Cash Building Life Insurance A Good Investment

Post on: 26 Май, 2015 No Comment

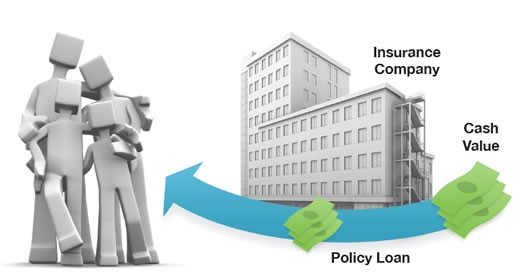

Soon after my husband and I were married, we decided that it would be a good idea to purchase life insurance for each of us. We spoke with an insurance agent, and he gushed about the great investment a universal life policy would be. According to him, it would build cash value, we could use it during retirement, and we could borrow against it!

At the time, we were students, and in debt. We couldnt afford a whole lot of coverage, but we decided that we would each be covered by a policy that would pay off our debts, and allow the other one to finish school debt-free, and get a good start on life. So we went with the universal life insurance policy. While I suppose its a safe investment (as long as the life insurance company doesnt tank), looking back I think I would have done things differently.

Could You Do Better with a Term Life?

Four years ago, when my home business really started taking off, and we bought a house, it became apparent that I would need more coverage. I decided to go with a term life insurance policy, in addition to the universal life policy. Obviously, there was a huge different in price. I was able to get three times the coverage for less than half the price of my universal life insurance policy. It got me thinking. What if, instead of getting those universal policies in 2002, we had decided on term life insurance getting more coverage and investing the difference?

For the five years between 2002 and 2007 (the year I bought my term policy), we would have seen rather huge gains. (GenX Finance did a visual history of the stock market, and pointed out that, between April 2003 and early 2007, the Dow gained 75%.) And, if we had kept investing the difference during the stock market downturn following the financial crisis, and continued our investments, we would be sitting rather pretty, especially if we had been invested in an index tracking the Dow.

How Much Cash Value Will You Build?

Of course, part of the issue is how much cash value you will actually build. You build cash value in such a policy according to your premium. The part of your premium building cash value grows at a set rate, usually determined at regular intervals. Right now, the statement from my life insurance company says that I am earning 4% on the money that is building cash value. Thats not a horrible return. After all, 4% is expected to beat inflation. and its a fairly safe investment. However, the premium isnt that big, so the portion that contributes to the cash value builds slowly (to say the least). At the rate our cash building life insurance policies are growing, well probably have enough cash value to take a nice vacation when were ready to retire and surrender the policies. But we certainly wont have enough to retire on, so it wont make that big a difference.

Before you decide that a cash building life insurance policy is the way to go, carefully consider your options, and determine whether or not you are willing to take the risk that the stock market might provide better overall returns if you were to get term life insurance coverage and then invest the difference.

This post is in support for the Life Insurance Movement started by Good Financial Cents.

Editor’s Note: I’ve begun tracking my assets through Personal Capital. I’m only using the free service so far and I no longer have to log into all the different accounts just to pull the numbers. And with a single screen showing all my assets, it’s much easier to figure out when I need to rebalance or where I stand on the path to financial independence. They developed this pretty nifty 401K Fee Analyzer that will show you whether you are paying too much in fees, as well as an Investment Checkup tool to help determine whether your asset allocation fits your risk profile. The platform literally takes a few minutes to sign up and it’s free to use by following this link here. For those trying to build wealth, Personal Capital is worth a look.