель, 2015 No Comment

- The example above provides a simple introduction to preparing the cash flow statement. There are a few things to note before you go on:

- The actual excess of revenue over cost is $105,000, which is total expenses ($120,000) less depreciation ($15,000).

- The increase in Accounts Receivable is deducted from Funds Flow

- The increase in Accounts Payable is added to Funds Flow

Accounts Receivable and Accounts Payable, as well as all other working capital items are included in the cash flow statement because they are important to the flow of cash in and out of the business. The general rule when including changes in working capital to the cash flow statement is shown below:

- Increase in assets — Outflow/Use of funds

- Increase in liabilities — Inflow/Source of funds

- Decrease in assets — Inflow/Source of funds

- Decrease in liabilities — Outflow/Use of funds

In our example, we assumed that Accounts Receivable was zero at the beginning of the accounting period and $165,000 at the end. That’s a $165,000 increase in A/R which is then included on the cash flow statement as a Use of fund (subtracted from income).

Similarly, our assumption regarding Accounts Payable was that A/P was zero at the beginning of the year and $105,000 at the end. The increase in A/P is then included on the cash flow statement as a Source of fund (added to net income).

Finally, to see how we moved from a revenue position of $200,000 to cash in hand of $35,000, we will follow the money trail:

- Company A purchased $105,000 in inventory. How did it pay for this and still end up with $35,000 in cash? The answer is that Company A has not paid for the inventory. This $105,000 is still owed to suppliers. This is shown as the increase in Accounts Payable in the Cash Flow Statement.

- Of the $200,000 in revenue, Company A’s customers are holding onto $165,000. This is shown on the Cash Flow Statement as the increase in Accounts Receivable. The full amount of cash collected from customers is $35,000 and this is the only cash that Company A has, and this is what is shown on the Cash Flow Statement as Cash Inflow (see above).

That’s it for the section of the Cash Flow Statement covering Cash Flow from Operations. As you may have recognized, this section of the Cash Flow Statement is very important to the investors, creditors and management due mainly to the fact that it shows just how liquidity generating is the company through its operation.

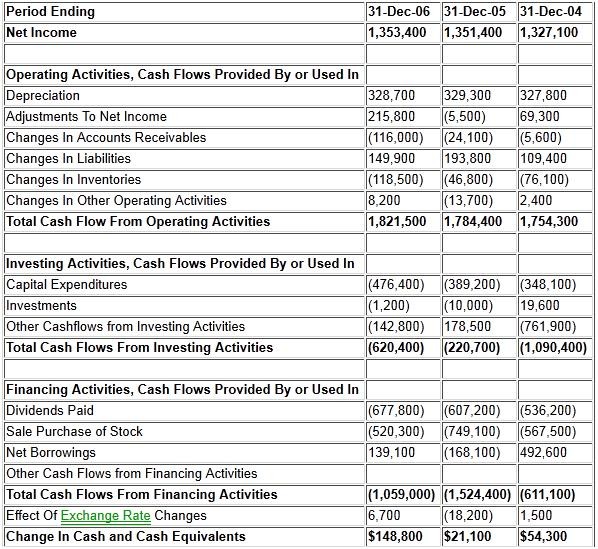

The Cash Flow from Investing and Financing sections

The remaining portion of the Cash Flow Statement is divided between the Investing and Financing sections. These sections are not as academically demanding as the Cash Flow from Operating section, but they are very important to a full understanding of the company’s cash inflow and outflow.

Investing activities as used in the Cash Flow Statement refers to the investments made by management and includes both losses and gains from those investments. This section displays:

- Cash flows from acquiring and disposing short-term investments other than cash equivalents.

- Cash flows from acquiring and disposing fixed assets.

Cash flow from investing activities refers to the cash inflow and outflow related to external financing. The section displays cash flows from obtaining financing from and making payments to shareholders and creditors. The line items in this section may be the following:

- Cash flow related to new issue of stock (common or preferred)

- Loan proceeds or payments

- Dividends payments as well.

While the Cash Flow from Operations section of the Cash Flow Statement is arguably the most significant section from an analytical perspective, the other two sections should not be ignored or belittled.

Free Cash Flow:

Free Cash Flow is a performance indicator that has taken on significance in recent time. The company’s Free Cash Flow is calculated by taking Total Capital Expenditure from Cash Flow from Operations:

Cash Flow from Operations — Capital Expenditure

Capital Expenditure (investment in plant, equipment, property and other similar assets) is usually the first item listed in the Cash Flow from Investing activities section of the Cash Flow Statement, making Free Cash Flow calculation easy to accomplish while reviewing the Cash Flow Statement.

Free Cash Flow has gained the attention of investors and analysis because it reflects the cash available to the company for free or discretionary spending. Capital expenditure is required spending by the company to maintain/improve its present stock of assets in a competitive environment and a company’s ability to generate cash in excess of this amount is considered bonus.

Free Cash Flow gives a company the cash resources to do things such as pay dividends, pay down debts, purchase new businesses etc. so the next time you review the Cash Flow Statement, take a few minutes to analyze free cash flow; it could be the difference between a good decision and a very good decision!