Cash Flow from Operating Activities Definition Example

Post on: 22 Апрель, 2015 No Comment

What it is:

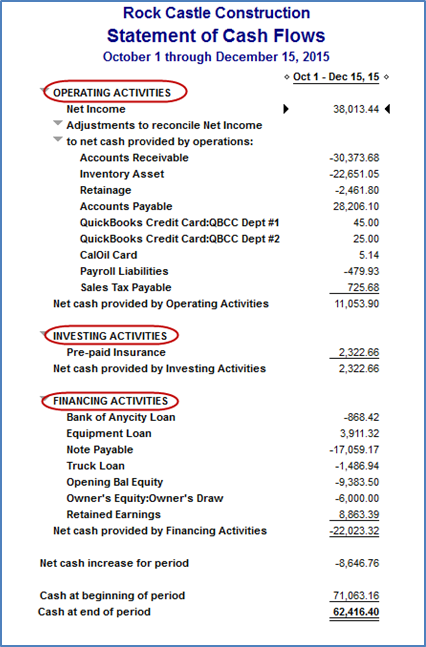

Cash flow from operating activities is a section of the cash flow statement that provides information regarding the cash-generating abilities of a company’s core activities.

How it works/Example:

Cash flow from operating activities is generally calculated according to the following formula:

Cash Flow from Operating Activities = Net income + Noncash Expenses + Changes in Working Capital

The noncash expenses are usually the depreciation and/or amortization expenses listed on the firm’s income statement .

A statement of cash flows typically breaks out a company’s cash sources and uses for the period into three categories: cash flows from operations, cash flows from investing activities, and cash flows from financing activities. Cash flows from operations primarily measures the cash-generating abilities of the company’s core operations rather than from its ability to raise capital or purchase assets.

Because working capital is a component of cash flow from operations, investors should be aware that companies can influence cash flow from operating activities by lengthening the time they take to pay the bills (thus preserving their cash), shortening the time it takes to collect what’s owed to them (thus accelerating the receipt of cash), and putting off buying inventory (again thus preserving cash). It is also important to note that companies also have some leeway about what items are or are not considered capital expenditures, and the investor should be aware of this when comparing the cash flow of different companies.

It is important to note that cash flow is not the same as net income, which includes transactions that did not involve actual transfers of money (depreciation is common example of a noncash expense that is included in net income calculations but not in cash flow calculations).

Why it Matters:

Cash helps companies expand, develop new products, buy back stock. pay dividends, or reduce debt. This is why some people value cash flow statements more than just about any other financial statement or measure out there, including earnings per share — it’s also why many analysts look to cash flow from operations for insight into the core of a company’s cash-generating engine.

Almost all cash flow measures are influenced heavily by the state of a company’s cash from operations, which in turn is heavily influenced by a company’s net income. Thus, higher revenues. lower overhead. and more efficiency are big drivers of cash flow from operating activities. For these reasons, investors often hunt for companies that have high or improving cash flow from operations but low share prices—the disparity often means the share price will soon increase.

It is important to note. however, that having negative cash flow for a time is not always a bad thing. If a company is a net spender of cash from operations for a time because it is introducing a new product, for example, this could pay off in the end if the company’s operations generate more cash. On the other hand, if the company has a negative cash flow from operations because it made a poor managerial decisions, then the long-term benefit might not be there.